Anixter International Inc. Financial Statement Analysis

ANIXTER INTERNATIONAL INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS - (Continued)

Undistributed Earnings: Undistributed earnings of Anixter's foreign subsidiaries amounted to approximately $680.0

million at January 3, 2020. The Act converted the U.S. system of taxing foreign earnings from a worldwide system to a

territorial system. Future distributions of foreign earnings by Anixter affiliates abroad will no longer result in U.S. taxation. In

converting to a territorial system the Act levied a one-time transition tax on deferred foreign earnings as of 2017. Anixter has

calculated the net combined U.S. tax impact on this deemed repatriation to be approximately $47.2 million and plans to elect to

pay the federal portion of this tax liability in installments over eight years. Despite the conversion to a territorial system,

Anixter considers the undistributed earnings of its foreign subsidiaries to be indefinitely reinvested. Upon distribution of those

earnings in the form of dividends or otherwise, Anixter may be subject to withholding taxes payable to the various foreign

countries. With respect to the countries that have undistributed earnings as of January 3, 2020, according to the foreign laws

and treaties in place at that time, estimated foreign jurisdiction withholding taxes of approximately $37.6 million would be

payable upon the remittance of all earnings at January 3, 2020.

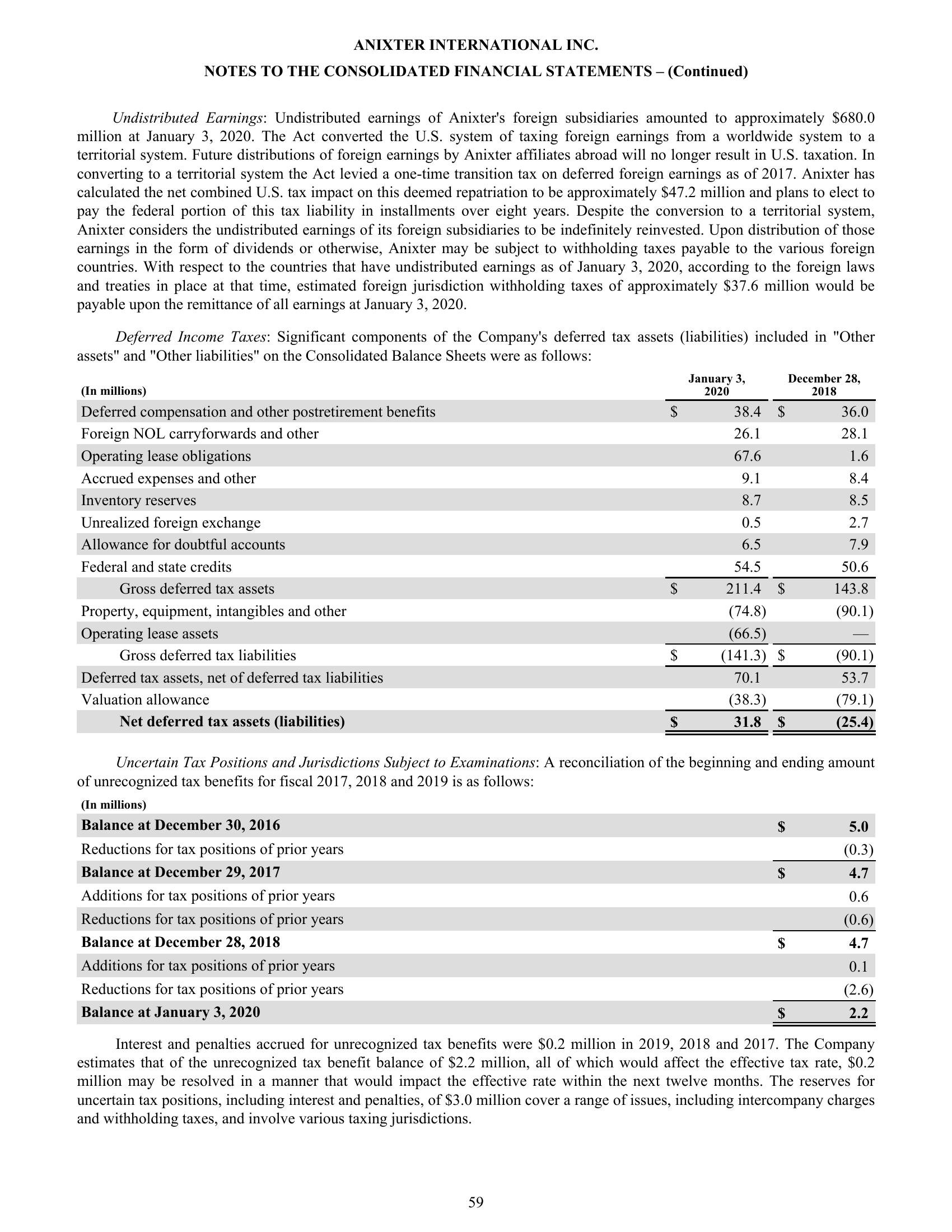

Deferred Income Taxes: Significant components of the Company's deferred tax assets (liabilities) included in "Other

assets" and "Other liabilities" on the Consolidated Balance Sheets were as follows:

(In millions)

Deferred compensation and other postretirement benefits

Foreign NOL carryforwards and other

Operating lease obligations

Accrued expenses and other

Inventory reserves

Unrealized foreign exchange

Allowance for doubtful accounts

Federal and state credits

Gross deferred tax assets

Property, equipment, intangibles and other

Operating lease assets

Gross deferred tax liabilities

Deferred tax assets, net of deferred tax liabilities

Valuation allowance

Net deferred tax assets (liabilities)

January 3,

2020

December 28,

2018

$

38.4 $

36.0

26.1

28.1

67.6

1.6

9.1

8.4

8.7

8.5

0.5

2.7

6.5

7.9

54.5

50.6

$

211.4 $

143.8

(74.8)

(90.1)

(66.5)

$

(141.3) $

(90.1)

70.1

53.7

(38.3)

(79.1)

S

31.8 $

(25.4)

Uncertain Tax Positions and Jurisdictions Subject to Examinations: A reconciliation of the beginning and ending amount

of unrecognized tax benefits for fiscal 2017, 2018 and 2019 is as follows:

(In millions)

Balance at December 30, 2016

Reductions for tax positions of prior years

Balance at December 29, 2017

Additions for tax positions of prior years

Reductions for tax positions of prior years

Balance at December 28, 2018

Additions for tax positions of prior years

5.0

(0.3)

$

4.7

0.6

(0.6)

4.7

0.1

(2.6)

$

2.2

Reductions for tax positions of prior years

Balance at January 3, 2020

Interest and penalties accrued for unrecognized tax benefits were $0.2 million in 2019, 2018 and 2017. The Company

estimates that of the unrecognized tax benefit balance of $2.2 million, all of which would affect the effective tax rate, $0.2

million may be resolved in a manner that would impact the effective rate within the next twelve months. The reserves for

uncertain tax positions, including interest and penalties, of $3.0 million cover a range of issues, including intercompany charges

and withholding taxes, and involve various taxing jurisdictions.

59View entire presentation