NewFortress Energy Results Presentation Deck

Financial Performance

Financial Performance

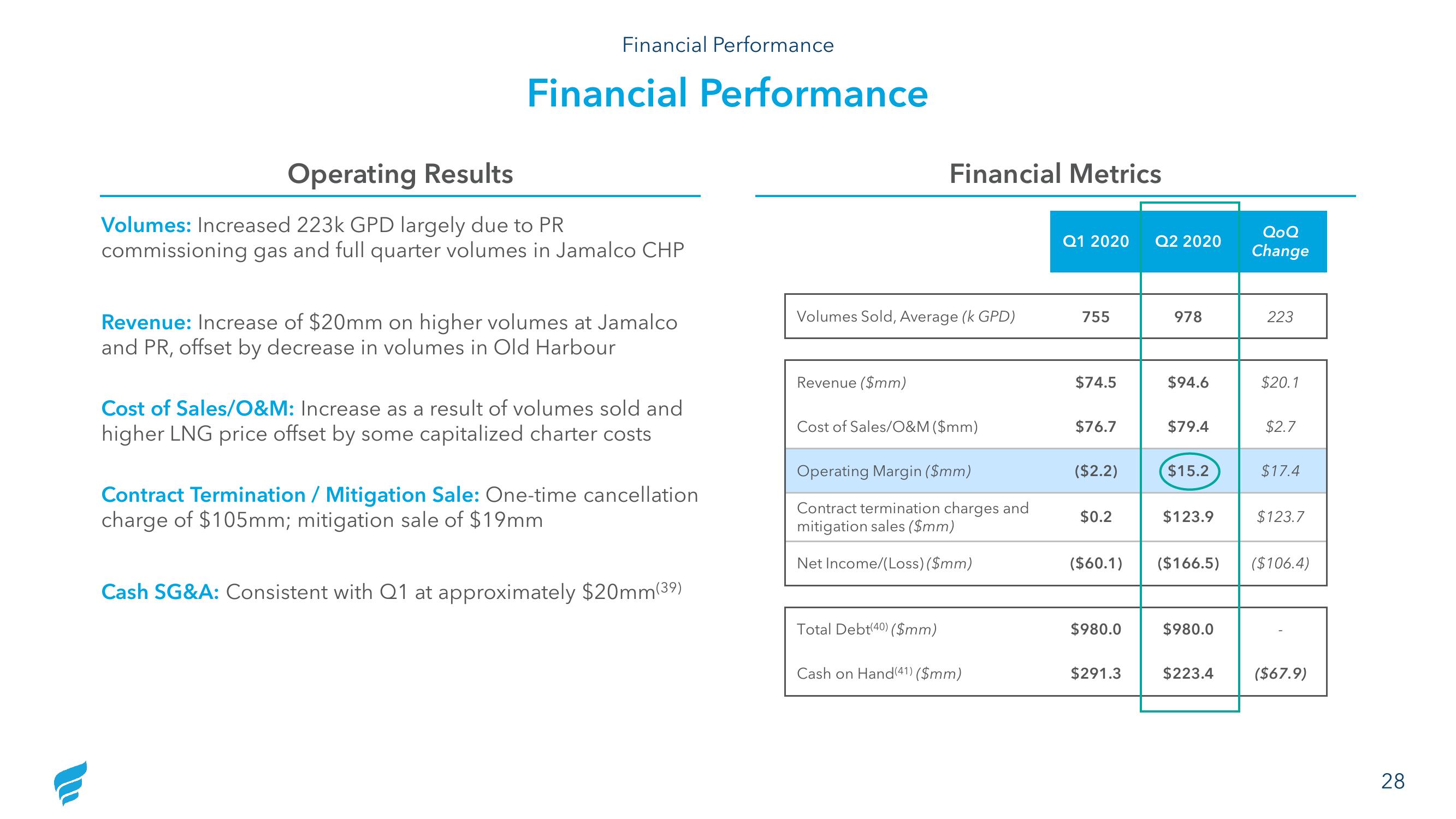

Operating Results

Volumes: Increased 223k GPD largely due to PR

commissioning gas and full quarter volumes in Jamalco CHP

Revenue: Increase of $20mm on higher volumes at Jamalco

and PR, offset by decrease in volumes in Old Harbour

Cost of Sales/O&M: Increase as a result of volumes sold and

higher LNG price offset by some capitalized charter costs

Contract Termination / Mitigation Sale: One-time cancellation

charge of $105mm; mitigation sale of $19mm

Cash SG&A: Consistent with Q1 at approximately $20mm(39)

Volumes Sold, Average (k GPD)

Revenue ($mm)

Financial Metrics

Cost of Sales/O&M ($mm)

Operating Margin ($mm)

Contract termination charges and

mitigation sales ($mm)

Net Income/(Loss) ($mm)

Total Debt(40) ($mm)

Cash on Hand (41) ($mm)

Q1 2020 Q2 2020

755

$74.5

$76.7

($2.2)

$0.2

($60.1)

$980.0

$291.3

978

$94.6

$79.4

$15.2

$123.9

$980.0

QoQ

Change

$223.4

223

$20.1

$2.7

$17.4

($166.5) ($106.4)

$123.7

($67.9)

28View entire presentation