Pathward Financial Results Presentation Deck

Summary Financial Results

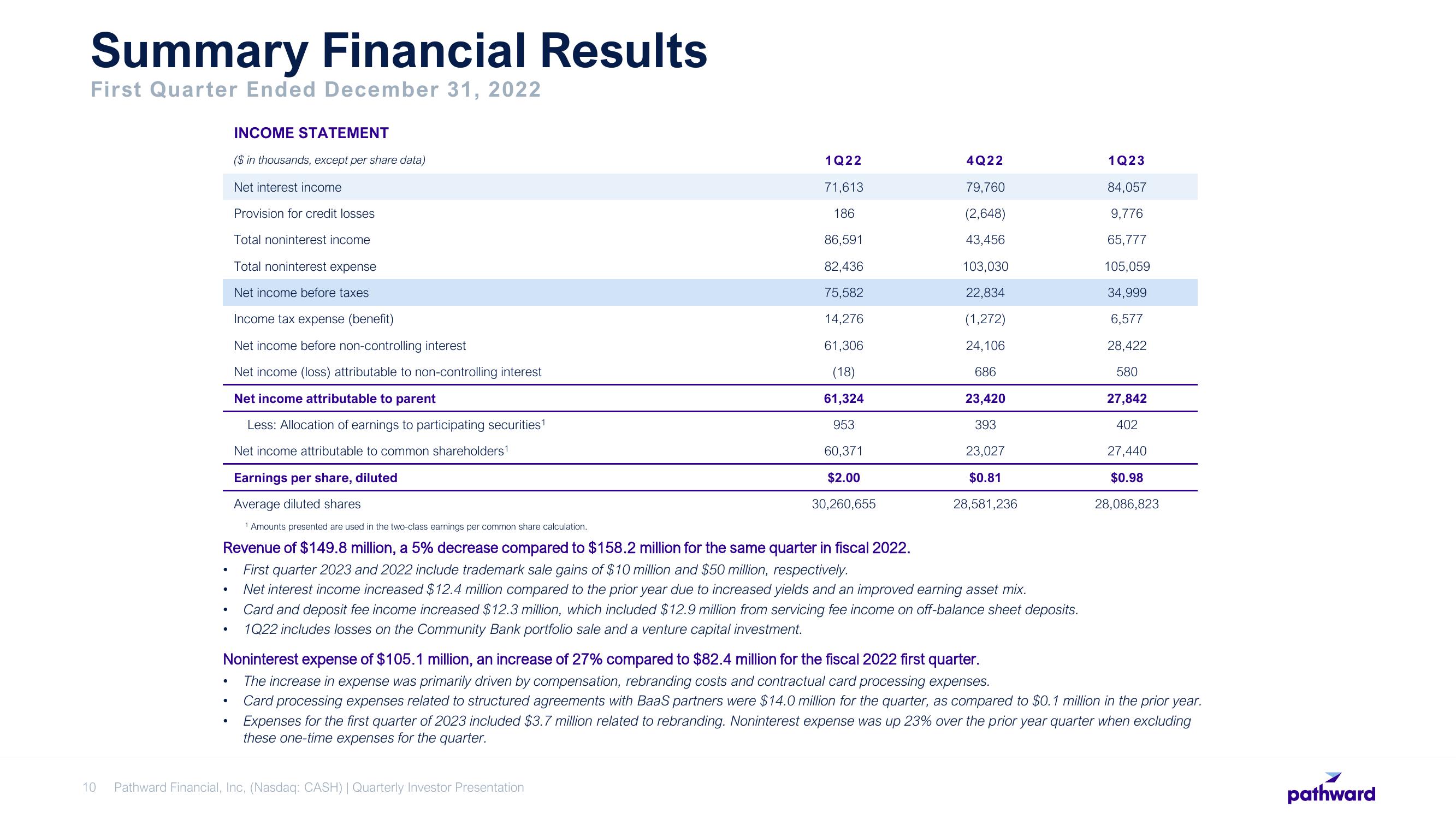

First Quarter Ended December 31, 2022

10

●

●

Earnings per share, diluted

Average diluted shares

1 Amounts presented are used in the two-class earnings per common share calculation.

Revenue of $149.8 million, a 5% decrease compared to $158.2 million for the same quarter in fiscal 2022.

First quarter 2023 and 2022 include trademark sale gains of $10 million and $50 million, respectively.

Net interest income increased $12.4 million compared to the prior year due to increased yields and an improved earning asset mix.

Card and deposit fee income increased $12.3 million, which included $12.9 million from servicing fee income on off-balance sheet deposits.

1Q22 includes losses on the Community Bank portfolio sale and a venture capital investment.

●

INCOME STATEMENT

($ in thousands, except per share data)

Net interest income

Provision for credit losses

Total noninterest income

Total noninterest expense

Net income before taxes

Income tax expense (benefit)

Net income before non-controlling interest

Net income (loss) attributable to non-controlling interest

Net income attributable to parent

Less: Allocation of earnings to participating securities¹

Net income attributable to common shareholders¹

●

●

1Q22

71,613

186

86,591

82,436

75,582

14,276

61,306

(18)

61,324

953

60,371

$2.00

30,260,655

4Q22

79,760

(2,648)

43,456

103,030

22,834

(1,272)

24,106

686

23,420

393

23,027

$0.81

28,581,236

Pathward Financial, Inc, (Nasdaq: CASH) | Quarterly Investor Presentation

Noninterest expense of $105.1 million, an increase of 27% compared to $82.4 million for the fiscal 2022 first quarter.

The increase in expense was primarily driven by compensation, rebranding costs and contractual card processing expenses.

Card processing expenses related to structured agreements with BaaS partners were $14.0 million for the quarte as compared to $0.1 million in the prior year.

Expenses for the first quarter of 2023 included $3.7 million related to rebranding. Noninterest expense was up 23% over the prior year quarter when excluding

these one-time expenses for the quarter.

1Q23

84,057

9,776

65,777

105,059

34,999

6,577

28,422

580

27,842

402

27,440

$0.98

28,086,823

pathwardView entire presentation