Brivo SPAC Presentation Deck

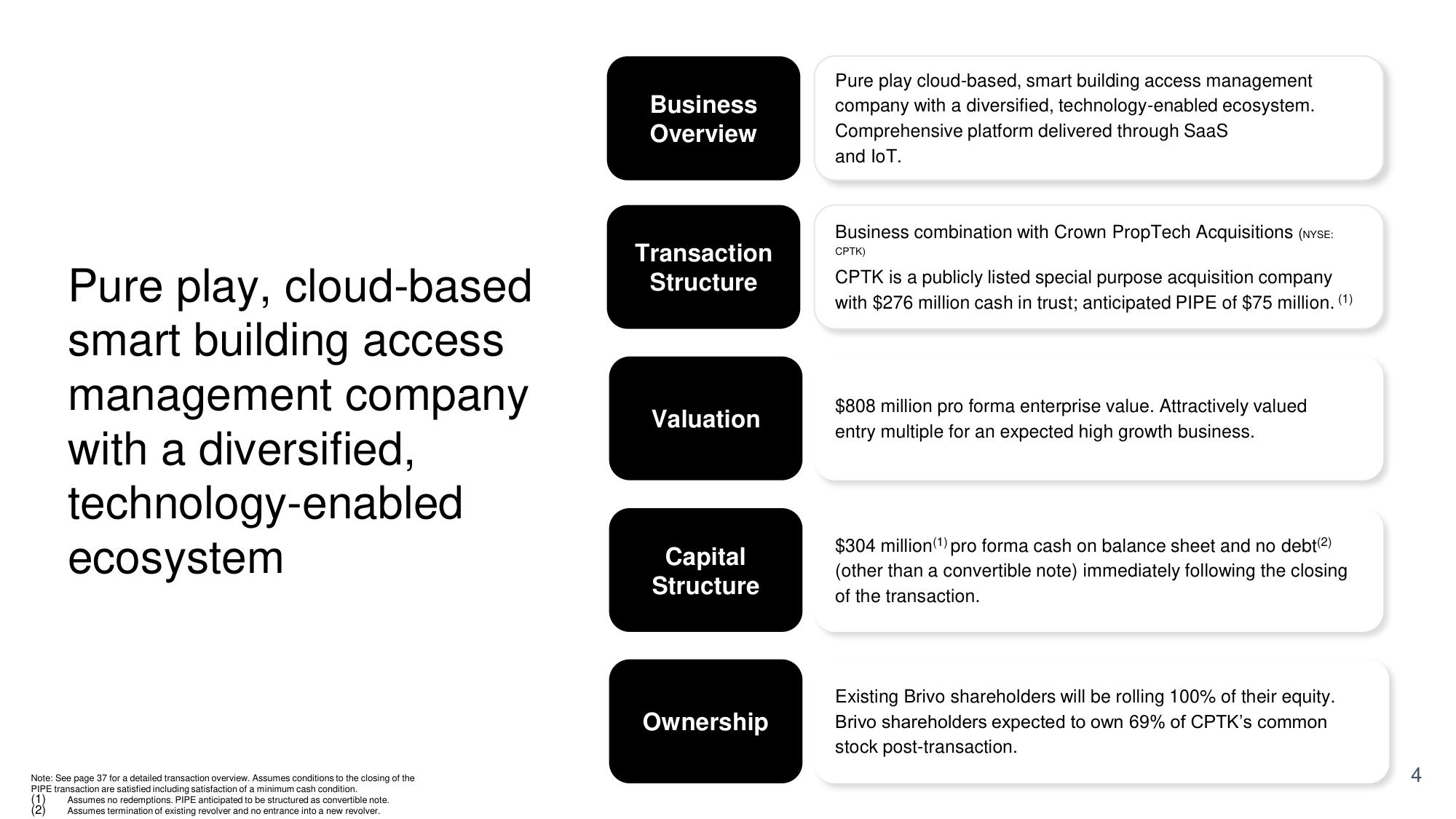

Pure play, cloud-based

smart building access

management company

with a diversified,

technology-enabled

ecosystem

Note: See page 37 for a detailed transaction overview. Assumes conditions to the closing of the

PIPE transaction are satisfied including satisfaction of a minimum cash condition.

(2)

Assumes no redemptions. PIPE anticipated to be structured as convertible note.

Assumes termination of existing revolver and no entrance into a new revolver.

Business

Overview

Transaction

Structure

Valuation

Capital

Structure

Ownership

Pure play cloud-based, smart building access management

company with a diversified, technology-enabled ecosystem.

Comprehensive platform delivered through SaaS

and loT.

Business combination with Crown Prop Tech Acquisitions (NYSE:

CPTK)

CPTK is a publicly listed special purpose acquisition company

with $276 million cash in trust; anticipated PIPE of $75 million. (1)

$808 million pro forma enterprise value. Attractively valued

entry multiple for an expected high growth business.

$304 million (1) pro forma cash on balance sheet and no debt (²)

(other than a convertible note) immediately following the closing

of the transaction.

Existing Brivo shareholders will be rolling 100% of their equity.

Brivo shareholders expected to own 69% of CPTK's common

stock post-transaction.

4View entire presentation