TPG Results Presentation Deck

FAUM Rollforward

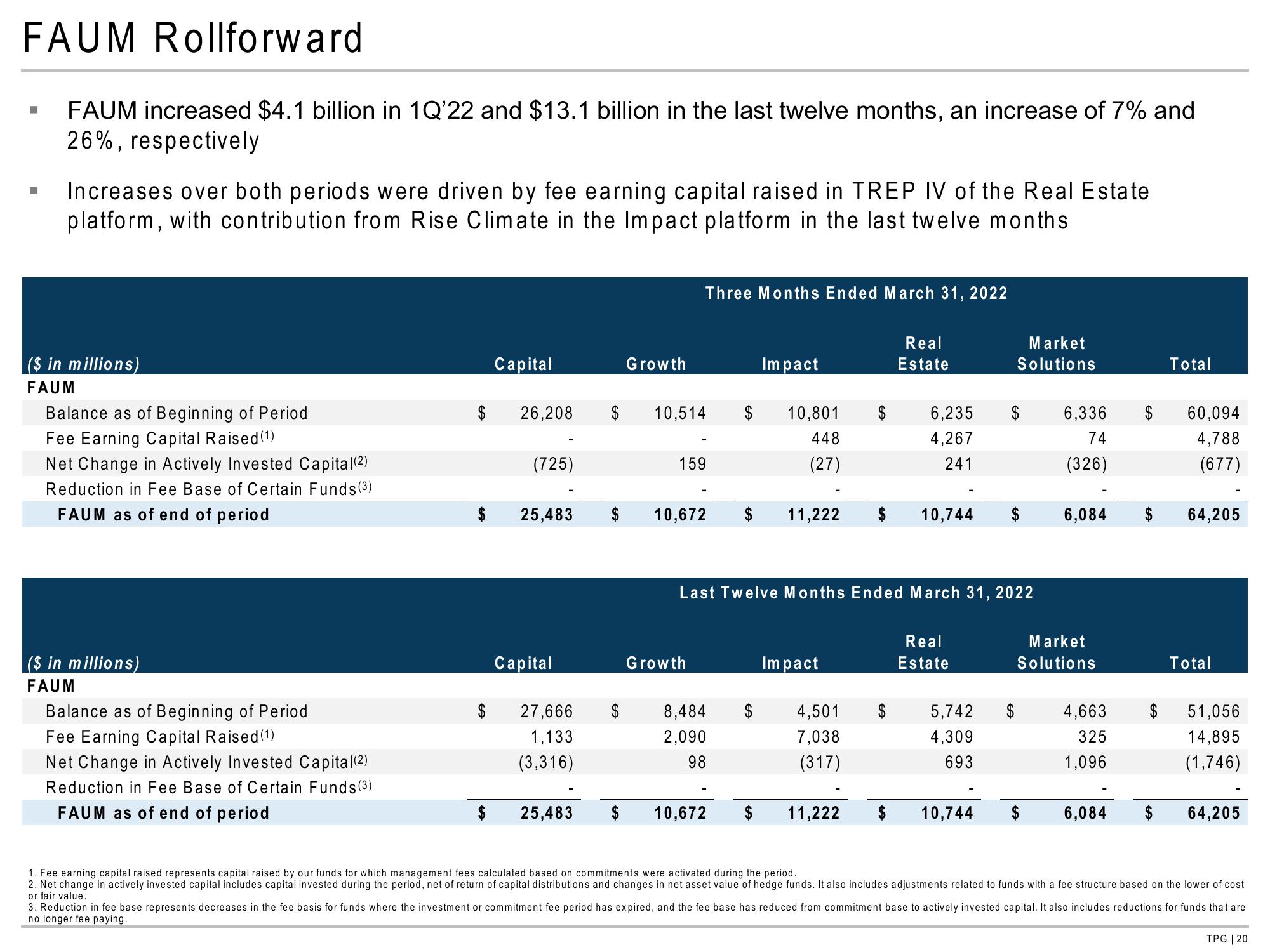

FAUM increased $4.1 billion in 1Q'22 and $13.1 billion in the last twelve months, an increase of 7% and

26%, respectively

■

Increases over both periods were driven by fee earning capital raised in TREP IV of the Real Estate

platform, with contribution from Rise Climate in the Impact platform in the last twelve months

($ in millions)

FAUM

Balance as of Beginning of Period

Fee Earning Capital Raised (1)

Net Change in Actively Invested Capital (2)

Reduction in Fee Base of Certain Funds (3)

FAUM as of end of period

($ in millions)

FAUM

Balance as of Beginning of Period

Fee Earning Capital Raised (1)

Net Change in Actively Invested Capital (2)

Reduction in Fee Base of Certain Funds (3)

FAUM as of end of period

$

$

Capital

26,208

(725)

25,483

Capital

27,666

1,133

(3,316)

25,483

Growth

$

Three Months Ended March 31, 2022

$ 10,514 $ 10,801

448

(27)

159

10,672

Growth

Impact

8,484 $

2,090

98

$ 10,672

11,222

Impact

4,501

7,038

(317)

$

Last Twelve Months Ended March 31, 2022

11,222

Real

Estate

6,235

4,267

241

10,744

Real

Estate

5,742

4,309

693

10,744

Market

Solutions

$ 6,336

74

(326)

$

6,084

Market

Solutions

4,663

325

1,096

6,084

$

$

$

Total

60,094

4,788

(677)

64,205

Total

51,056

14,895

(1,746)

64,205

1. Fee earning capital raised represents capital raised by our funds for which management fees calculated based on commitments were activated during the period.

2. Net change in actively invested capital includes capital invested during the period, net of return of capital distributions and changes in net asset value of hedge funds. It also includes adjustments related to funds with a fee structure based on the lower of cost

or fair value.

3. Reduction in fee base represents decreases in the fee basis for funds where the investment or commitment fee period has expired, and the fee base has reduced from commitment base to actively invested capital. It also includes reductions for funds that are

no longer fee paying.

TPG | 20View entire presentation