HPS Specialty Loan Fund VI

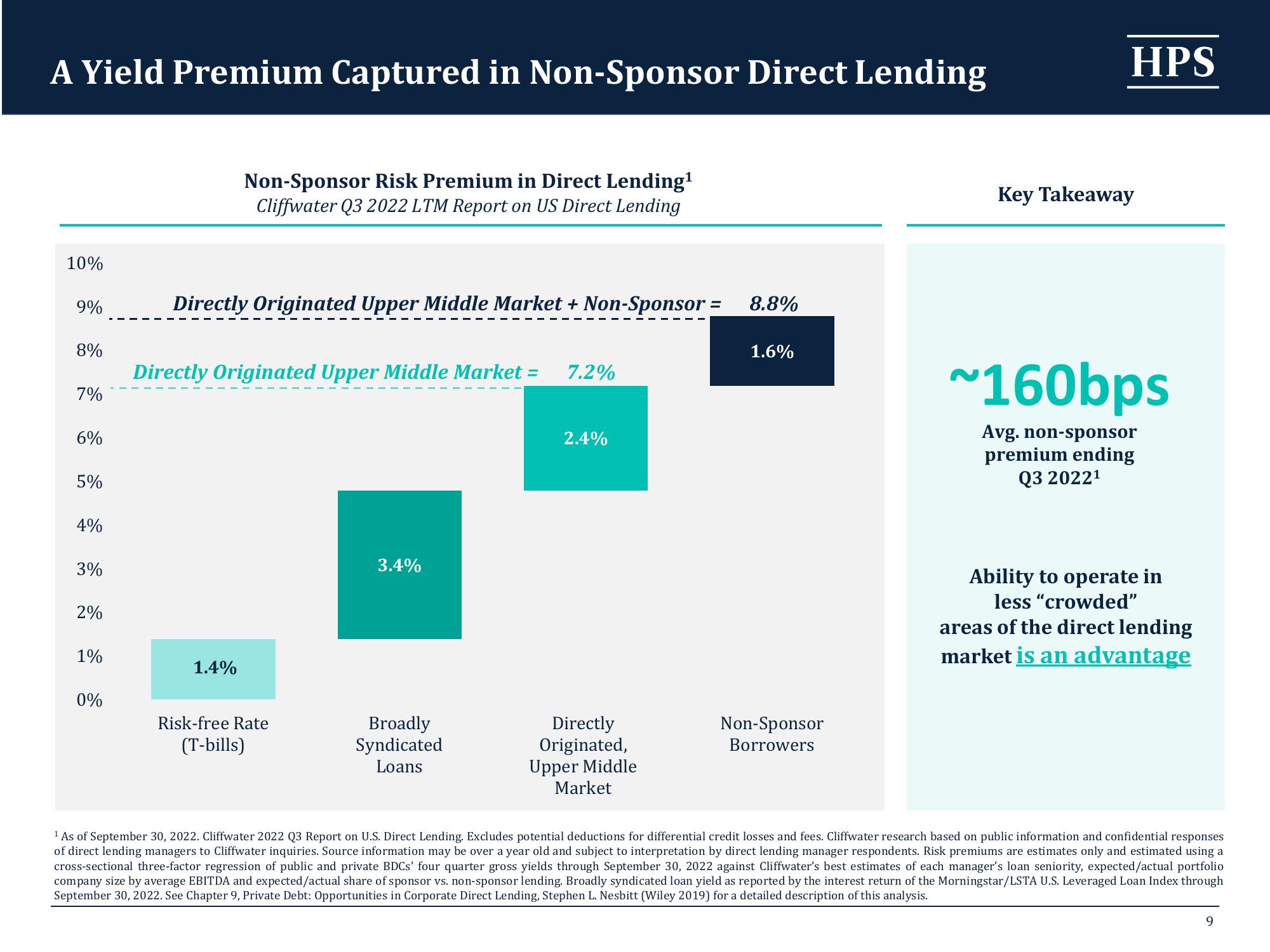

A Yield Premium Captured in Non-Sponsor Direct Lending

10%

9%

8%

7%

6%

5%

4%

3%

2%

1%

0%

Non-Sponsor Risk Premium in Direct Lending¹

Cliffwater Q3 2022 LTM Report on US Direct Lending

Directly Originated Upper Middle Market + Non-Sponsor = 8.8%

Directly Originated Upper Middle Market = 7.2%

1.4%

Risk-free Rate

(T-bills)

3.4%

Broadly

Syndicated

Loans

2.4%

Directly

Originated,

Upper Middle

Market

1.6%

Non-Sponsor

Borrowers

HPS

Key Takeaway

~160bps

Avg. non-sponsor

premium ending

Q3 2022¹

Ability to operate in

less "crowded"

areas of the direct lending

market is an advantage

¹ As of September 30, 2022. Cliffwater 2022 Q3 Report on U.S. Direct Lending. Excludes potential deductions for differential credit losses and fees. Cliffwater research based on public information and confidential responses

of direct lending managers to Cliffwater inquiries. Source information may be over a year old and subject to interpretation by direct lending manager respondents. Risk premiums are estimates only and estimated using a

cross-sectional three-factor regression of public and private BDCs' four quarter gross yields through September 30, 2022 against Cliffwater's best estimates of each manager's loan seniority, expected/actual portfolio

company size by average EBITDA and expected/actual share of sponsor vs. non-sponsor lending. Broadly syndicated loan yield as reported by the interest return of the Morningstar/LSTA U.S. Leveraged Loan Index through

September 30, 2022. See Chapter 9, Private Debt: Opportunities in Corporate Direct Lending, Stephen L. Nesbitt (Wiley 2019) for a detailed description of this analysis.

9View entire presentation