Freyr SPAC Presentation Deck

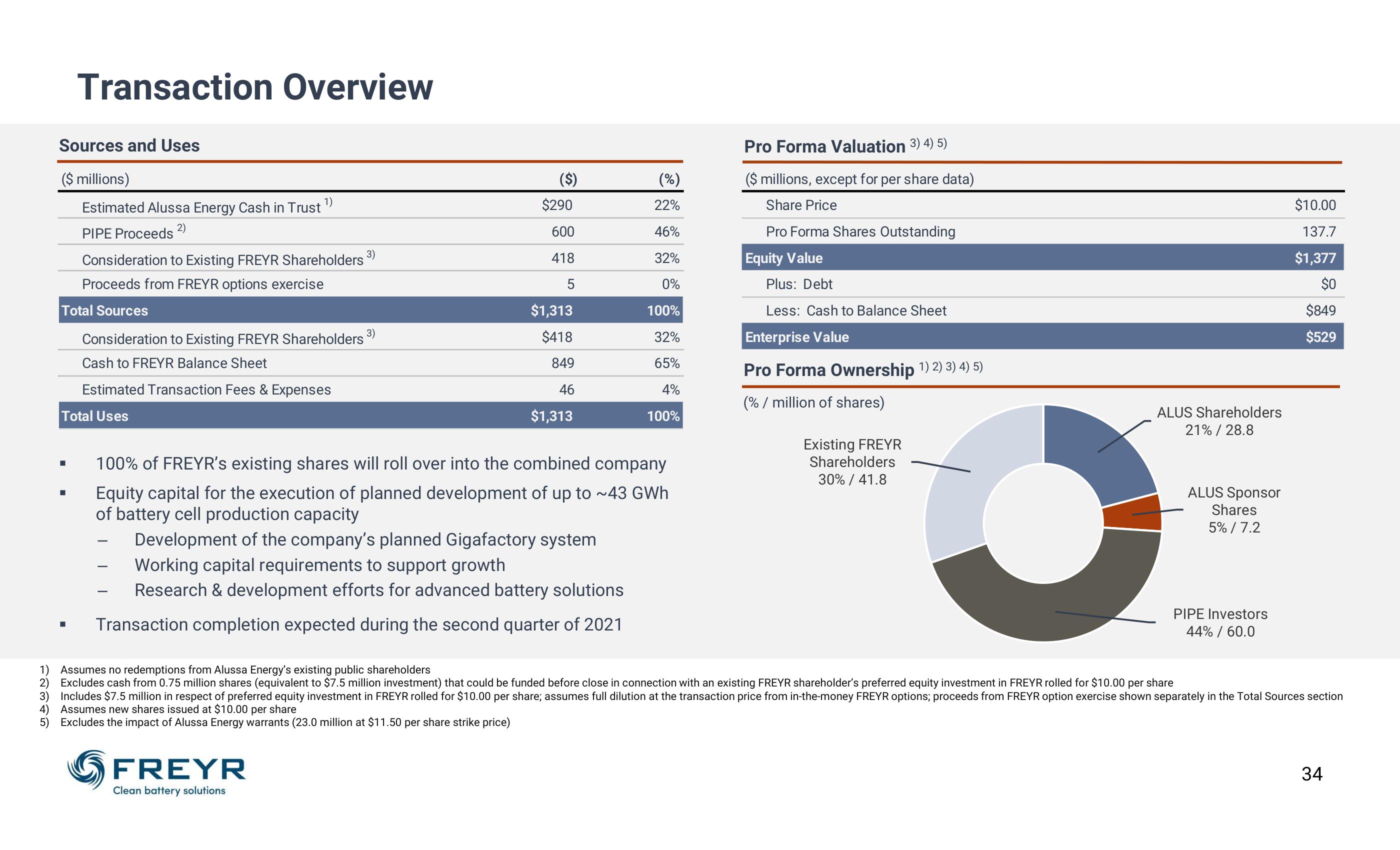

Sources and Uses

($ millions)

1)

Estimated Alussa Energy Cash in Trust

2)

PIPE Proceeds

Consideration to Existing FREYR Shareholders 3)

Proceeds from FREYR options exercise

Total Sources

Consideration to Existing FREYR Shareholders

Cash to FREYR Balance Sheet

Estimated Transaction Fees & Expenses

Total Uses

■

Transaction Overview

■

I

3)

$290

500

418

5

FREYR

Clean battery solutions

$1,313

$418

849

46

$1,313

(%)

22%

46%

32%

0%

100%

32%

65%

4%

100%

100% of FREYR's existing shares will roll over into the combined company

Equity capital for the execution of planned development of up to ~43 GWh

of battery cell production capacity

Development of the company's planned Gigafactory system

Working capital requirements to support growth

Research & development efforts for advanced battery solutions

Transaction completion expected during the second quarter of 2021

Pro Forma Valuation 3) 4) 5)

($ millions, except for per share data)

Share Price

Pro Forma Shares Outstanding

Equity Value

Plus: Debt

Less: Cash to Balance Sheet

Enterprise Value

Pro Forma Ownership ¹) 2) 3) 4) 5)

(%/million of shares)

Existing FREYR

Shareholders

30% / 41.8

ALUS Shareholders

21% / 28.8

ALUS Sponsor

Shares

5% / 7.2

PIPE Investors

44% / 60.0

$10.00

137.7

$1,377

$0

$849

$529

1)

Assumes no redemptions from Alussa Energy's existing public shareholders

2) Excludes cash from 0.75 million shares (equivalent to $7.5 million investment) that could be funded before close in connection with an existing FREYR shareholder's preferred equity investment in FREYR rolled for $10.00 per share

3) Includes $7.5 million in respect of preferred equity investment in FREYR rolled for $10.00 per share; assumes full dilution at the transaction price from in-the-money FREYR options; proceeds from FREYR option exercise shown separately in the Total Sources section

4) Assumes new shares issued at $10.00 per share

5) Excludes the impact of Alussa Energy warrants (23.0 million at $11.50 per share strike price)

34View entire presentation