Bird Results Presentation Deck

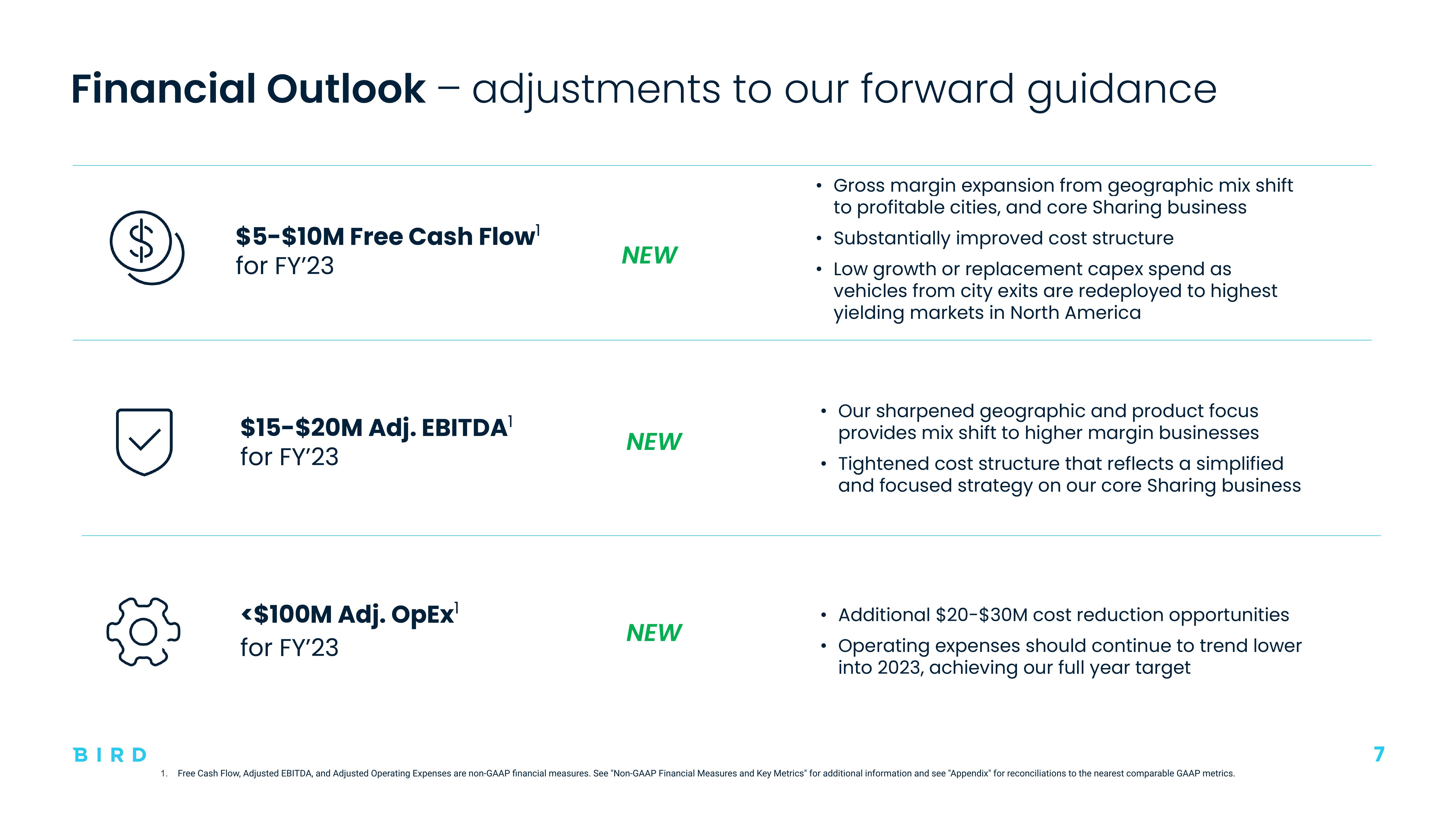

Financial Outlook - adjustments to our forward guidance

Gross margin expansion from geographic mix shift

to profitable cities, and core Sharing business

Substantially improved cost structure

$

BIRD

1.

$5-$10M Free Cash Flow¹

for FY'23

$15-$20M Adj. EBITDA¹

for FY'23

<$100M Adj. OpEx¹

for FY'23

NEW

NEW

NEW

• Low growth or replacement capex spend as

vehicles from city exits are redeployed to highest

yielding markets in North America

• Our sharpened geographic and product focus

provides mix shift to higher margin businesses

Tightened cost structure that reflects a simplified

and focused strategy on our core Sharing business

Additional $20-$30M cost reduction opportunities

Operating expenses should continue to trend lower

into 2023, achieving our full year target

Free Cash Flow, Adjusted EBITDA, and Adjusted Operating Expenses are non-GAAP financial measures. See "Non-GAAP Financial Measures and Key Metrics for additional information and see "Appendix" for reconciliations to the nearest comparable GAAP metrics.

7View entire presentation