Maersk Investor Presentation Deck

Highlights Q4 2019

Ocean

●

16

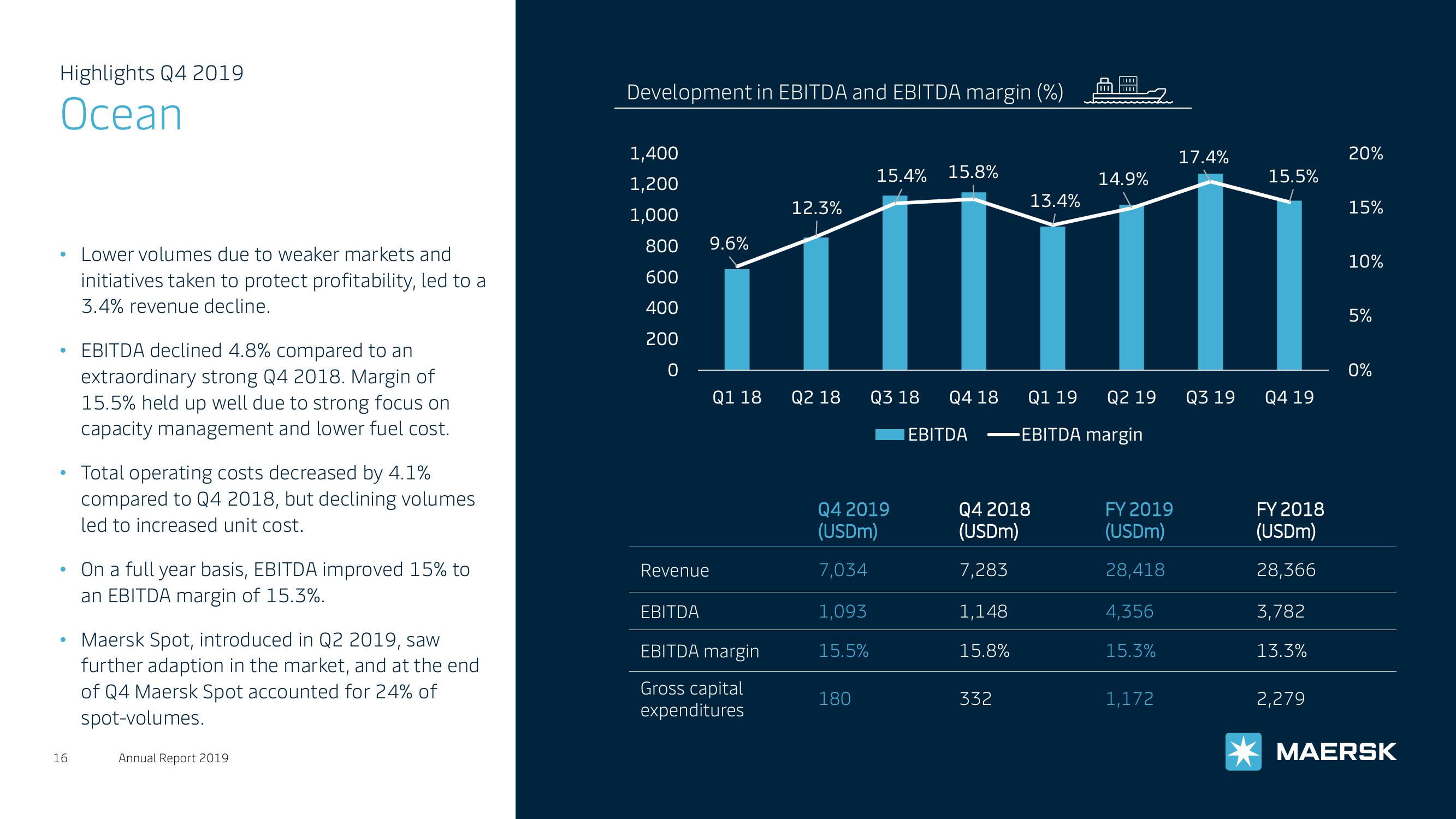

Lower volumes due to weaker markets and

initiatives taken to protect profitability, led to a

3.4% revenue decline.

EBITDA declined 4.8% compared to an

extraordinary strong Q4 2018. Margin of

15.5% held up well due to strong focus on

capacity management and lower fuel cost.

Total operating costs decreased by 4.1%

compared to Q4 2018, but declining volumes

led to increased unit cost.

On a full year basis, EBITDA improved 15% to

an EBITDA margin of 15.3%.

Maersk Spot, introduced in Q2 2019, saw

further adaption in the market, and at the end

of Q4 Maersk Spot accounted for 24% of

spot-volumes.

Annual Report 2019

Development in EBITDA and EBITDA margin (%)

1,400

1,200

1,000

800

600

400

200

0

Revenue

9.6%

Q1 18

EBITDA

EBITDA margin

Gross capital

expenditures

12.3%

Q2 18 Q3 18 Q4 18

15.4% 15.8%

Q4 2019

(USDm)

7,034

1,093

15.5%

180

EBITDA

Q4 2018

(USDm)

7,283

1,148

15.8%

332

13.4%

14.9%

Q1 19 Q2 19 Q3 19

EBITDA margin

FY 2019

(USDm)

28,418

4,356

15.3%

17.4%

1,172

15.5%

Q4 19

FY 2018

(USDm)

28,366

3,782

13.3%

2,279

20%

15%

10%

5%

0%

MAERSKView entire presentation