Cadre Holdings IPO Presentation Deck

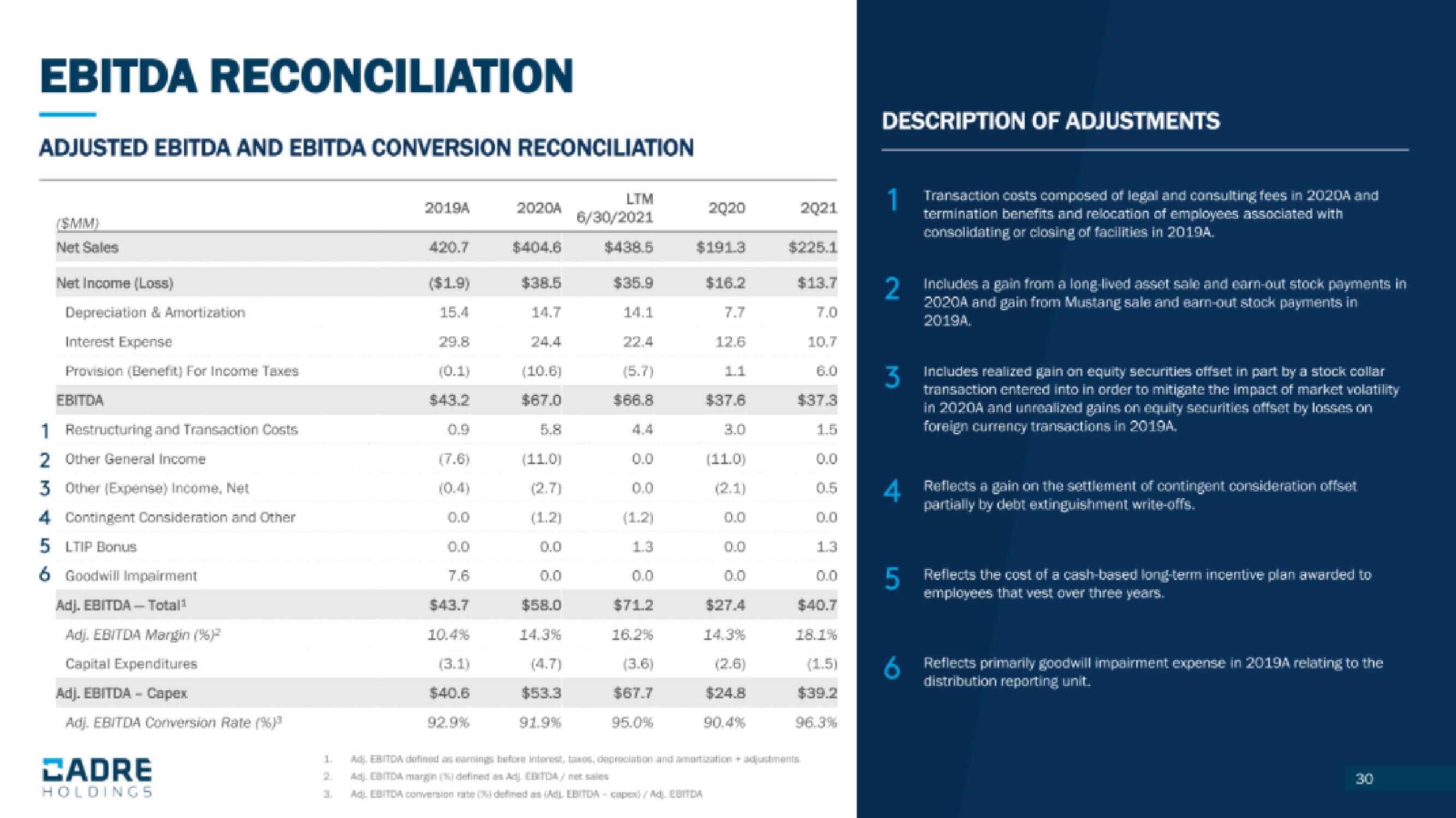

EBITDA RECONCILIATION

ADJUSTED EBITDA AND EBITDA CONVERSION RECONCILIATION

(SMM)

Net Sales

Net Income (Loss)

Depreciation & Amortization

Interest Expense

Provision (Benefit) For Income Taxes

EBITDA

1 Restructuring and Transaction Costs

2 Other General Income

3 Other (Expense) Income, Net

4 Contingent Consideration and Other

5 LTIP Bonus

6 Goodwill Impairment

Adj. EBITDA - Total¹

Adj. EBITDA Margin (%) ²

Capital Expenditures

Adj. EBITDA - Capex

Adj. EBITDA Conversion Rate (%)³

CADRE

HOLDINGS

1.

2019A

420.7

($1.9)

15.4

(0.1)

$43.2

0.9

(7.6)

(0.4)

0.0

0.0

7.6

$43.7

10.4%

(3.1)

$40.6

92.9%

2020A

$404.6

$38.5

14.7

(10.6)

$67.0

5.8

(11.0)

(2.7)

(1.2)

$58.0

14.3%

(4.7)

$53.3

91.9%

LTM

6/30/2021

$438.5

$35.9

14.1

(5.7)

$66.8

0.0

(1.2)

1.3

0.0

$71.2

16.2%

(3.6)

$67.7

95.0%

2020

$191.3

$16.2

12.6

1.1

$37.6

3.0

(11.0)

(2.1)

$27.4

14.3%

(2.6)

$24.8

90.4%

2021

$225.1

$13.7

7.0

10.7

6.0

$37.3

Adj. EBITDA defined as earnings before interest, taxes, depreciation and amortization + adjustments

Adj. EBITDA margin (%) defined as Adj. EBITDA/ net sales

Adi EBITDA conversion rate (N) defined as (Adj. EBITDA-capex)/Ad. EBITDA

1.5

0.5

1.3

0.0

$40.7

18.1%

(1.5)

$39.2

96.3%

DESCRIPTION OF ADJUSTMENTS

1

2 Includes a gain from a long-lived asset sale and earn-out stock payments in

2020A and gain from Mustang sale and earn-out stock payments in

2019A.

3

Transaction costs composed of legal and consulting fees in 2020A and

termination benefits and relocation of employees associated with

consolidating or closing of facilities in 2019A.

Includes realized gain on equity securities offset in part by a stock collar

transaction entered into in order to mitigate the impact of market volatility

in 2020A and unrealized gains on equity securities offset by losses on

foreign currency transactions in 2019A.

4 Reflects a gain on the settlement of contingent consideration offset

partially by debt extinguishment write-offs.

6

5

Reflects the cost of a cash-based long-term incentive plan awarded to

employees that vest over three years.

Reflects primarily goodwill impairment expense in 2019A relating to the

distribution reporting unit.View entire presentation