OppFi Results Presentation Deck

25

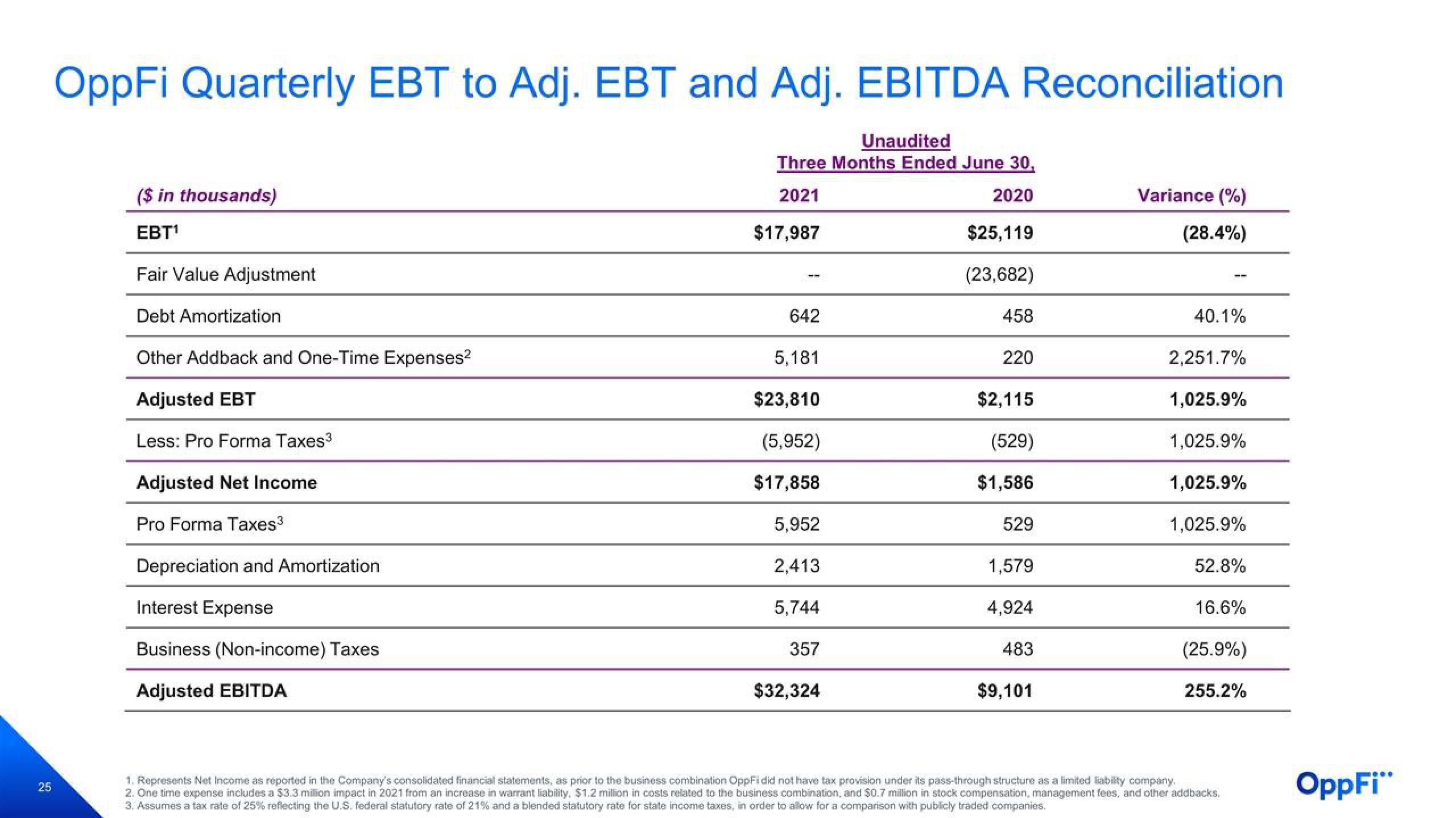

OppFi Quarterly EBT to Adj. EBT and Adj. EBITDA Reconciliation

($ in thousands)

EBT¹

Fair Value Adjustment

Debt Amortization

Other Addback and One-Time Expenses²

Adjusted EBT

Less: Pro Forma Taxes³

Adjusted Net Income

Pro Forma Taxes³

Depreciation and Amortization

Interest Expense

Business (Non-income) Taxes

Adjusted EBITDA

Unaudited

Three Months Ended June 30,

2021

2020

$25,119

(23,682)

$17,987

642

5,181

$23,810

(5,952)

$17,858

5,952

2,413

5,744

357

$32,324

458

220

$2,115

(529)

$1,586

529

1,579

4,924

483

$9,101

Variance (%)

(28.4%)

40.1%

2,251.7%

1,025.9%

1,025.9%

1,025.9%

1,025.9%

52.8%

16.6%

(25.9%)

255.2%

1. Represents Net Income as reported in the Company's consolidated financial statements, as prior to the business combination OppFi did not have tax provision under its pass-through structure as a limited liability company.

2. One time expense includes a $3.3 million impact in 2021 from an increase in warrant liability, $1.2 million in costs related to the business combination, and $0.7 million in stock compensation, management fees, and other addbacks.

3. Assumes a tax rate of 25% reflecting the U.S. federal statutory rate of 21% and a blended statutory rate for state income taxes, in order to allow for a comparison with publicly traded companies.

OppFi"View entire presentation