Axalta Coating Systems (axta) First Quarter 2021 Financial Results

In Europe, pandemic-related restrictions intensified in December and remained in effect for much of the

first quarter, impacting vehicle miles driven and therefore Refinish demand, which was generally

consistent with fourth quarter levels. Certain countries such as Germany extended restrictions a month

further than initially planned, with easing expected to begin late April, though very country specific in

terms of timelines with easing.

In Latin America, Mexico miles driven remain around 10% below normal, while Brazil was around even

with pre-COVID levels in Q1, perhaps weaker than the rate entering the quarter as case count for

COVID increased and restrictions in Brazil have come back.

In China and Asia Pacific, most countries continue to see traffic levels above pre-COVID levels through

the first quarter, as was the case in fourth quarter. In China, after a slower fourth quarter, and increased

activity starting in January, overall refinish volumes ended the quarter up fairly substantially for Axalta.

In the Industrial end-market, Axalta's first quarter results indicated broad based demand strength

through the period. All end-businesses as well as regions were either stable or increased over the prior

year in the period, with Energy Solutions and General Industrial coatings including powder coatings

both showing particular strength. Strength in U.S. home building and remodeling as well as global

automotive demand both served as continued tailwinds for Axalta's Industrial business.

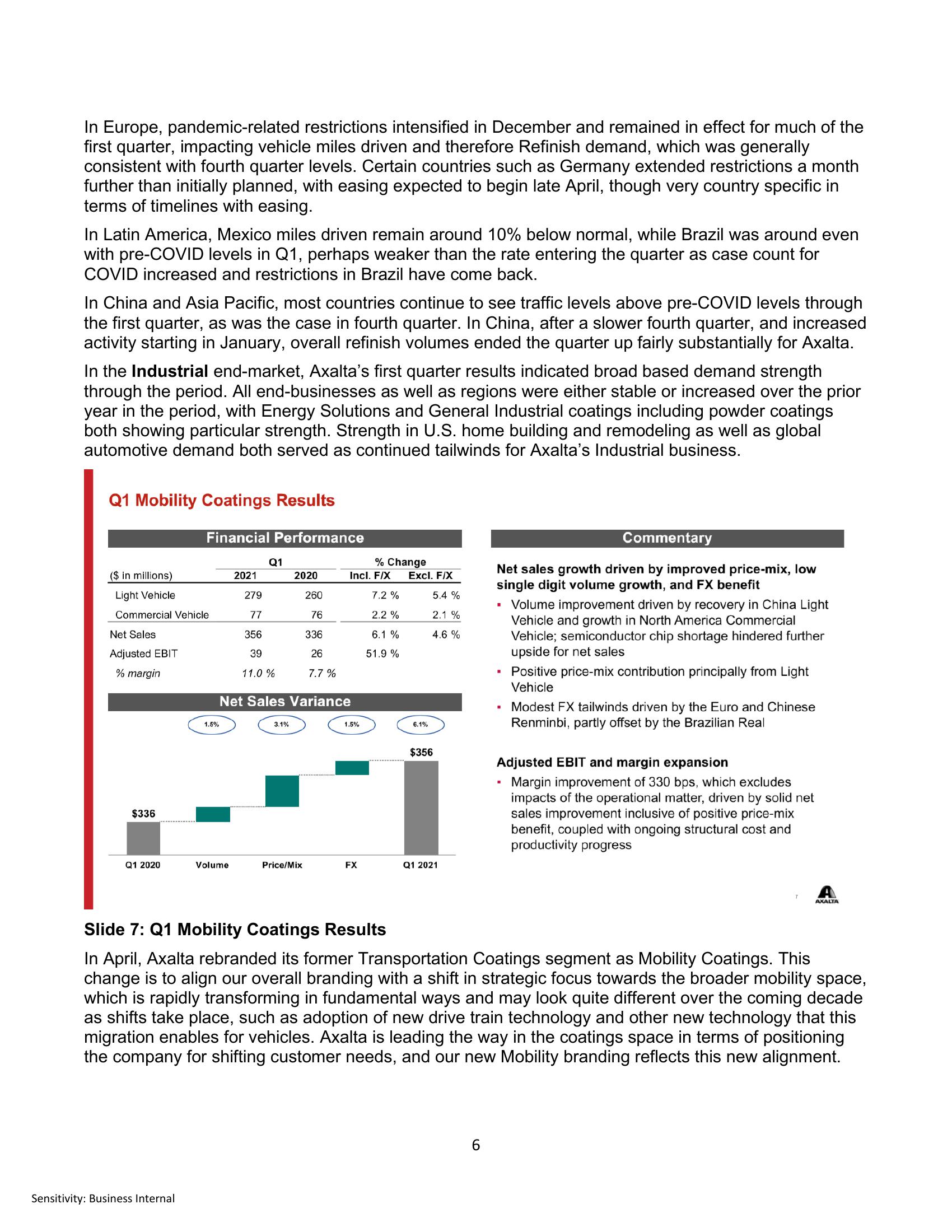

Q1 Mobility Coatings Results

($ in millions)

Light Vehicle

Commercial Vehicle

Net Sales

Adjusted EBIT

% margin

$336

Q1 2020

Financial Performance

Sensitivity: Business Internal

1.5%

2021

Volume

Q1

279

77

356

39

11.0%

26

7.7%

Net Sales Variance

2020

260

76

336

3.1%

% Change

Incl. F/X Excl. F/X

7.2 %

5.4 %

2.2%

2.1 %

6.1 %

51.9%

4.6 %

Price/Mix

1.5%

FX

6.1%

$356

Q1 2021

Commentary

Net sales growth driven by improved price-mix, low

single digit volume growth, and FX benefit

6

■

I

.

Volume improvement driven by recovery in China Light

Vehicle and growth in North America Commercial

Vehicle; semiconductor chip shortage hindered further

upside for net sales

■

Positive price-mix contribution principally from Light

Vehicle

Modest FX tailwinds driven by the Euro and Chinese

Renminbi, partly offset by the Brazilian Real

Adjusted EBIT and margin expansion

Margin improvement of 330 bps, which excludes

impacts of the operational matter, driven by solid net

sales improvement inclusive of positive price-mix

benefit, coupled with ongoing structural cost and

productivity progress

Slide 7: Q1 Mobility Coatings Results

In April, Axalta rebranded its former Transportation Coatings segment as Mobility Coatings. This

change is to align our overall branding with a shift in strategic focus towards the broader mobility space,

which is rapidly transforming in fundamental ways and may look quite different over the coming decade

as shifts take place, such as adoption of new drive train technology and other new technology that this

migration enables for vehicles. Axalta is leading the way in the coatings space in terms of positioning

the company for shifting customer needs, and our new Mobility branding reflects this new alignment.

AXALTAView entire presentation