TPG Results Presentation Deck

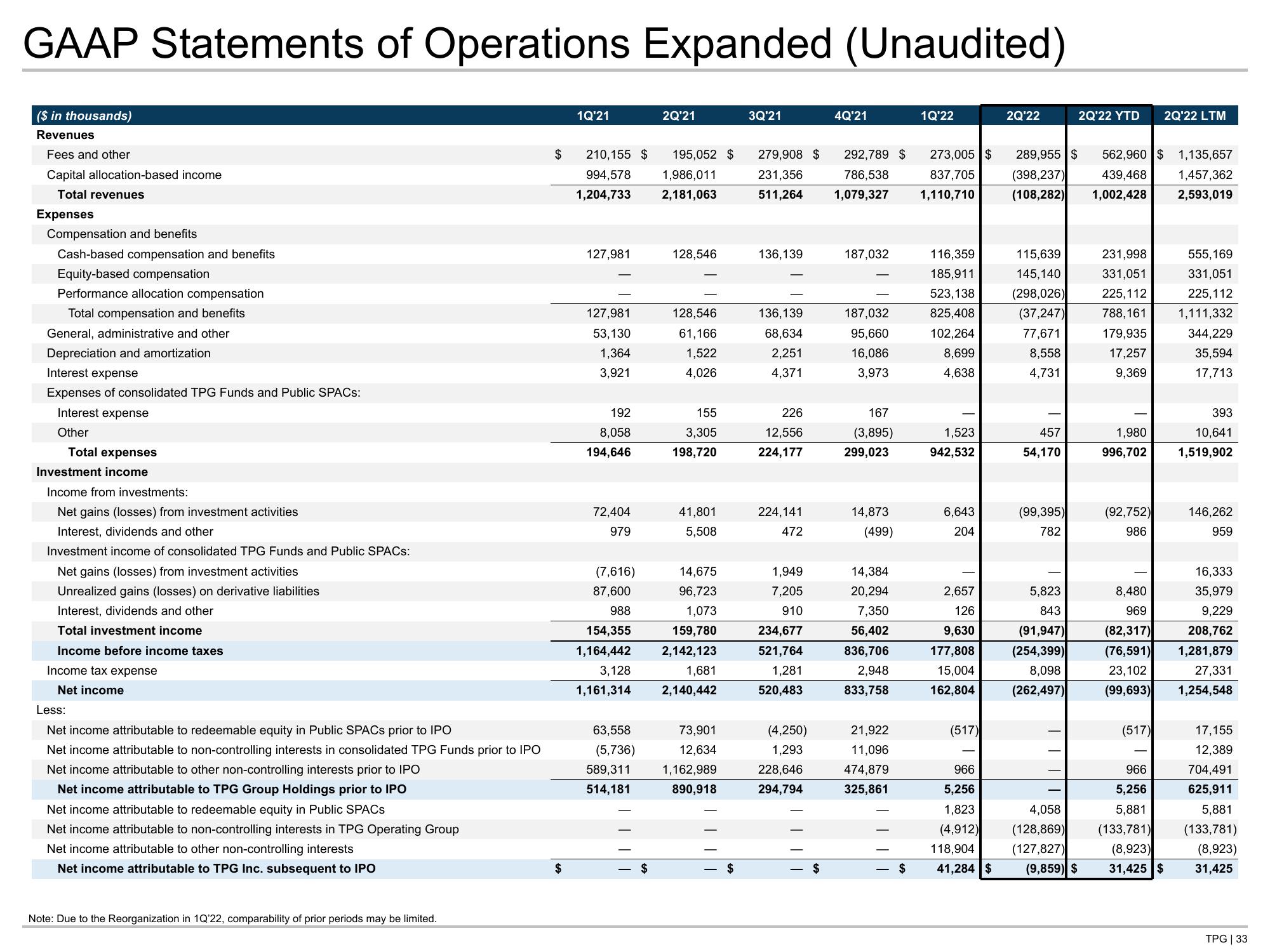

GAAP Statements of Operations Expanded (Unaudited)

($ in thousands)

Revenues

Fees and other

Capital allocation-based income

Total revenues

Expenses

Compensation and benefits

Cash-based compensation and benefits

Equity-based compensation

Performance allocation compensation

Total compensation and benefits

General, administrative and other

Depreciation and amortization

Interest expense

Expenses of consolidated TPG Funds and Public SPACS:

Interest expense

Other

Total expenses

Investment income

Income from investments:

Net gains (losses) from investment activities

Interest, dividends and other

Investment income of consolidated TPG Funds and Public SPACs:

Net gains (losses) from investment activities

Unrealized gains (losses) on derivative liabilities

Interest, dividends and other

Total investment income

Income before income taxes

Income tax expense

Net income

Less:

Net income attributable to redeemable equity in Public SPACs prior to IPO

Net income attributable to non-controlling interests in consolidated TPG Funds prior to IPO

Net income attributable to other non-controlling interests prior to IPO

Net income attributable to TPG Group Holdings prior to IPO

Net income attributable to redeemable equity in Public SPACs

Net income attributable to non-controlling interests in TPG Operating Group

Net income attributable to other non-controlling interests

Net income attributable to TPG Inc. subsequent to IPO

Note: Due to the Reorganization in 1Q'22, comparability of prior periods may be limited.

$

$

1Q'21

210,155 $ 195,052 $

994,578 1,986,011

1,204,733 2,181,063

127,981

127,981

53,130

1,364

3,921

192

8,058

194,646

72,404

979

63,558

(5,736)

2Q'21

589,311

514,181

$

128,546

128,546

61,166

1,522

4,026

(7,616)

87,600

988

154,355

1,164,442

3,128

1,161,314 2,140,442

155

3,305

198,720

41,801

5,508

14,675

96,723

1,073

159,780

2,142,123

1,681

73,901

12,634

1,162,989

890,918

$

3Q'21

279,908 $ 292,789 $

231,356

511,264

786,538

1,079,327

136,139

136,139

68,634

2,251

4,371

226

12,556

224,177

224,141

472

1,949

7,205

910

234,677

521,764

1,281

520,483

(4,250)

1,293

228,646

294,794

4Q'21

$

187,032

187,032

95,660

16,086

3,973

167

(3,895)

299,023

14,873

(499)

14,384

20,294

7,350

56,402

836,706

2,948

833,758

21,922

11,096

474,879

325,861

1Q'22

116,359

185,911

523,138

825,408

102,264

8,699

4,638

1,523

942,532

273,005 $ 289,955 $ 562,960 $ 1,135,657

837,705

1,110,710

1,457,362

(398,237) 439,468

(108,282) 1,002,428

2,593,019

6,643

204

2,657

126

9,630

177,808

15,004

162,804

(517)

2Q'22

966

5,256

1,823

(4,912)

118,904

41,284 $

115,639

145,140

(298,026)

(37,247)

77,671

8,558

4,731

457

54,170

(99,395)

782

5,823

843

(91,947)

(254,399)

8,098

(262,497)

2Q'22 YTD

4,058

(128,869)

(127,827)

(9,859) $

231,998

331,051

225,112

788,161

179,935

17,257

9,369

1,980

996,702

(92,752)

986

8,480

969

(82,317)

(76,591)

23,102

(99,693)

2Q'22 LTM

(517)

966

5,256

5,881

(133,781)

(8,923)

31,425 $

555,169

331,051

225,112

1,111,332

344,229

35,594

17,713

393

10,641

1,519,902

146,262

959

16,333

35,979

9,229

208,762

1,281,879

27,331

1,254,548

17,155

12,389

704,491

625,911

5,881

(133,781)

(8,923)

31,425

TPG | 33View entire presentation