Second Quarter 2022 Conference Call

Second Quarter 2022 Financial Highlights

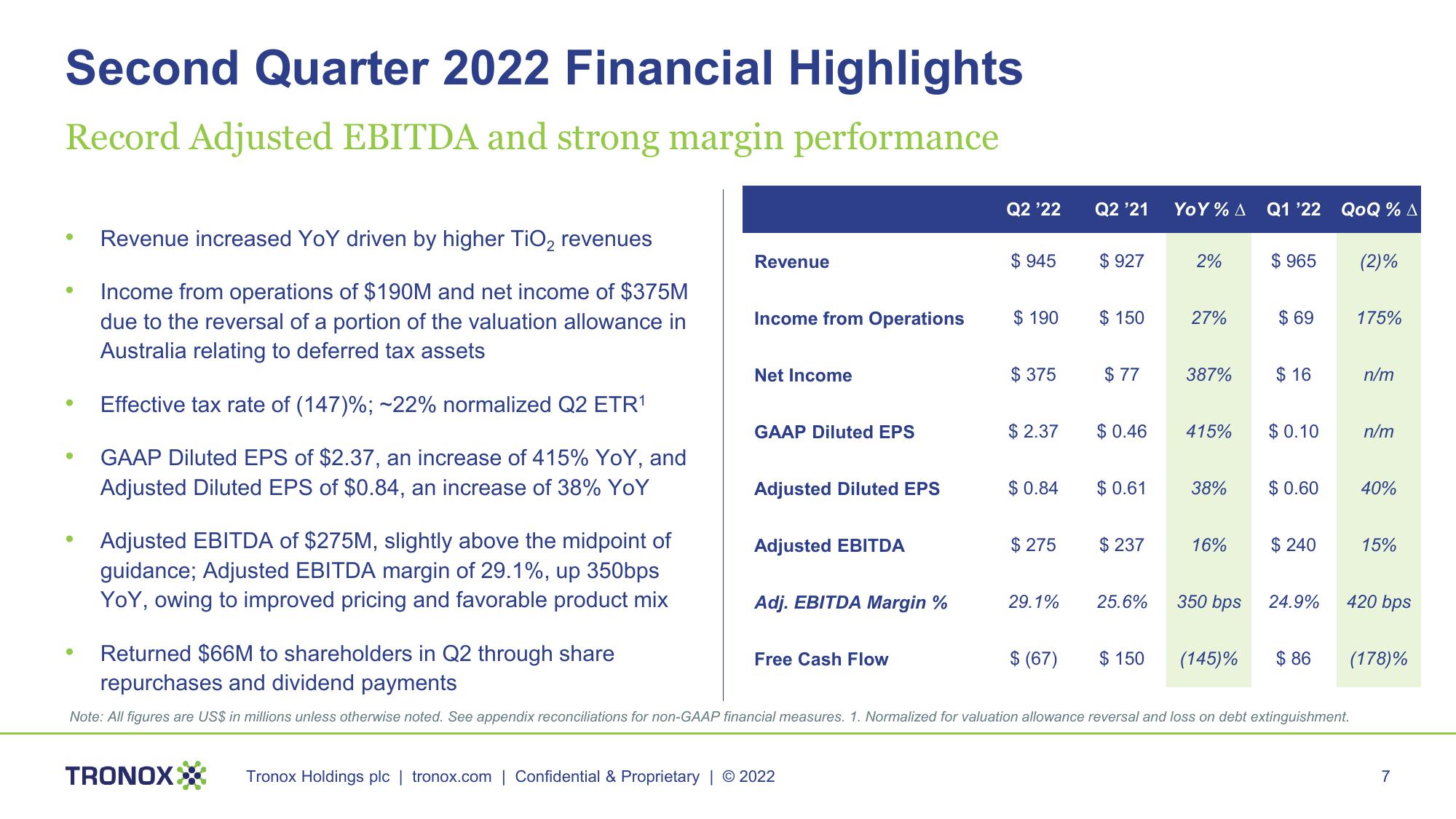

Record Adjusted EBITDA and strong margin performance

●

●

Revenue increased YoY driven by higher TiO₂ revenues

Income from operations of $190M and net income of $375M

due to the reversal of a portion of the valuation allowance in

Australia relating to deferred tax assets

Effective tax rate of (147)%; -22% normalized Q2 ETR¹

GAAP Diluted EPS of $2.37, an increase of 415% YoY, and

Adjusted Diluted EPS of $0.84, an increase of 38% YoY

Adjusted EBITDA of $275M, slightly above the midpoint of

guidance; Adjusted EBITDA margin of 29.1%, up 350bps

YoY, owing to improved pricing and favorable product mix

Revenue

TRONOX

Income from Operations

Net Income

GAAP Diluted EPS

Adjusted Diluted EPS

Adjusted EBITDA

Adj. EBITDA Margin %

Free Cash Flow

Q2 '22

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2022

$945

$ 190

$375

$ 2.37

$ 0.84

$275

29.1%

Q2 '21

$ (67)

$927

$150

$77

$ 0.46

$0.61

$ 237

25.6%

YoY % A

2%

27%

387%

38%

16%

350 bps

Q1 '22 QoQ % A

415% $0.10

$ 965

$150 (145)%

$69

$16

Returned $66M to shareholders in Q2 through share

repurchases and dividend payments

Note: All figures are US$ in millions unless otherwise noted. See appendix reconciliations for non-GAAP financial measures. 1. Normalized for valuation allowance reversal and loss on debt extinguishment.

$ 0.60

$ 240

24.9%

$ 86

(2)%

175%

n/m

n/m

40%

15%

420 bps

(178)%

7View entire presentation