Vivid Seats SPAC Presentation Deck

Transaction Summary

Opportunity

Vivid Seats is a scaled, growing and highly profitable secondary ticketing marketplace

$39 billion growing ticketing market opportunity serving the sports and entertainment markets

Well positioned for both significant immediate growth in post-pandemic recovery and above-

market long term growth from strategic positioning and competitive advantages

Strategic Sponsor and aligned shareholders with strong pro form a balance sheet to capitalize

on opportunity

●

Capital Structure

Vivid Seats shareholders rolling 100% of their equity

$750 million of proceeds used for debt repayment and capital structure optimization

Horizon has $544 million of cash in trust account (including $155 million committed by Sponsor)

PIPE size: $225 million (including Sponsor investment)

●

●

●

●

Valuation

●

Enterprise value of $2.1 billion

Implied EV / 2019A EBITDA of 16.1x

Implied EV / 2022E EBITDA of 18.7x

Attractive valuation versus other digital marketplaces and ticketing peers

-

2

VIVIDSEATS.

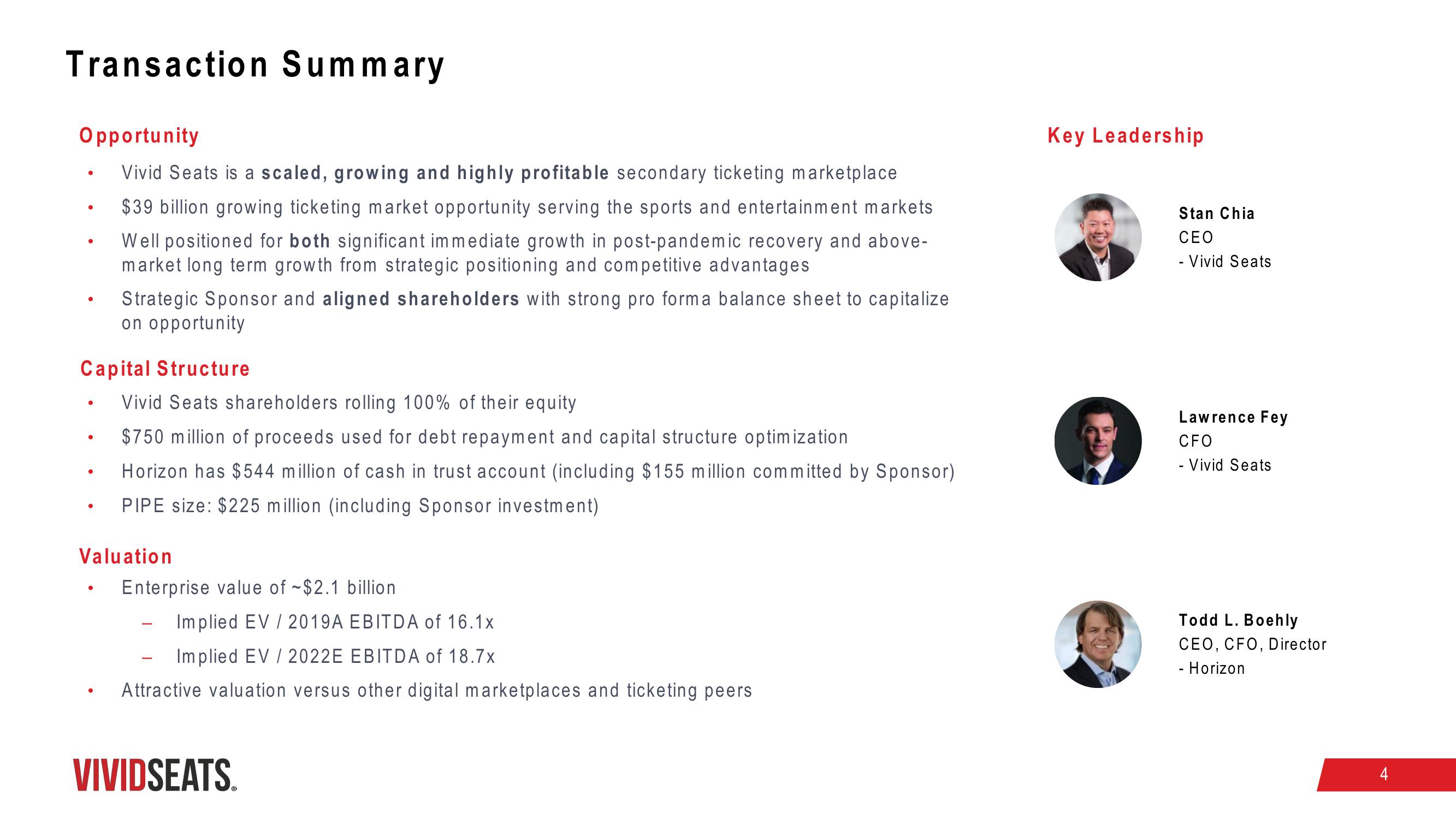

Key Leadership

Stan Chia

CEO

- Vivid Seats

Lawrence Fey

CFO

- Vivid Seats

Todd L. Boehly

CEO, CFO, Director

- Horizon

4View entire presentation