Credit Suisse Results Presentation Deck

Currency mix & Group capital metrics

31

Group

Wealth Management

Investment Bank

Swiss Bank

Asset Management

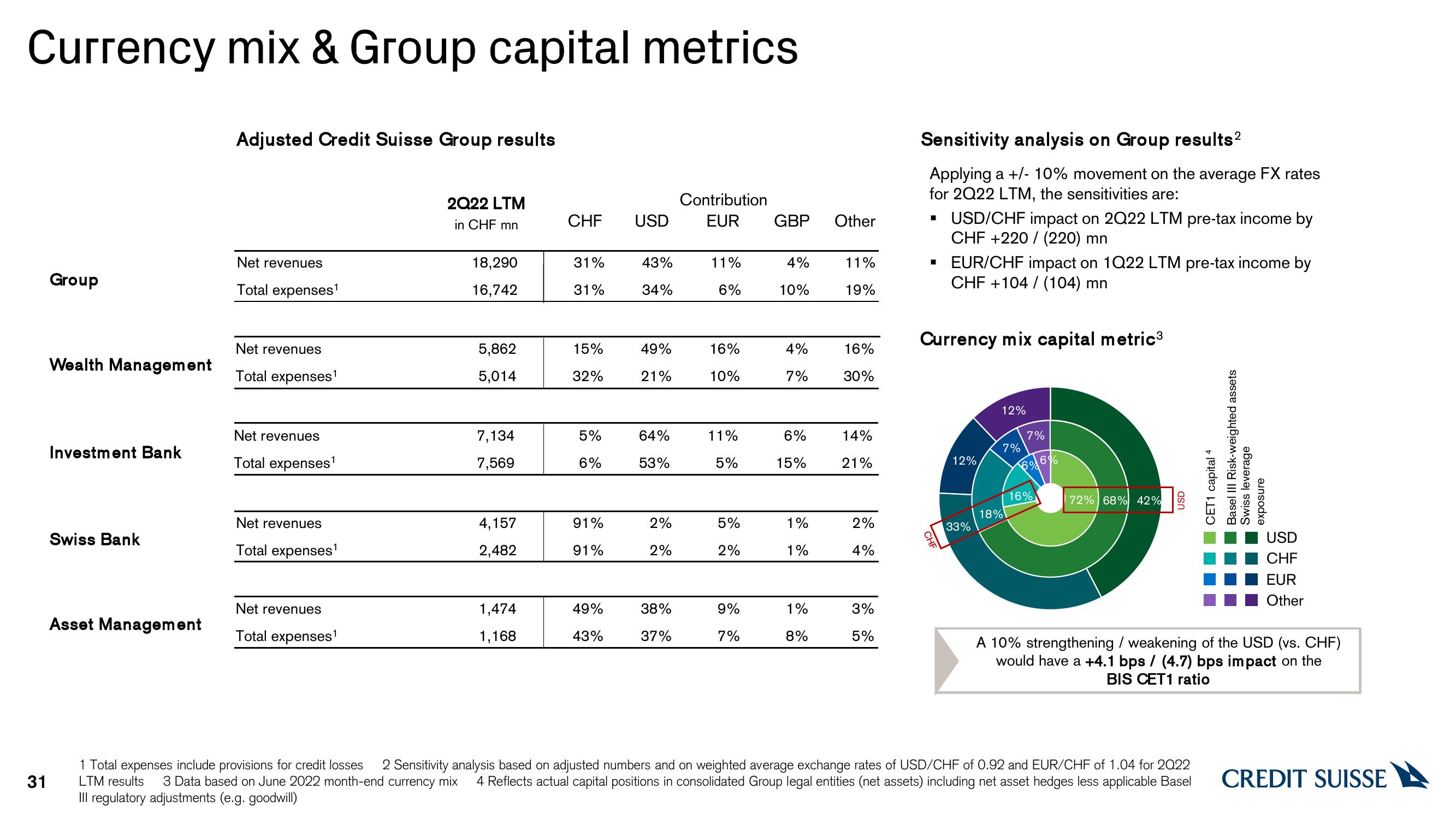

Adjusted Credit Suisse Group results

Net revenues

Total expenses¹

Net revenues

Total expenses1¹

Net revenues

Total expenses1¹

Net revenues

Total expenses¹

Net revenues

Total expenses¹

2Q22 LTM

in CHF mn

18,290

16,742

5,862

5,014

7,134

7,569

4,157

2,482

1,474

1,168

CHF

31%

31%

15%

32%

5%

6%

91%

91%

49%

43%

USD

43%

34%

49%

21%

64%

53%

2%

2%

38%

37%

Contribution

EUR GBP

11%

6%

16%

10%

11%

5%

5%

2%

9%

7%

4%

10%

4%

7%

6%

15%

1%

1%

1%

8%

Other

11%

19%

16%

30%

14%

21%

2%

4%

3%

5%

Sensitivity analysis on Group results²

Applying a +/- 10% movement on the average FX rates

for 2Q22 LTM, the sensitivities are:

▪ USD/CHF impact on 2Q22 LTM pre-tax income by

CHF +220 / (220) mn

▪ EUR/CHF impact on 1Q22 LTM pre-tax income by

CHF +104/(104) mn

Currency mix capital metric³

CHF

12%

33%

18%

12%

7%

616%

7%

16%

72% 68% 42%

USD

Basel III Risk-weighted assets

CET1 capital 4

Swiss leverage

exposure

1 Total expenses include provisions for credit losses 2 Sensitivity analysis based on adjusted numbers and on weighted average exchange rates of USD/CHF of 0.92 and EUR/CHF of 1.04 for 2022

3 Data based on June 2022 month-end currency mix 4 Reflects actual capital positions in consolidated Group legal entities (net assets) including net asset hedges less applicable Basel

III regulatory adjustments (e.g. goodwill)

LTM results

USD

CHF

EUR

Other

A 10% strengthening / weakening of the USD (vs. CHF)

would have a +4.1 bps / (4.7) bps impact on the

BIS CET1 ratio

CREDIT SUISSEView entire presentation