JFL Equity Investors VI, L.P Recommendation Report

●

Hamilton Lane

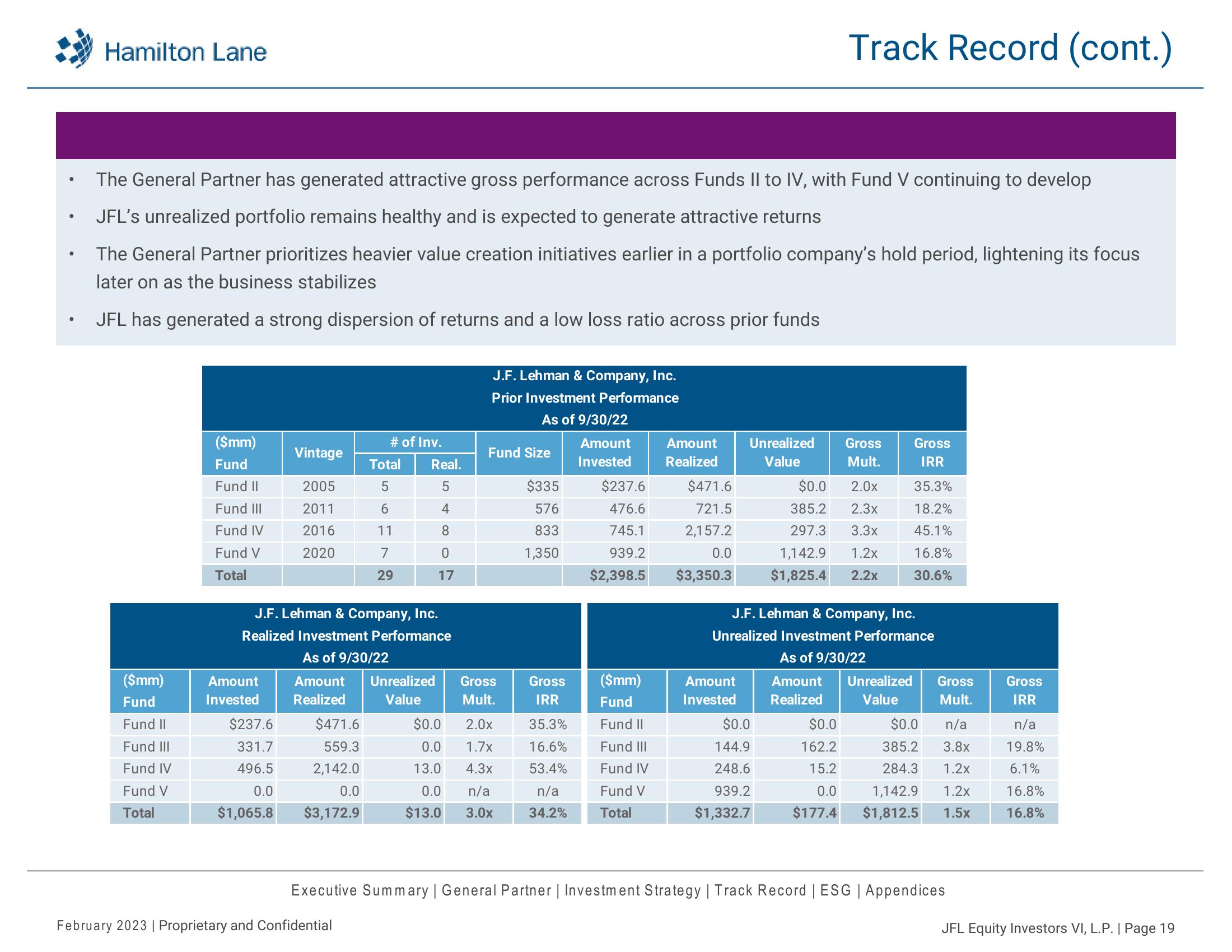

The General Partner has generated attractive gross performance across Funds II to IV, with Fund V continuing to develop

JFL's unrealized portfolio remains healthy and is expected to generate attractive returns

The General Partner prioritizes heavier value creation initiatives earlier in a portfolio company's hold period, lightening its focus

later on as the business stabilizes

JFL has generated a strong dispersion of returns and a low loss ratio across prior funds

($mm)

Fund

Fund II

Fund III

Fund IV

Fund V

Total

($mm)

Fund

Fund II

Fund III

Fund IV

Fund V

Total

Amount

Invested

Vintage

2005

2011

2016

2020

$237.6

331.7

496.5

0.0

$1,065.8

# of Inv.

Total

5

6

11

7

29

$471.6

559.3

2,142.0

0.0

$3,172.9

Real.

J.F. Lehman & Company, Inc.

Realized Investment Performance

As of 9/30/22

54

February 2023 | Proprietary and Confidential

4

8

0

17

Amount Unrealized Gross

Realized

Value

Mult.

J.F. Lehman & Company, Inc.

Prior Investment Performance

As of 9/30/22

$0.0

0.0

13.0

Fund Size

2.0x

1.7x

4.3x

0.0 n/a

$13.0 3.0x

$335

576

833

1,350

Gross

IRR

35.3%

16.6%

53.4%

n/a

34.2%

Amount

Invested

$237.6

476.6

745.1

939.2

$2,398.5

($mm)

Fund

Fund II

Fund III

Fund IV

Fund V

Total

Amount

Realized

$471.6

721.5

2,157.2

0.0

$3,350.3

Amount

Invested

Track Record (cont.)

Unrealized Gross

Value

Mult.

$0.0

144.9

248.6

939.2

$1,332.7

$0.0 2.0x

385.2 2.3x

297.3 3.3x

1,142.9 1.2x

$1,825.4 2.2x

J.F. Lehman & Company, Inc.

Unrealized Investment Performance

As of 9/30/22

Gross

IRR

$0.0

162.2

15.2

0.0

$177.4

35.3%

18.2%

45.1%

16.8%

30.6%

Amount Unrealized Gross

Realized Value Mult.

$0.0 n/a

385.2

3.8x

284.3 1.2x

1,142.9 1.2x

$1,812.5

1.5x

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

Gross

IRR

n/a

19.8%

6.1%

16.8%

16.8%

JFL Equity Investors VI, L.P. | Page 19View entire presentation