Acies SPAC Presentation Deck

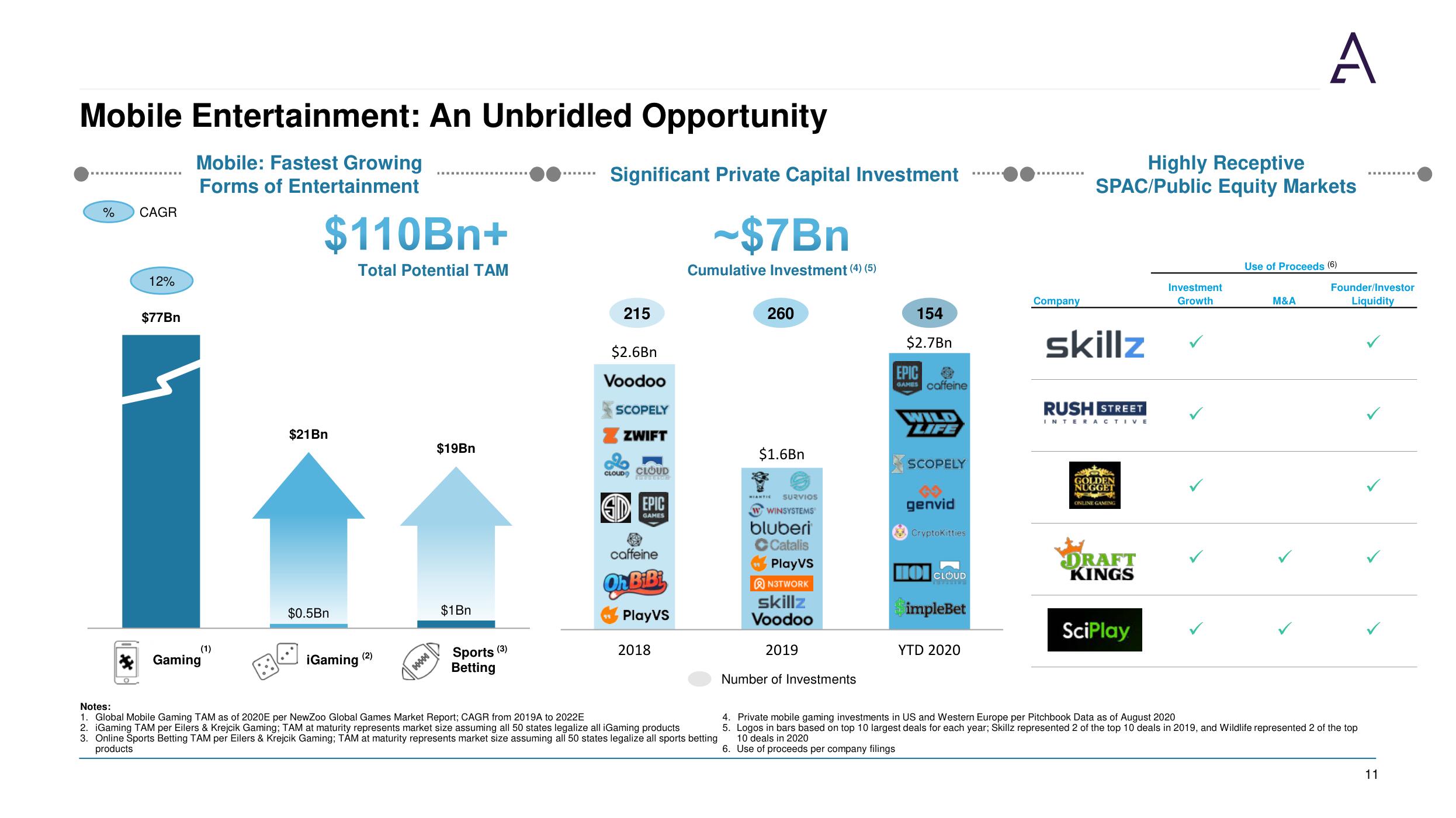

Mobile Entertainment: An Unbridled Opportunity

Mobile: Fastest Growing

Forms of Entertainment

%

CAGR

12%

$77Bn

Gaming

(1)

$110Bn+

Total Potential TAM

$21Bn

$0.5Bn

iGaming (2)

HHH

$19Bn

$1Bn

Sports

Betting

(3)

Significant Private Capital Investment

215

$2.6Bn

Voodoo

SCOPELY

ZWIFT

CLOUD CLOUD

THUOCLOR

SD

GAMES

caffeine

QħBiBL

PlayVS

2018

-$7Bn

Cumulative Investment (4) (5)

Notes:

1. Global Mobile Gaming TAM as of 2020E per NewZoo Global Games Market Report; CAGR from 2019A to 2022E

2. iGaming TAM per Eilers & Krejcik Gaming; TAM at maturity represents market size assuming all 50 states legalize all iGaming products

3. Online Sports Betting TAM per Eilers & Krejcik Gaming; TAM at maturity represents market size assuming all 50 states legalize all sports betting

products

260

$1.6Bn

MEANTIC SURVIOS

WINSYSTEMS

bluberi

Catalis

PlayVS

N3TWORK

skillz

Voodoo

2019

Number of Investments

154

$2.7Bn

EPIC

3

GAMES caffeine

WILD

LIFE

SCOPELY

genvid

CryptoKitties

HOLCLOUD

impleBet

YTD 2020

Company

Highly Receptive

SPAC/Public Equity Markets

skillz

RUSH STREET

INTERACTIVE

GOLDEN

NUGGET

H

ONLINE GAMING

DRAFT

KINGS

SciPlay

Investment

Growth

A

Use of Proceeds (6)

M&A

Founder/Investor

Liquidity

4. Private mobile gaming investments in US and Western Europe per Pitchbook Data as of August 2020

5. Logos in bars based on top 10 largest deals for each year; Skillz represented 2 of the top 10 deals in 2019, and Wildlife represented 2 of the top

10 deals in 2020

6. Use of proceeds per company filings

11View entire presentation