AMC Mergers and Acquisitions Presentation Deck

Transaction Financing Overview

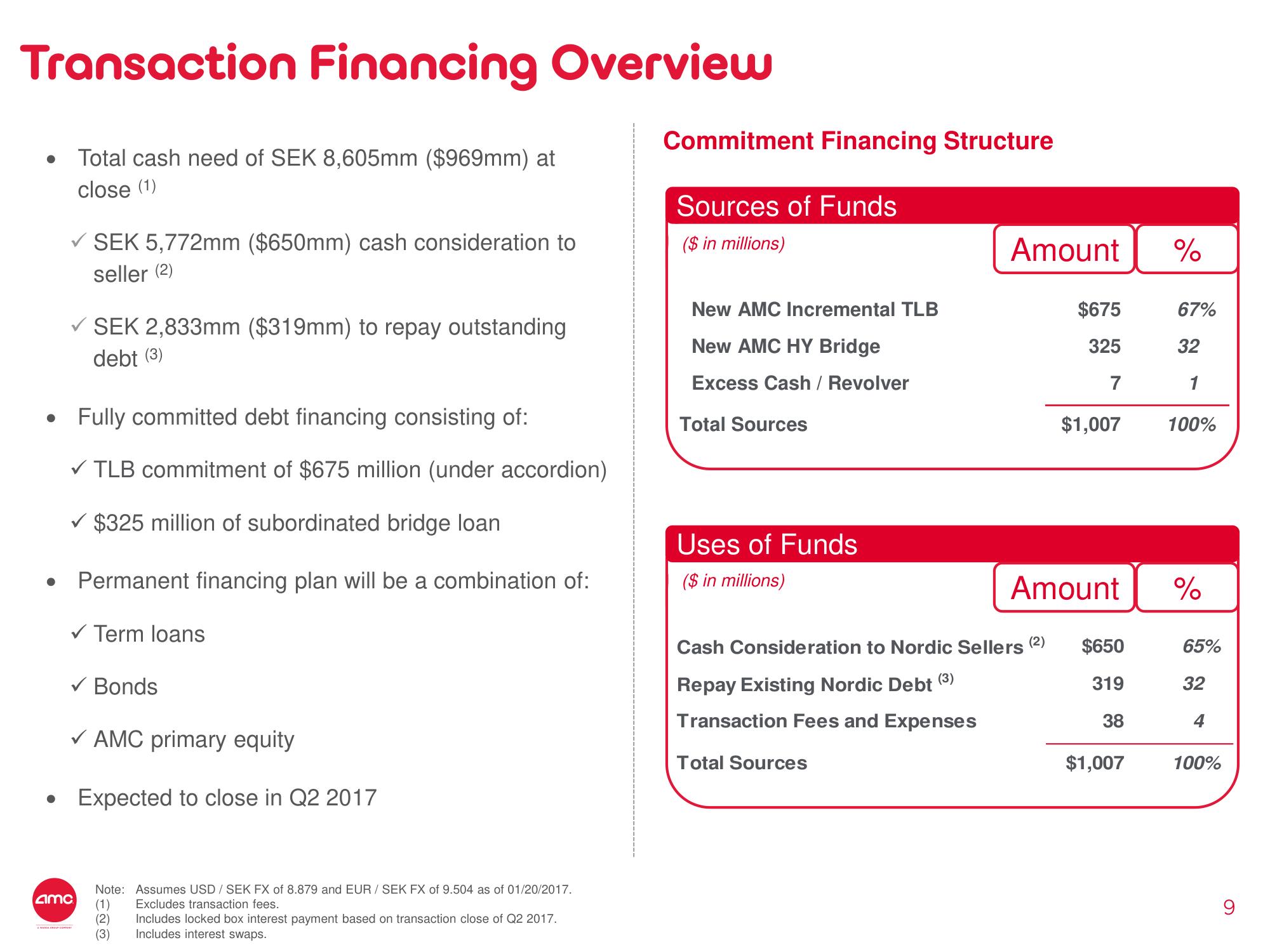

Total cash need of SEK 8,605mm ($969mm) at

close (1)

●

●

✓ SEK 5,772mm ($650mm) cash consideration to

seller (2)

SEK 2,833mm ($319mm) to repay outstanding

debt (3)

Fully committed debt financing consisting of:

✓ TLB commitment of $675 million (under accordion)

✓ $325 million of subordinated bridge loan

Permanent financing plan will be a combination of:

✓ Term loans

✓ Bonds

✓ AMC primary equity

Expected to close in Q2 2017

4mc

Note: Assumes USD / SEK FX of 8.879 and EUR/ SEK FX of 9.504 as of 01/20/2017.

(1) Excludes transaction fees.

(2) Includes locked box interest payment based on transaction close of Q2 2017.

(3) Includes interest swaps.

Commitment Financing Structure

Sources of Funds

($ in millions)

New AMC Incremental TLB

New AMC HY Bridge

Excess Cash / Revolver

Total Sources

Uses of Funds

($ in millions)

Amount

Total Sources

Cash Consideration to Nordic Sellers (2)

Repay Existing Nordic Debt

Transaction Fees and Expenses

(3)

$675

325

7

$1,007

Amount

$650

319

38

%

67%

32

1

100%

%

65%

32

$1,007 100%View entire presentation