Investor Presentation

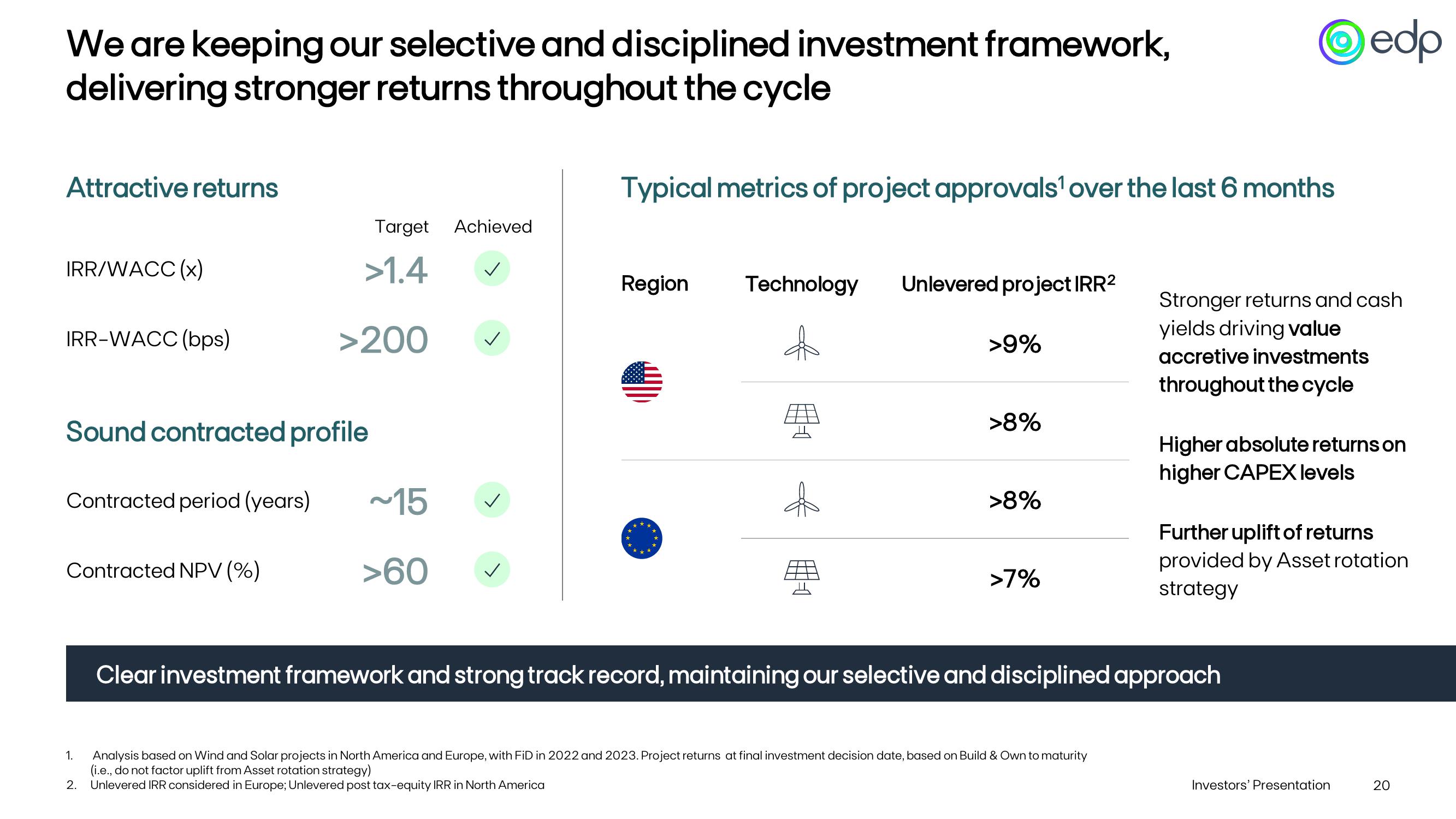

We are keeping our selective and disciplined investment framework,

delivering stronger returns throughout the cycle

Typical metrics of project approvals¹ over the last 6 months

Attractive returns

Target Achieved

IRR/WACC (x)

>1.4

Region

Technology

Unlevered project IRR2

IRR-WACC (bps)

>200

>9%

Sound contracted profile

Contracted period (years) ~15

Contracted NPV (%)

>60

*

囲

edp

Stronger returns and cash

yields driving value

accretive investments

throughout the cycle

>8%

Higher absolute returns on

higher CAPEX levels

>8%

Further uplift of returns

provided by Asset rotation

>7%

strategy

Clear investment framework and strong track record, maintaining our selective and disciplined approach

1.

Analysis based on Wind and Solar projects in North America and Europe, with FID in 2022 and 2023. Project returns at final investment decision date, based on Build & Own to maturity

(i.e., do not factor uplift from Asset rotation strategy)

2.

Unlevered IRR considered in Europe; Unlevered post tax-equity IRR in North America

Investors' Presentation

20View entire presentation