Greenlight Company Presentation

One-Time Dividend

o A one-time special dividend of $89

per share

o Assume a constant P/E on the

remaining earnings

Greenlight Capital, Inc.

Cash available for distribution

($ billions)

Shares outstanding (millions)

Distributable cash per share

Value unlocked: Up to $89 per share

$84

945

$89

20

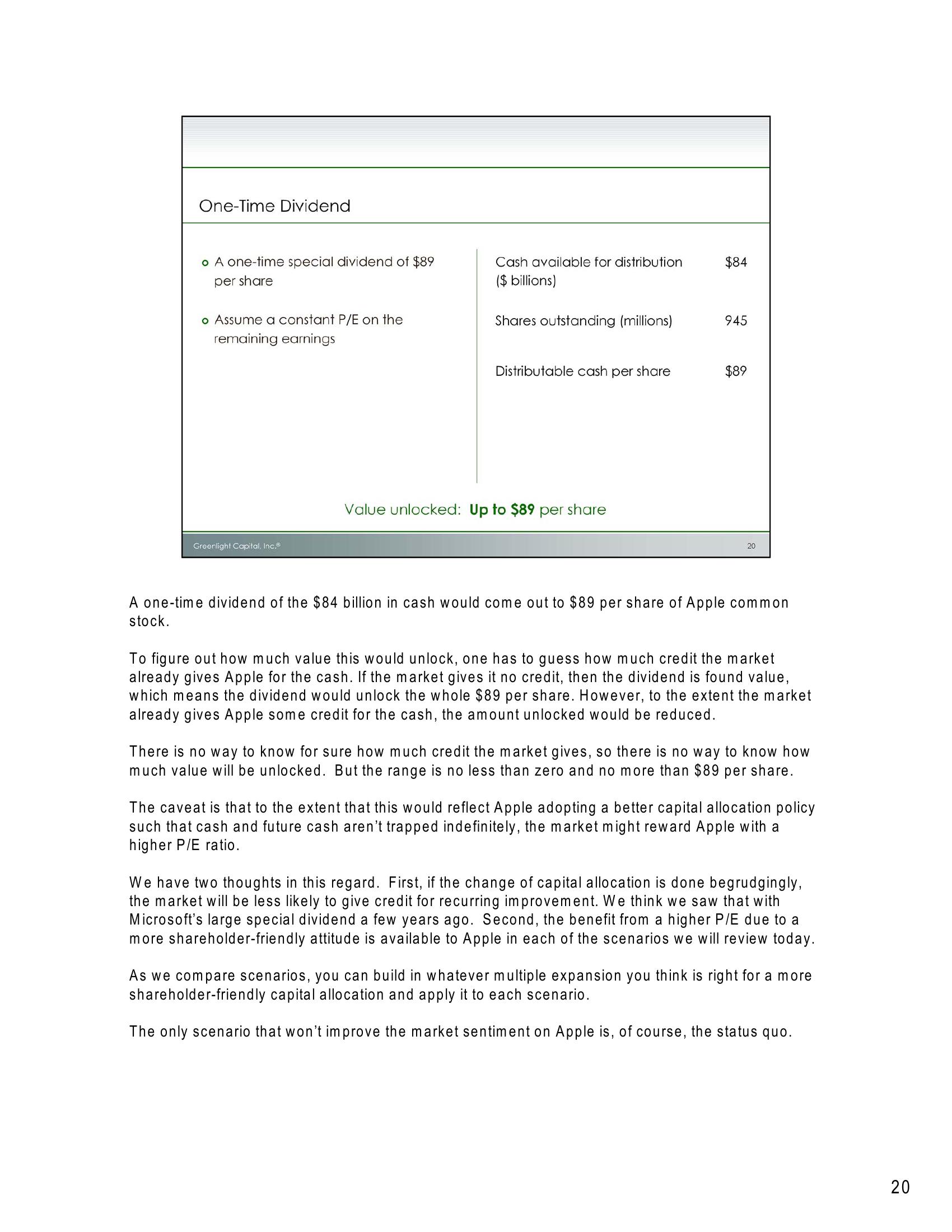

A one-time dividend of the $84 billion in cash would come out to $89 per share of Apple common

stock.

To figure out how much value this would unlock, one has to guess how much credit the market

already gives Apple for the cash. If the market gives it no credit, then the dividend is found value,

which means the dividend would unlock the whole $89 per share. However, to the extent the market

already gives Apple some credit for the cash, the amount unlocked would be reduced.

There is no way to know for sure how much credit the market gives, so there is no way to know how

much value will be unlocked. But the range is no less than zero and no more than $89 per share.

The caveat is that to the extent that this would reflect Apple adopting a better capital allocation policy

such that cash and future cash aren't trapped indefinitely, the market might reward Apple with a

higher P/E ratio.

We have two thoughts in this regard. First, if the change of capital allocation is done begrudgingly,

the market will be less likely to give credit for recurring improvement. We think we saw that with

Microsoft's large special dividend a few years ago. Second, the benefit from a higher P/E due to a

more shareholder-friendly attitude is available to Apple in each of the scenarios we will review today.

As we compare scenarios, you can build in whatever multiple expansion you think is right for a more

shareholder-friendly capital allocation and apply it to each scenario.

The only scenario that won't improve the market sentiment on Apple is, of course, the status quo.

20View entire presentation