Deutsche Bank Fixed Income Presentation Deck

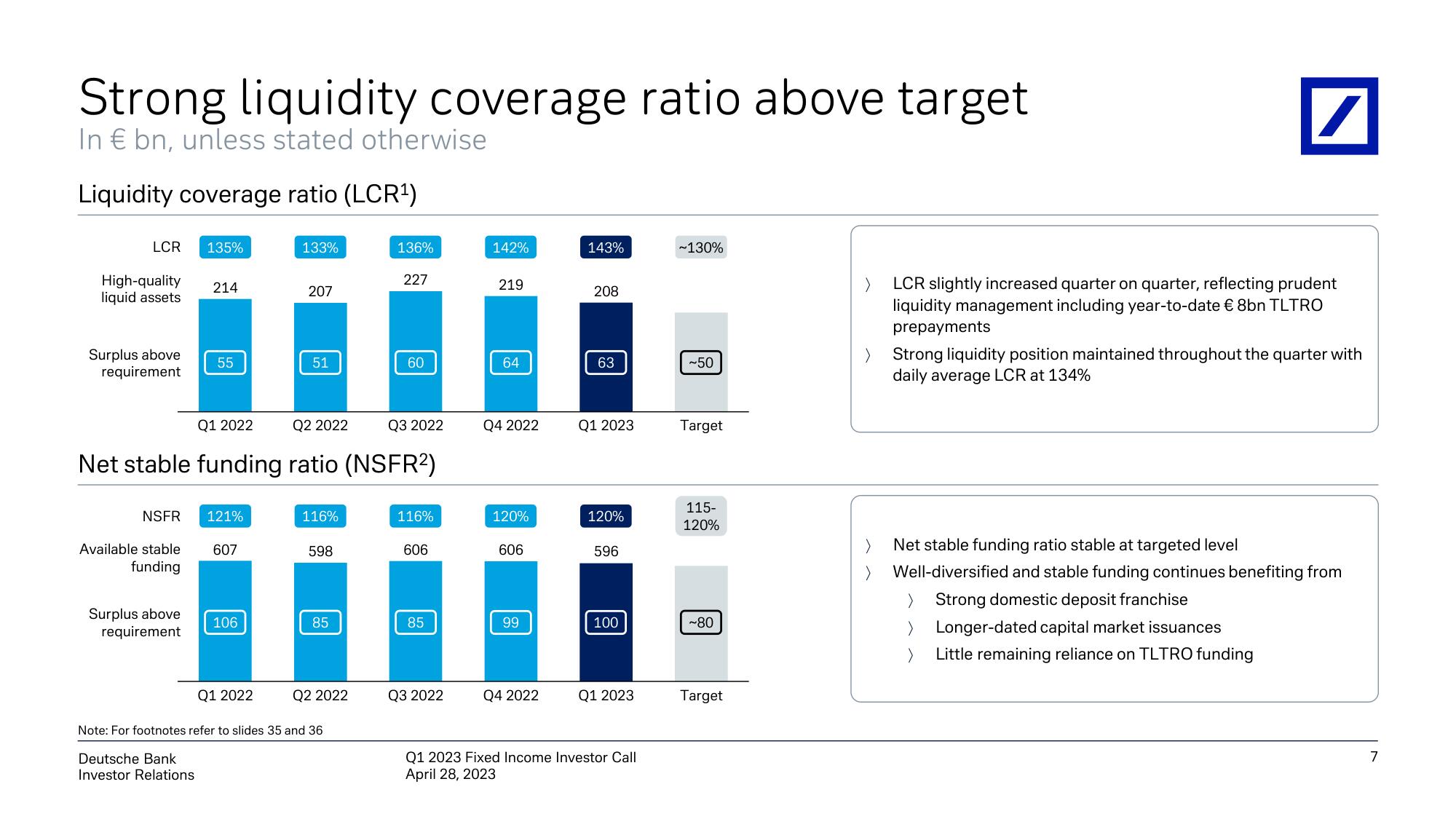

Strong liquidity coverage ratio above target

In € bn, unless stated otherwise

Liquidity coverage ratio (LCR¹)

LCR 135%

High-quality

liquid assets

Surplus above

requirement

NSFR

Available stable

funding

214

Surplus above

requirement

55

121%

607

Q1 2022

Net stable funding ratio (NSFR²)

106

133%

Q1 2022

207

51

Q2 2022

116%

598

85

Q2 2022

136%

227

Note: For footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

60

Q3 2022

116%

606

85

Q3 2022

142%

219

64

Q4 2022

120%

606

99

Q4 2022

143%

208

63

Q1 2023

120%

596

100

Q1 2023

Q1 2023 Fixed Income Investor Call

April 28, 2023

~130%

~50

Target

115-

120%

~80

Target

/

LCR slightly increased quarter on quarter, reflecting prudent

liquidity management including year-to-date € 8bn TLTRO

prepayments

Strong liquidity position maintained throughout the quarter with

daily average LCR at 134%

Net stable funding ratio stable at targeted level

Well-diversified and stable funding continues benefiting from

Strong domestic deposit franchise

Longer-dated capital market issuances

Little remaining reliance on TLTRO funding

7View entire presentation