HSBC Investor Event Presentation Deck

We are at the forefront of new opportunities in sustainability and technology

Aim to be a leading ESG bank

Support Singapore's Green Plan 2030

Lead in regulatory engagements and adoption of standards

Chair of the Green Finance Industry Taskforce

◆ Co-chair of the working group on Taxonomy & Transition Standards in ASEAN

Vice-chair of the GFANZ APAC Workstream

Supporting our clients

Partnered with Temasek to launch Pentagreen Capital

◆ Innovative financing solutions: Joint Lead Manager and Bookrunner for first

Sustainability Bond and first Sustainability Interest Rate Swap product

◆ Bookrunner for Singapore Government's inaugural Green Infrastructure bond

Educating our colleagues

Educating and empowering colleagues to engage clients on their transition plans

Cultivating expertise in senior management

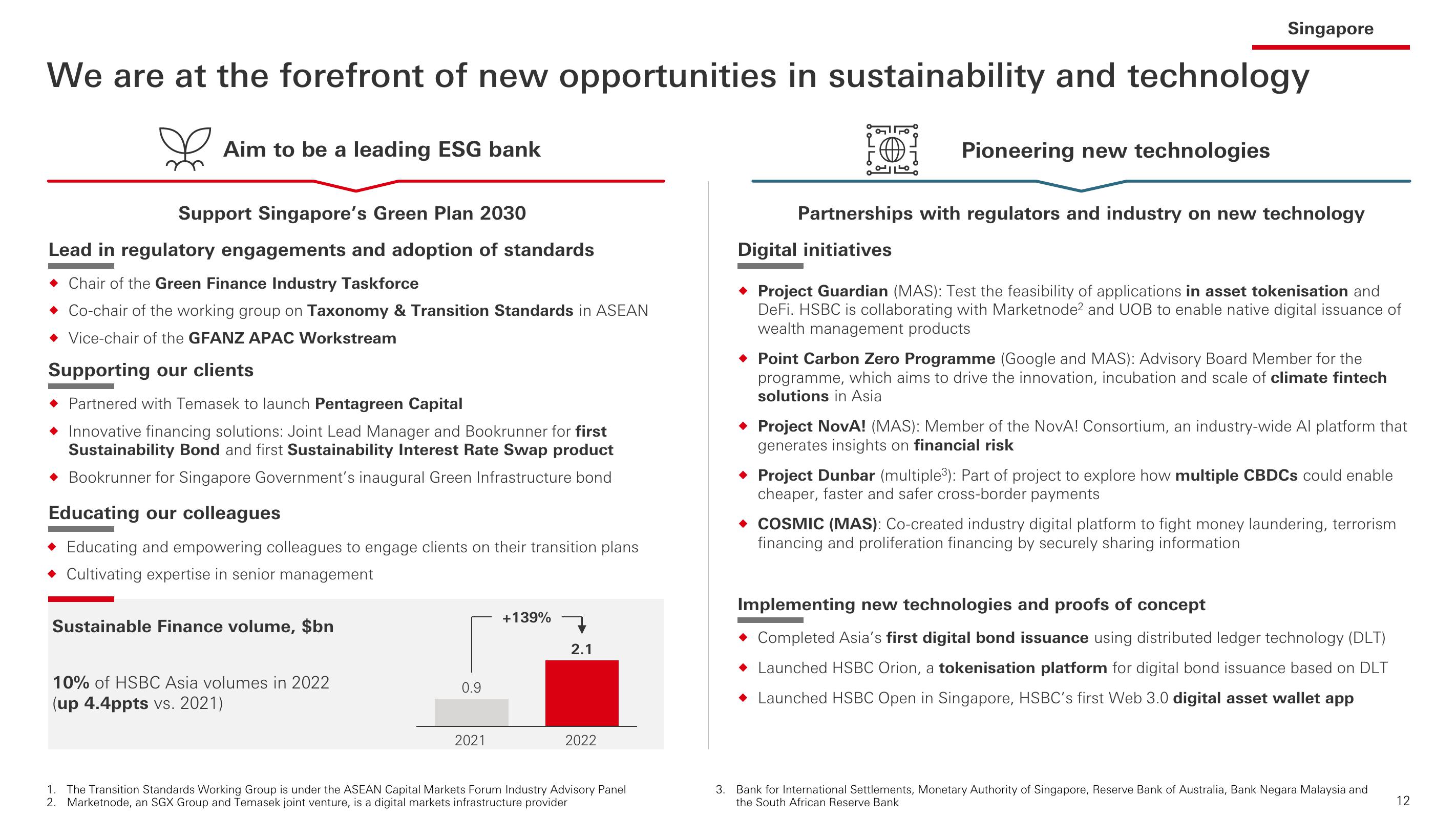

Sustainable Finance volume, $bn

10% of HSBC Asia volumes in 2022

(up 4.4ppts vs. 2021)

0.9

2021

+139%

2.1

2022

1. The Transition Standards Working Group is under the ASEAN Capital Markets Forum Industry Advisory Panel

2. Marketnode, an SGX Group and Temasek joint venture, is a digital markets infrastructure provider

Singapore

Pioneering new technologies

Partnerships with regulators and industry on new technology

Digital initiatives

◆ Project Guardian (MAS): Test the feasibility of applications in asset tokenisation and

DeFi. HSBC is collaborating with Marketnode² and UOB to enable native digital issuance of

wealth management products

◆ Point Carbon Zero Programme (Google and MAS): Advisory Board Member for the

programme, which aims to drive the innovation, incubation and scale of climate fintech

solutions in Asia

◆ Project NovA! (MAS): Member of the NovA! Consortium, an industry-wide Al platform that

generates insights on financial risk

Project Dunbar (multiple³): Part of project to explore how multiple CBDCs could enable

cheaper, faster and safer cross-border payments

◆ COSMIC (MAS): Co-created industry digital platform to fight money laundering, terrorism

financing and proliferation financing by securely sharing information

Implementing new technologies and proofs of concept

Completed Asia's first digital bond issuance using distributed ledger technology (DLT)

Launched HSBC Orion, a tokenisation platform for digital bond issuance based on DLT

Launched HSBC Open in Singapore, HSBC's first Web 3.0 digital asset wallet app

3. Bank for International Settlements, Monetary Authority of Singapore, Reserve Bank of Australia, Bank Negara Malaysia and

the South African Reserve Bank

12View entire presentation