Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

APM SHIPPING

SERVICES

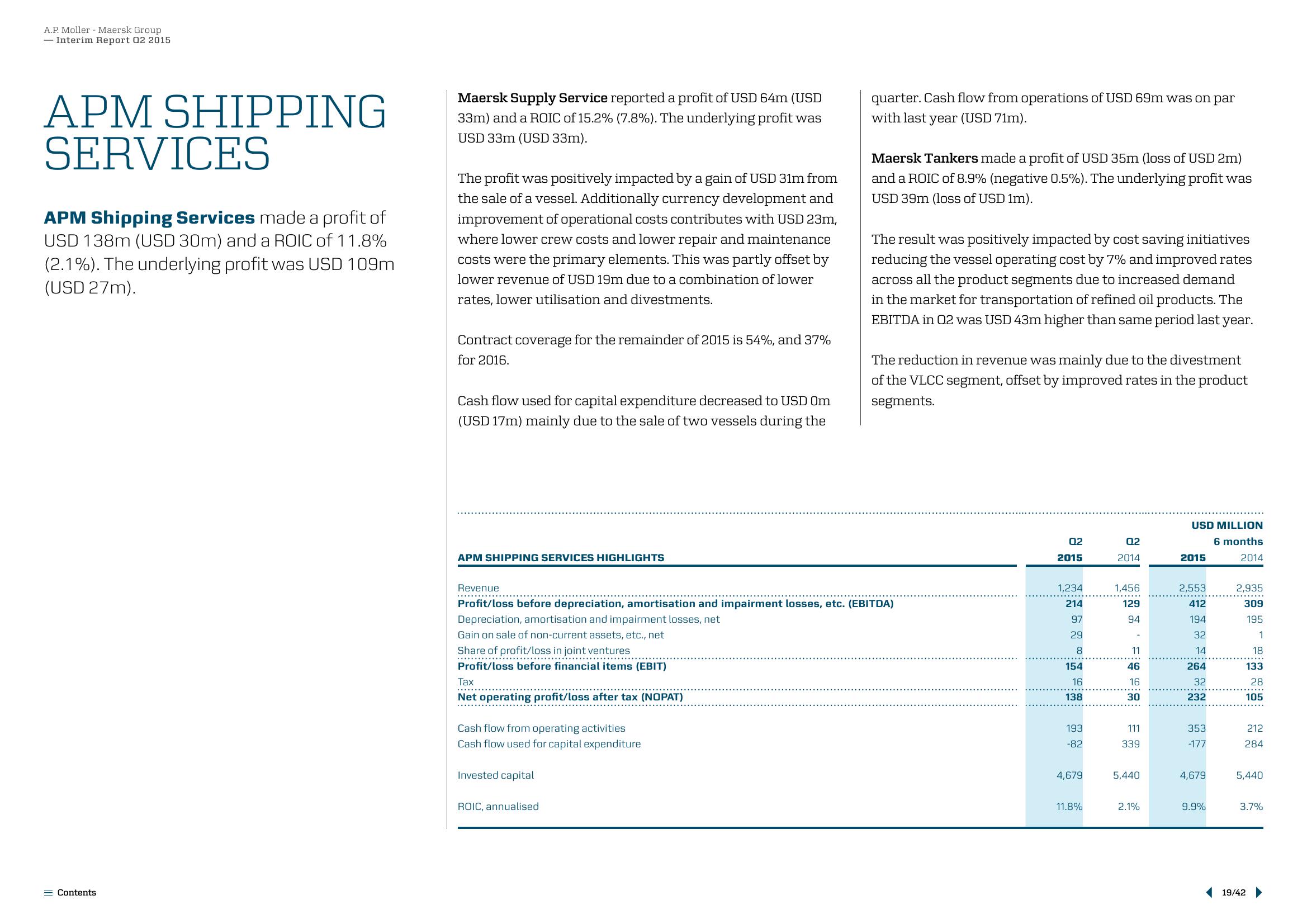

APM Shipping Services made a profit of

USD 138m (USD 30m) and a ROIC of 11.8%

(2.1%). The underlying profit was USD 109m

(USD 27m).

Contents

Maersk Supply Service reported a profit of USD 64m (USD

33m) and a ROIC of 15.2% (7.8%). The underlying profit was

USD 33m (USD 33m).

The profit was positively impacted by a gain of USD 31m from

the sale of a vessel. Additionally currency development and

improvement of operational costs contributes with USD 23m,

where lower crew costs and lower repair and maintenance

costs were the primary elements. This was partly offset by

lower revenue of USD 19m due to a combination of lower

rates, lower utilisation and divestments.

Contract coverage for the remainder of 2015 is 54%, and 37%

for 2016.

Cash flow used for capital expenditure decreased to USD Om

(USD 17m) mainly due to the sale of two vessels during the

APM SHIPPING SERVICES HIGHLIGHTS

.…….…….….…..….

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Revenue

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Profit/loss before financial items (EBIT)

Invested capital

quarter. Cash flow from operations of USD 69m was on par

with last year (USD 71m).

ROIC, annualised

Maersk Tankers made a profit of USD 35m (loss of USD 2m)

and a ROIC of 8.9% (negative 0.5%). The underlying profit was

USD 39m (loss of USD 1m).

The result was positively impacted by cost saving initiatives

reducing the vessel operating cost by 7% and improved rates

across all the product segments due to increased demand

in the market for transportation of refined oil products. The

EBITDA in Q2 was USD 43m higher than same period last year.

The reduction in revenue was mainly due to the divestment

of the VLCC segment, offset by improved rates in the product

segments.

02

2015

1,234

214

97

29

8

154

16

138

193

-82

4,679

11.8%

02

2014

1,456

129

94

11

46

16

30

111

339

5,440

2.1%

USD MILLION

6 months

2014

2015

2,553

412

194

32

14

264

32

232

353

-177

4,679

9.9%

2,935

309

195

1

18

133

28

105

212

284

5,440

3.7%

19/42View entire presentation