Credit Suisse Investor Event Presentation Deck

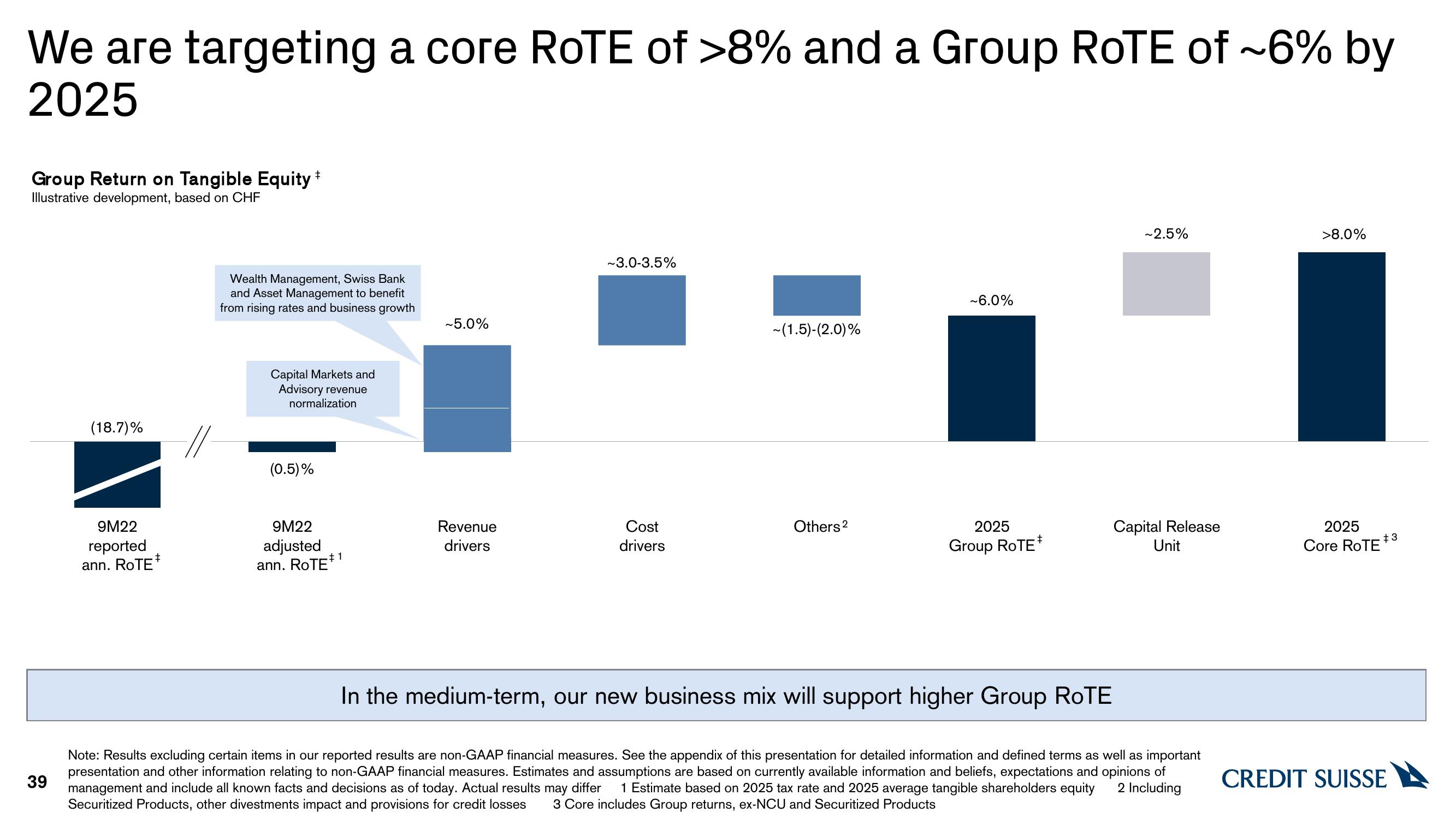

We are targeting a core ROTE of >8% and a Group ROTE of ~6% by

2025

Group Return on Tangible Equity *

Illustrative development, based on CHF

39

(18.7)%

9M22

reported

ann. ROTE*

Wealth Management, Swiss Bank

and Asset Management to benefit

from rising rates and business growth

Capital Markets and

Advisory revenue

normalization

(0.5)%

9M22

adjusted

ann. ROTE*¹

~5.0%

Revenue

drivers

~3.0-3.5%

Cost

drivers

~(1.5)-(2.0)%

Others ²

~6.0%

2025

Group ROTE

‡

~2.5%

Capital Release

Unit

In the medium-term, our new business mix will support higher Group ROTE

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures. Estimates and assumptions are based on currently available information and beliefs, expectations and opinions of

management and include all known facts and decisions as of today. Actual results may differ 1 Estimate based on 2025 tax rate and 2025 average tangible shareholders equity 2 Including

Securitized Products, other divestments impact and provisions for credit losses 3 Core includes Group returns, ex-NCU and Securitized Products

>8.0%

2025

Core ROTE

#3

CREDIT SUISSEView entire presentation