Summit Hotel Properties Investor Presentation Deck

15

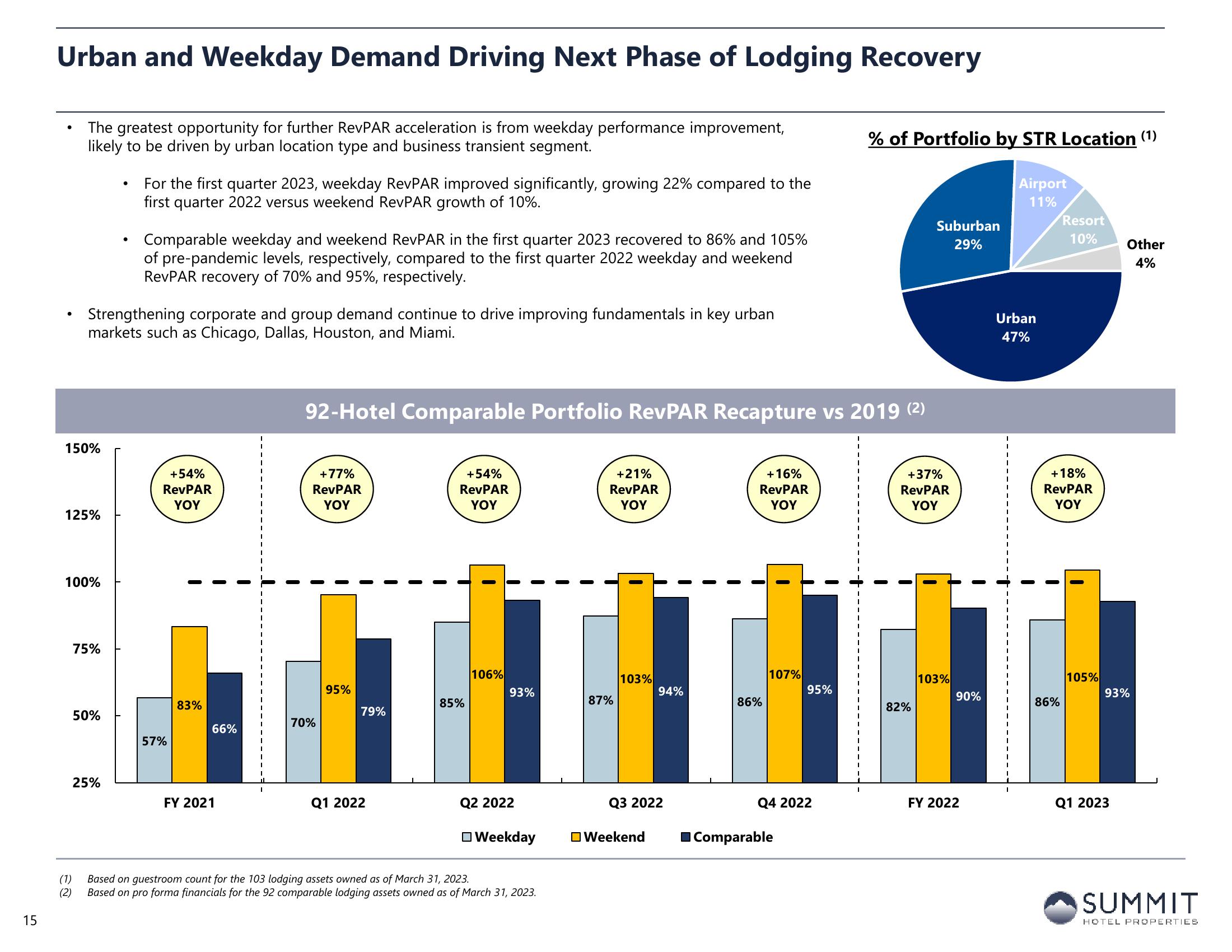

Urban and Weekday Demand Driving Next Phase of Lodging Recovery

The greatest opportunity for further RevPAR acceleration is from weekday performance improvement,

likely to be driven by urban location type and business transient segment.

●

150%

125%

Strengthening corporate and group demand continue to drive improving fundamentals in key urban

markets such as Chicago, Dallas, Houston, and Miami.

100%

75%

50%

(1)

(2)

25%

For the first quarter 2023, weekday RevPAR improved significantly, growing 22% compared to the

first quarter 2022 versus weekend RevPAR growth of 10%.

Comparable weekday and weekend RevPAR in the first quarter 2023 recovered to 86% and 105%

of pre-pa emic levels, respective

ared to the first quarter 2022 weekday and weekend

RevPAR recovery of 70% and 95%, respectively.

+54%

RevPAR

YOY

57%

83%

66%

FY 2021

92-Hotel Comparable Portfolio RevPAR Recapture vs 2019 (²)

+77%

RevPAR

YOY

70%

95%

79%

Q1 2022

+54%

RevPAR

YOY

85%

106%

93%

Q2 2022

Weekday

Based on guestroom count for the 103 lodging assets owned as of March 31, 2023.

Based on pro forma financials for the 92 comparable lodging assets owned as of March 31, 2023.

+21%

RevPAR

YOY

87%

103%

94%

Q3 2022

Weekend

+16%

RevPAR

YOY

86%

107%

95%

Q4 2022

Comparable

% of Portfolio by STR Location (¹)

Airport

11%

Suburban

29%

+37%

RevPAR

YOY

82%

103%

90%

FY 2022

Urban

47%

Resort

10%

+18%

RevPAR

YOY

86%

105%

Other

4%

93%

Q1 2023

SUMMIT

HOTEL PROPERTIESView entire presentation