Investor Presentation

FINANCIALS

TECHNOLOGY

ENERGY EVOLUTION

NATURAL RESOURCES

INTRO

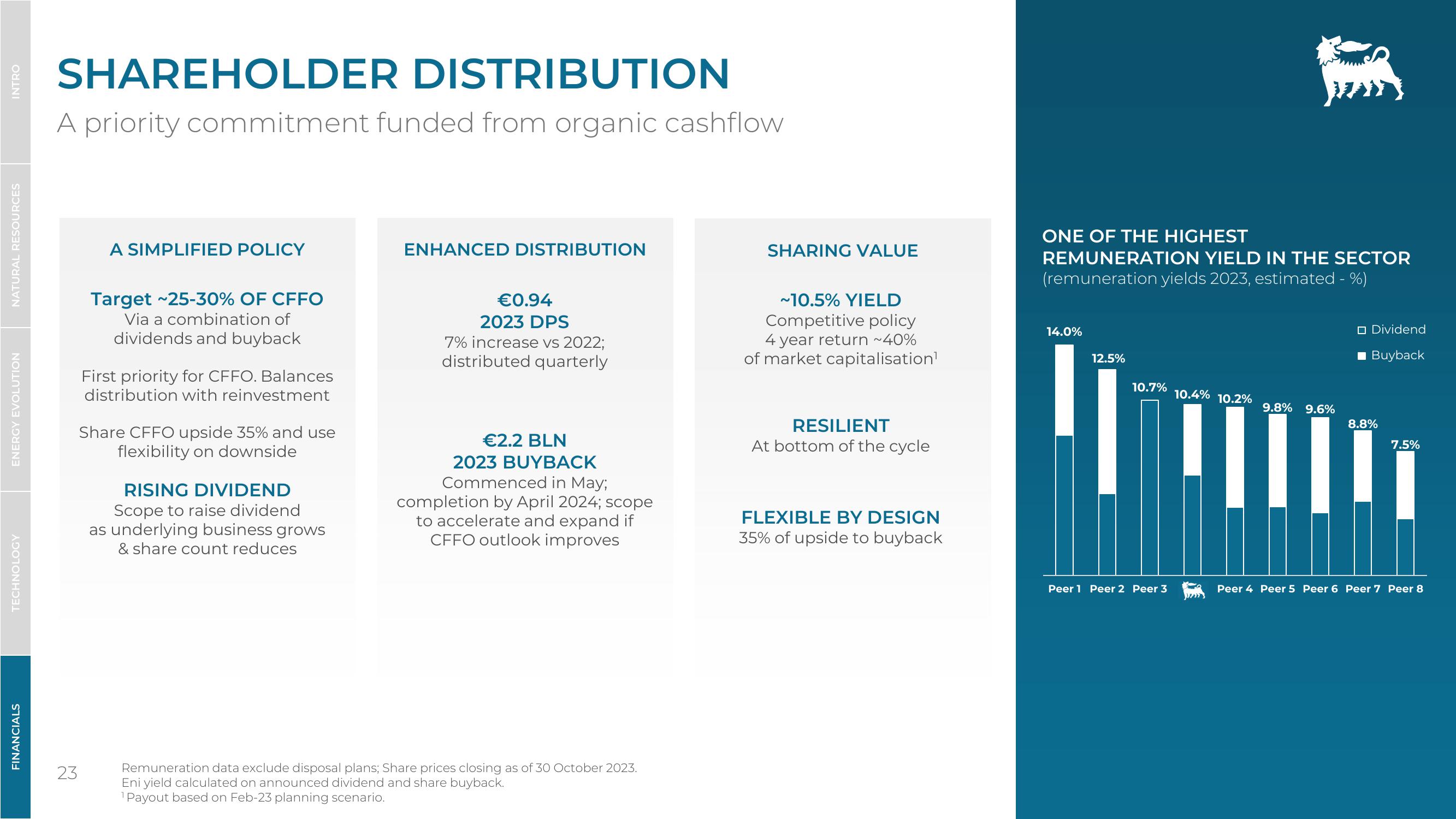

SHAREHOLDER DISTRIBUTION

A priority commitment funded from organic cashflow

A SIMPLIFIED POLICY

Target ~25-30% OF CFFO

Via a combination of

dividends and buyback

First priority for CFFO. Balances

distribution with reinvestment

Share CFFO upside 35% and use

flexibility on downside

RISING DIVIDEND

Scope to raise dividend

as underlying business grows

& share count reduces

ENHANCED DISTRIBUTION

€0.94

2023 DPS

7% increase vs 2022;

distributed quarterly

€2.2 BLN

2023 BUYBACK

Commenced in May;

completion by April 2024; scope

to accelerate and expand if

CFFO outlook improves

SHARING VALUE

~10.5% YIELD

Competitive policy

4 year return ~40%

of market capitalisation

RESILIENT

At bottom of the cycle

FLEXIBLE BY DESIGN

35% of upside to buyback

ONE OF THE HIGHEST

REMUNERATION YIELD IN THE SECTOR

(remuneration yields 2023, estimated - %)

14.0%

12.5%

10.7%

10.4% 10.2%

9.8% 9.6%

IIII

□ Dividend

■Buyback

8.8%

7.5%

23

Remuneration data exclude disposal plans; Share prices closing as of 30 October 2023.

Eni yield calculated on announced dividend and share buyback.

1 Payout based on Feb-23 planning scenario.

Peer 1 Peer 2 Peer 3

Peer 4 Peer 5 Peer 6 Peer 7 Peer 8View entire presentation