Netstreit Investor Presentation Deck

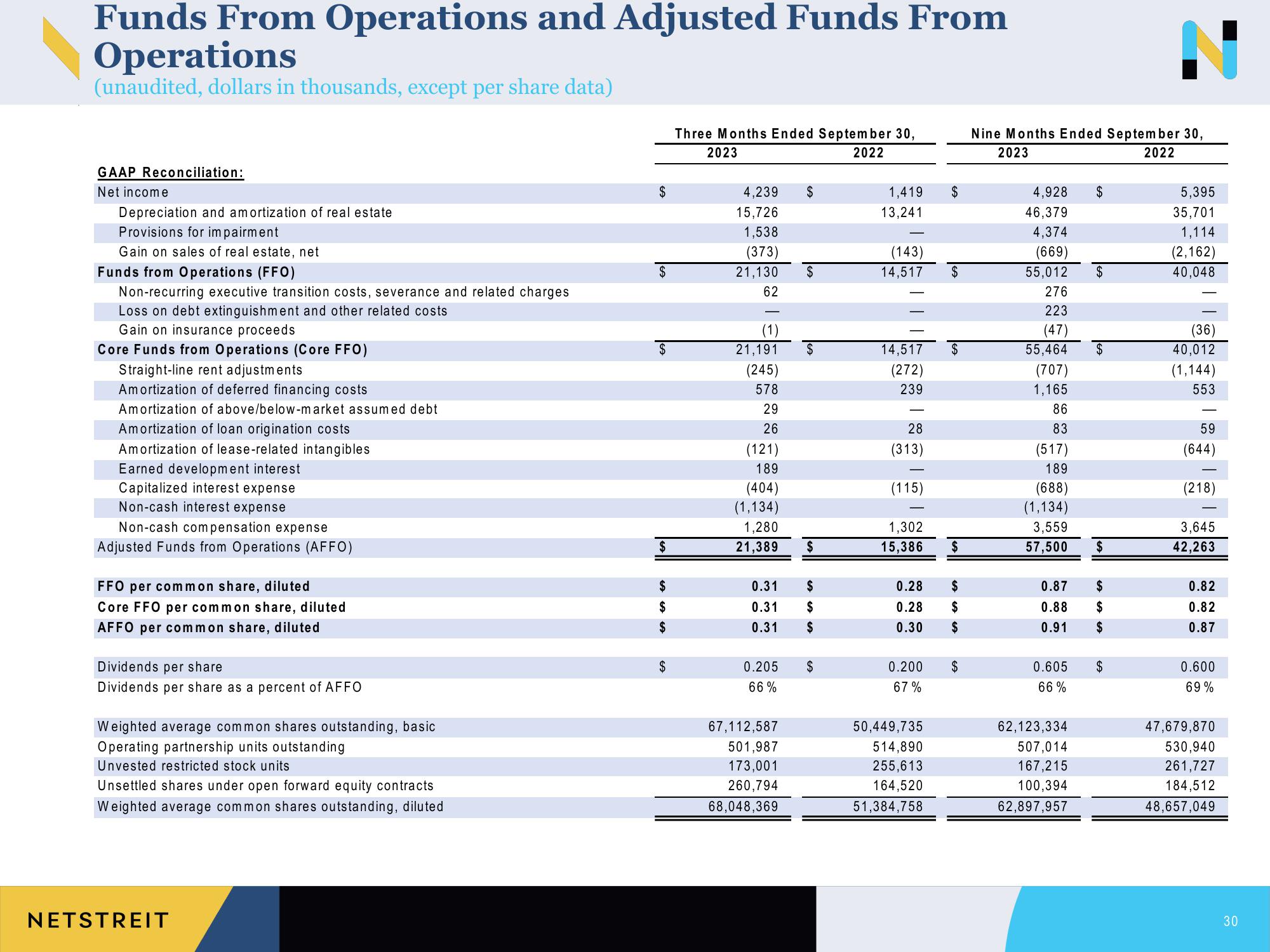

Funds From Operations and Adjusted Funds From

Operations

(unaudited, dollars in thousands, except per share data)

GAAP Reconciliation:

Net income

Depreciation and amortization of real estate

Provisions for impairment

Gain on sales of real estate, net

Funds from Operations (FFO)

Non-recurring executive transition costs, severance and related charges

Loss on debt extinguishment and other related costs

Gain on insurance proceeds

Core Funds from Operations (Core FFO)

Straight-line rent adjustments

Amortization of deferred financing costs

Amortization of above/below-market assumed debt

Amortization of loan origination costs

Amortization of lease-related intangibles

Earned development interest

Capitalized interest expense

Non-cash interest expense

Non-cash compensation expense

Adjusted Funds from Operations (AFFO)

FFO per common share, diluted

Core FFO per common share, diluted

AFFO per common share, diluted

Dividends per share

Dividends per share as a percent of AFFO

Weighted average common shares outstanding, basic

Operating partnership units outstanding

Unvested restricted stock units

Unsettled shares under open forward equity contracts

Weighted average common shares outstanding, diluted

NETSTREIT

$

$

$

$

$

$

$

$

Three Months Ended September 30,

2023

2022

4,239 $

15,726

1,538

(373)

21,130

62

(1)

21,191

(245)

578

29

26

(121)

189

(404)

(1,134)

1,280

21,389

0.31

0.31

0.31

0.205

66%

67,112,587

501,987

173,001

260,794

68,048,369

$

$

$

$

$

$

$

1,419 $

13,241

(143)

14,517

14,517

(272)

239

28

(313)

(115)

1,302

15,386

0.28

0.28

0.30

0.200

67%

50,449,735

514,890

255,613

164,520

51,384,758

$

$

$

$

$

$

$

Nine Months Ended September 30,

2023

2022

4,928 $

46,379

4,374

(669)

55,012

276

223

(47)

55,464

(707)

1,165

86

83

(517)

189

(688)

(1,134)

3,559

57,500

0.605

66%

$

0.87 $

0.88 $

0.91 $

62,123,334

507,014

167,215

100,394

62,897,957

$

$

5,395

35,701

1,114

(2,162)

40,048

(36)

40,012

(1,144)

553

59

(644)

(218)

3,645

42,263

0.82

0.82

0.87

0.600

69%

47,679,870

530,940

261,727

184,512

48,657,049

30View entire presentation