Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

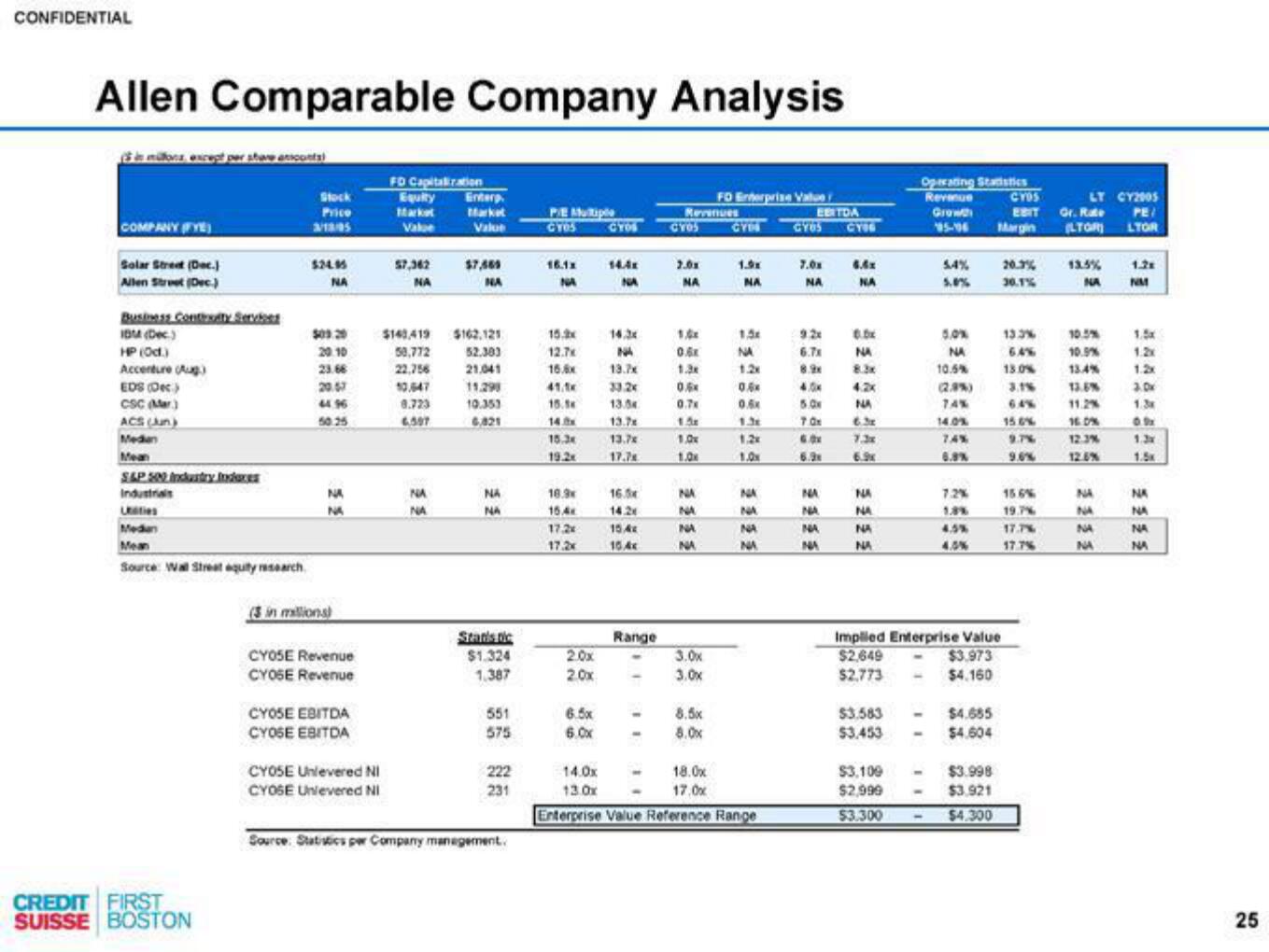

Allen Comparable Company Analysis

in mültons, except per share acont

COMPANY YE

Solar Street (Dec.)

Allen Street (Dec.)

Business Contruty Services

IBM (Dec.)

HP (0d.)

Accenture (Aug)

EDS (DK)

CSC (Mar)

ACS (Jun)

Medan

Mean

S&P 509 Includry Indices

Industrials

Utaties

Medan

Mean

Source: Wall Streat equity research

CREDIT FIRST

SUISSE BOSTON

Stock

Price

3/13/95

$24.95

NA

$03.20

20.10

23.66

20.57

44.96

50.25

NA

NA

(3 in millions)

CY05E Revenue

CYOSE Revenue

CYOSE EBITDA

CYOSE EBITDA

FD Capitalization

Equity Enterp

Market Market

Value

Value

CYOSE Unlevered NI

CYOSE Unlevered NI

57,362

NA

$143,419 $162.121

50,772

52.383

22,756

21.041

10.647

8.723

6.597

$7,669

NA

NA

NA

11.298

10.353

6,821

NA

NA

Statistic

$1.324

1.387

551

575

222

231

Source: Statistics per Company management.

PE Multiple

CYDS

16.1x

NA

15.x

12.7

16.6x

41.1x

15.1

14.x

15.3x

19.2x

18.9

15.4

17.2x

17.2x

2.0x

2.0x

6.5x

6.0x

CYOS

14.4x

NA

NA

13.7x

33.2x

13.04

13.7x

13.7x

17.7x

16.5

14.2

15.4x

10.Ax

Range

Revenues

CYOS

NA

0.6K

1.3x

0.6x

0.7x

1.5x

1.0x

1.0x

NA

NA

NA

NA

3.0x

3.0x

8.5x

8.0x

FO Enterprise Value

18.0x

- 17.0x

CY

1.9x

NA

1.5x

NA

1.2x

0.6

0.5x

1.3

1.2x

1.0x

NA

NA

NA

NA

14.0x

13.0x

Enterprise Value Reference Range

EBITDA

GY65 CYBE

7.0x

NA

9.2x

6.7x

8.9

4.0x

5.0

7.0x

6.0x

6.9

NA

NA

NA

NA

6.6x

NA

0.0x

NA

8.3x

4.2x

NA

7.3x

6.9x

NA

NA

NA

NA

$3.583

$3,453

Operating Statistics

Revenue CYDS

Growth

EBIT

95-96 Margin

$3,109

$2,999

$3.300

-

5.4%

5.0%

-

50%

NA

10.5%

(2.9%)

74%

Implied Enterprise Value

$2,649

$2,773

14.0%

74%

6.8%

7.2%

1.3%

4.0%

$3.973

$4.160

$4.685

$4.604

$3.998

$3.921

$4.300

20.3%

30.1%

13.3%

64%

13.0%

3.1%

64%

15.0%

9.7%

9.6%

15.6%

19.7%

17.7%

17.7%

LT CY2005

PE/

LTOR

Gr. Rate

(LTORI

13.5%

NA

10.5%

10.9%

13.4%

11.2%

16.0%

12.3%

12.6%

NA

NA

NA

NA

1.2x

NM

1.2x

1.2x

3.0x

0.9

1.3x

1.5K

NA

3333

NA

NA

NA

-

25View entire presentation