Credit Suisse Investment Banking Pitch Book

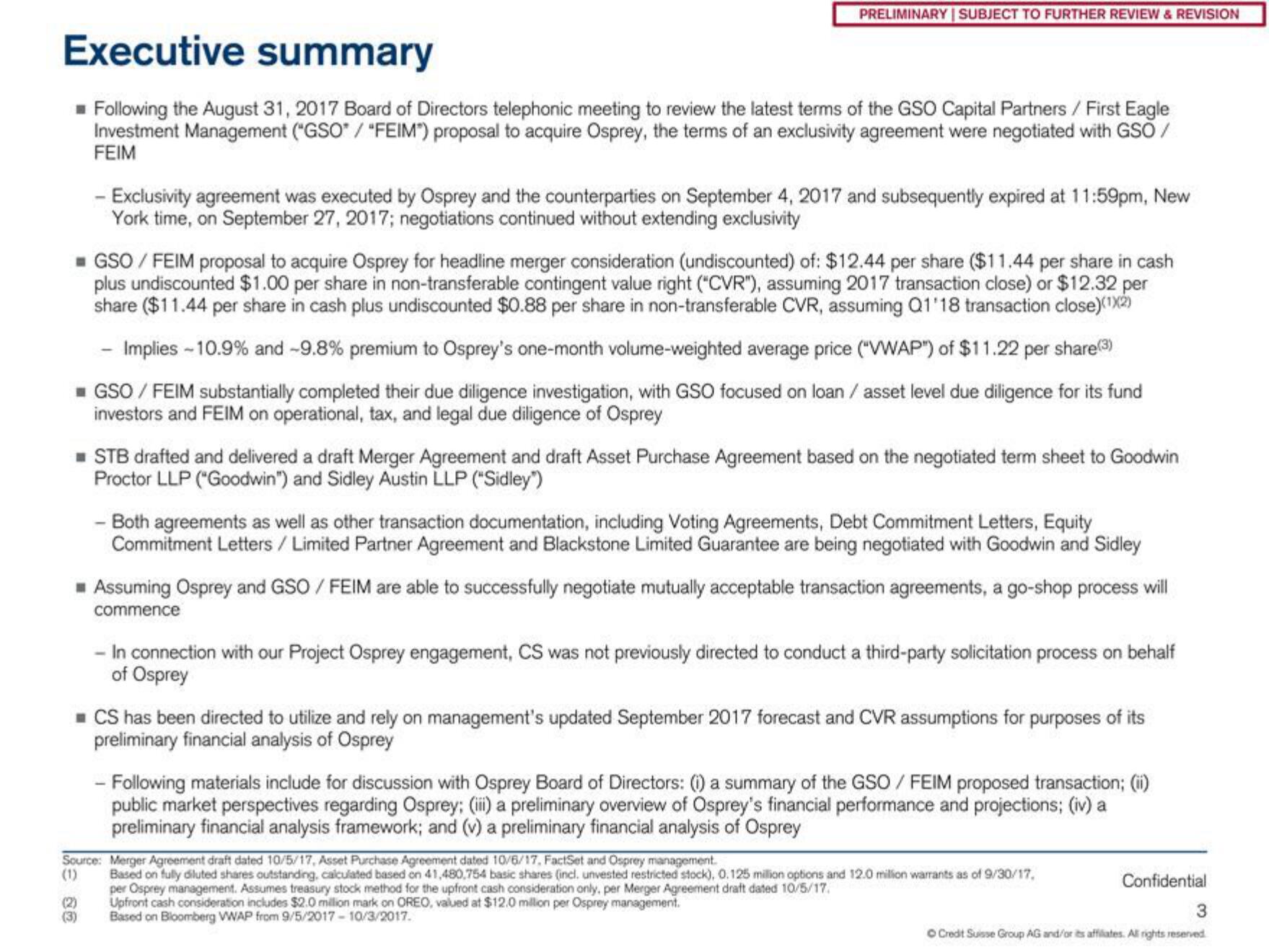

Executive summary

Following the August 31, 2017 Board of Directors telephonic meeting to review the latest terms of the GSO Capital Partners / First Eagle

Investment Management ("GSO" / "FEIM") proposal to acquire Osprey, the terms of an exclusivity agreement were negotiated with GSO /

FEIM

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

- Exclusivity agreement was executed by Osprey and the counterparties on September 4, 2017 and subsequently expired at 11:59pm, New

York time, on September 27, 2017; negotiations continued without extending exclusivity

■ GSO / FEIM proposal to acquire Osprey for headline merger consideration (undiscounted) of: $12.44 per share ($11.44 per share in cash

plus undiscounted $1.00 per share in non-transferable contingent value right ("CVR"), assuming 2017 transaction close) or $12.32 per

share ($11.44 per share in cash plus undiscounted $0.88 per share in non-transferable CVR, assuming Q1'18 transaction close)(¹)(2)

- Implies - 10.9% and -9.8% premium to Osprey's one-month volume-weighted average price ("VWAP") of $11.22 per share(3)

GSO / FEIM substantially completed their due diligence investigation, with GSO focused on loan/asset level due diligence for its fund

investors and FEIM on operational, tax, and legal due diligence of Osprey

■ STB drafted and delivered a draft Merger Agreement and draft Asset Purchase Agreement based on the negotiated term sheet to Goodwin

Proctor LLP ("Goodwin") and Sidley Austin LLP ("Sidley")

(2)

(3)

- Both agreements as well as other transaction documentation, including Voting Agreements, Debt Commitment Letters, Equity

Commitment Letters / Limited Partner Agreement and Blackstone Limited Guarantee are being negotiated with Goodwin and Sidley

Assuming Osprey and GSO / FEIM are able to successfully negotiate mutually acceptable transaction agreements, a go-shop process will

commence

- In connection with our Project Osprey engagement, CS was not previously directed to conduct a third-party solicitation process on behalf

of Osprey

■CS has been directed to utilize and rely on management's updated September 2017 forecast and CVR assumptions for purposes of its

preliminary financial analysis of Osprey

- Following materials include for discussion with Osprey Board of Directors: (i) a summary of the GSO / FEIM proposed transaction; (ii)

public market perspectives regarding Osprey; (iii) a preliminary overview of Osprey's financial performance and projections; (iv) a

preliminary financial analysis framework; and (v) a preliminary financial analysis of Osprey

Source: Merger Agreement draft dated 10/5/17, Asset Purchase Agreement dated 10/6/17, FactSet and Osprey management.

(1)

Based on fully diluted shares outstanding, calculated based on 41,480,754 basic shares (incl. unvested restricted stock), 0.125 million options and 12.0 million warrants as of 9/30/17,

per Osprey management. Assumes treasury stock method for the upfront cash consideration only, per Merger Agreement draft dated 10/5/17.

Upfront cash consideration includes $2.0 million mark on OREO, valued at $12.0 million per Osprey management.

Based on Bloomberg VWAP from 9/5/2017-10/3/2017.

Confidential

3

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation