Evercore Investment Banking Pitch Book

Discussion Materials

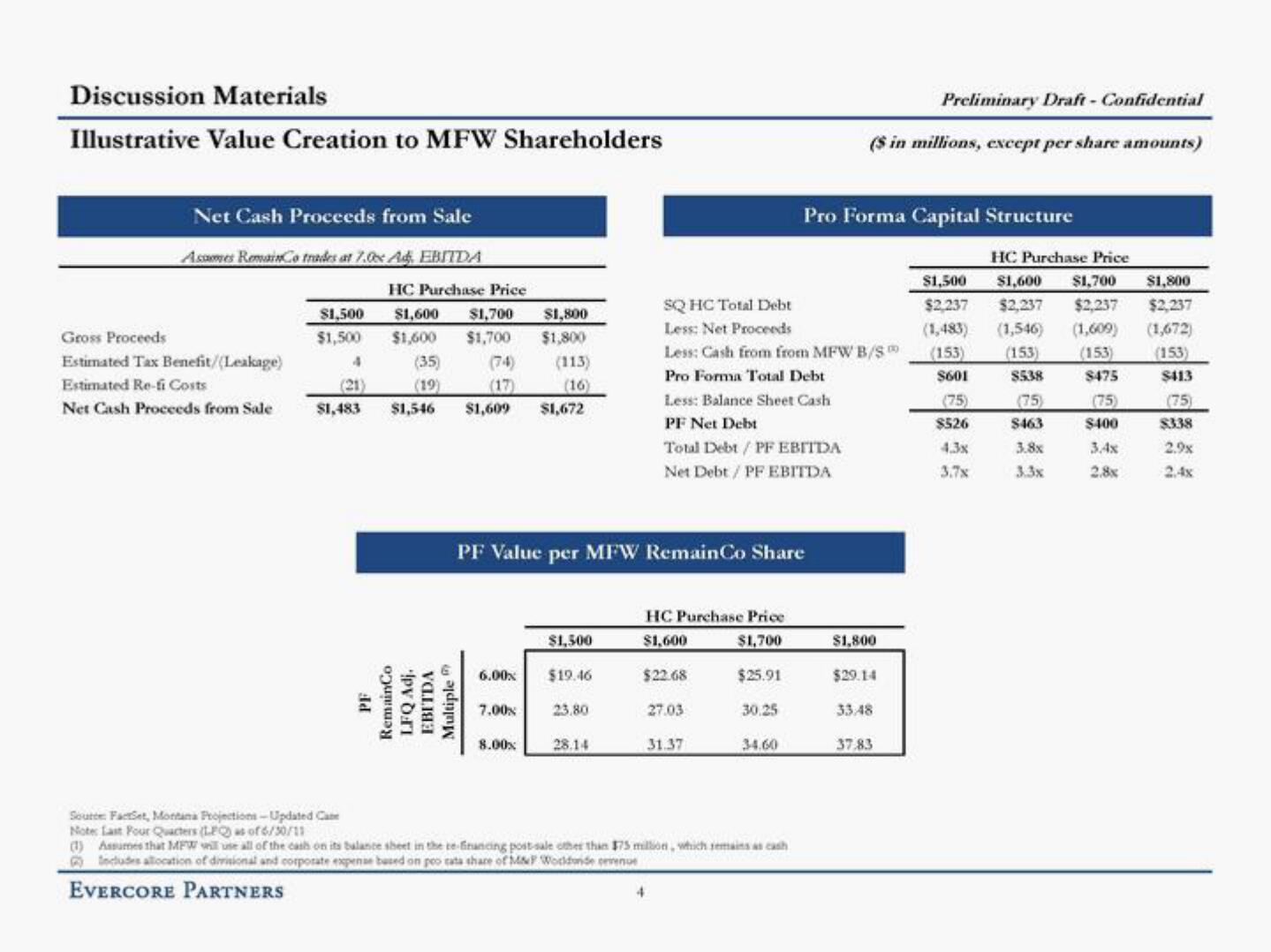

Illustrative Value Creation to MFW Shareholders

Net Cash Proceeds from Sale

Assames RemainCo trades at 7.0Ad EBITDA

Gross Proceeds

Estimated Tax Benefit/(Leakage)

Estimated Re-fi Costs

Net Cash Proceeds from Sale

$1,500

$1,500

4

$1,483

HC Purchase Price

$1,600 $1,700

$1,800

$1,600 $1,700 $1,800

(74)

(35)

(19)

(113)

(16)

$1,609 $1,672

(17)

$1,546

6.00x

PF Value per MFW RemainCo Share

7.00%

8.00x

$1,500

$19.46

23,80

28.14

HC Purchase Price

$1,600

$1,700

$25.91

30.25

SQ HC Total Debt

Less: Net Proceeds

Less: Cash from from MFW B/S

Pro Forma Total Debt

Less: Balance Sheet Cash

PF Net Debt

Total Debt / PF EBITDA

Net Debt / PF EBITDA

$22.68

4

27.03

31.37

34.60

Soutte FactSet, Montana Projections-Updated Cate

Note: Last Four Quarters (LFQ) as of 6/30/11

(1) Assumes that MFW will use all of the cash on its balance sheet in the te-financing post-sale other than $75 million, which remains a cash

Includes allocation of divisional and corporate expense based on poo tata share of M&F Worldonde vence

EVERCORE PARTNERS

Preliminary Draft - Confidential

($ in millions, except per share amounts)

Pro Forma Capital Structure

$1,800

$29.14

33.48

37.83

$1,500

$2,237

(1,483)

(153)

$601

(75)

$526

4.3x

HC Purchase Price

$1,600 $1,700 $1,800

$2,237 $2,237

(1,546) (1,609)

(153)

(153)

8538

(75)

$463

3.8x

3.3x

$475

(75)

$400

3.4x

2.8x

$2,237

(1,672)

(153)

$413

(75)

$338

2.9xView entire presentation