Allwyn SPAC

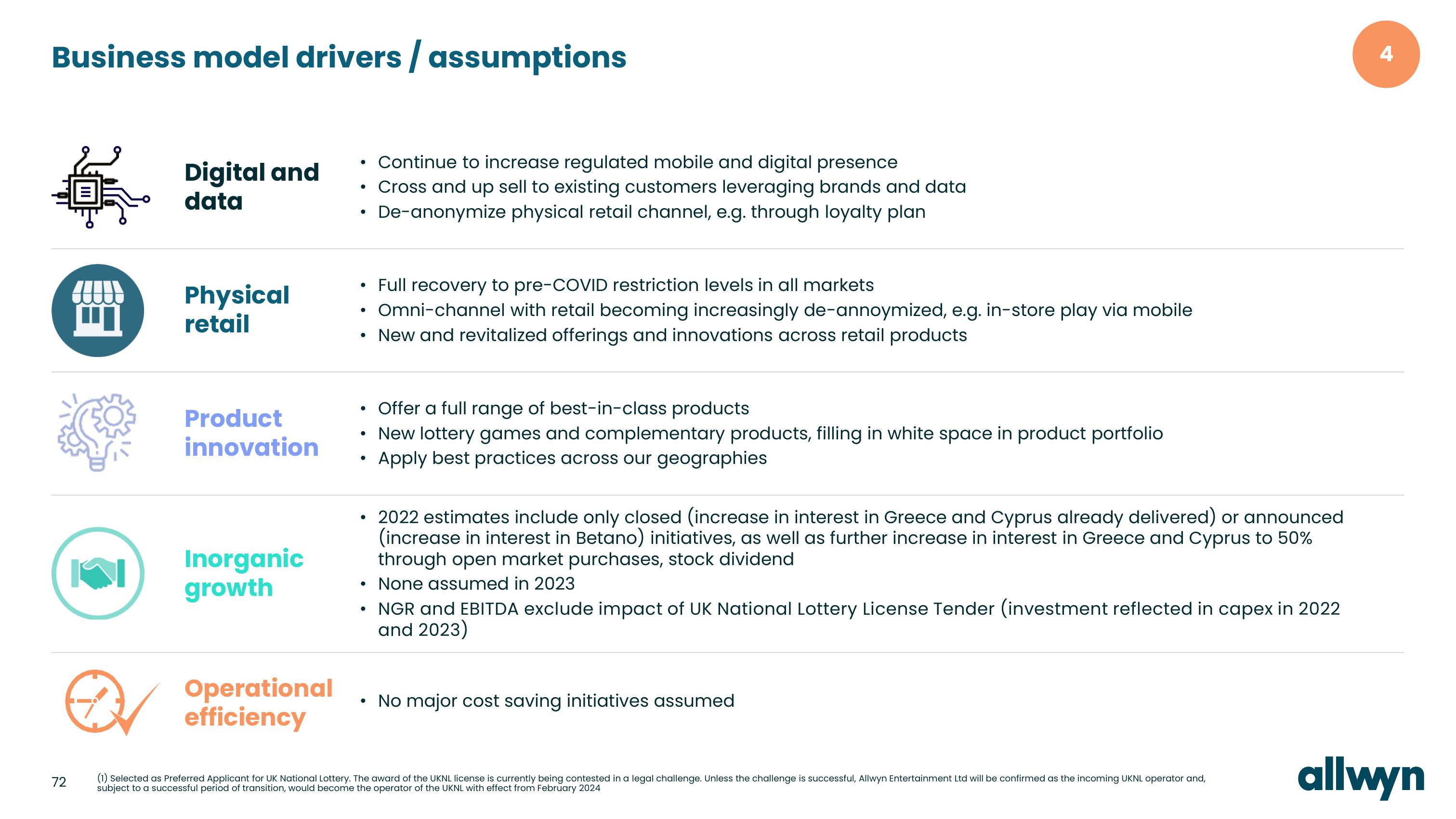

Business model drivers / assumptions

72

☐

Digital and

data

Physical

retail

Product

innovation

Inorganic

growth

Operational

efficiency

Continue to increase regulated mobile and digital presence

• Cross and up sell to existing customers leveraging brands and data

• De-anonymize physical retail channel, e.g. through loyalty plan

●

Full recovery to pre-COVID restriction levels in all markets

• Omni-channel with retail becoming increasingly de-annoymized, e.g. in-store play via mobile

New and revitalized offerings and innovations across retail products

●

●

Offer a full range of best-in-class products

• New lottery games and complementary products, filling in white space in product portfolio

Apply best practices across our geographies

●

●

●

●

●

2022 estimates include only closed (increase in interest in Greece and Cyprus already delivered) or announced

(increase in interest in Betano) initiatives, as well as further increase in interest in Greece and Cyprus to 50%

through open market purchases, stock dividend

None assumed in 2023

NGR and EBITDA exclude impact of UK National Lottery License Tender (investment reflected in capex in 2022

and 2023)

No major cost saving initiatives assumed

(1) Selected as Preferred Applicant for UK National Lottery. The award of the UKNL license is currently being contested in a legal challenge. Unless the challenge is successful, Allwyn Entertainment Ltd will be confirmed as the incoming UKNL operator and,

subject to a successful period of transition, would become the operator of the UKNL with effect from February 2024

4

allwynView entire presentation