Kroger Mergers and Acquisitions Presentation Deck

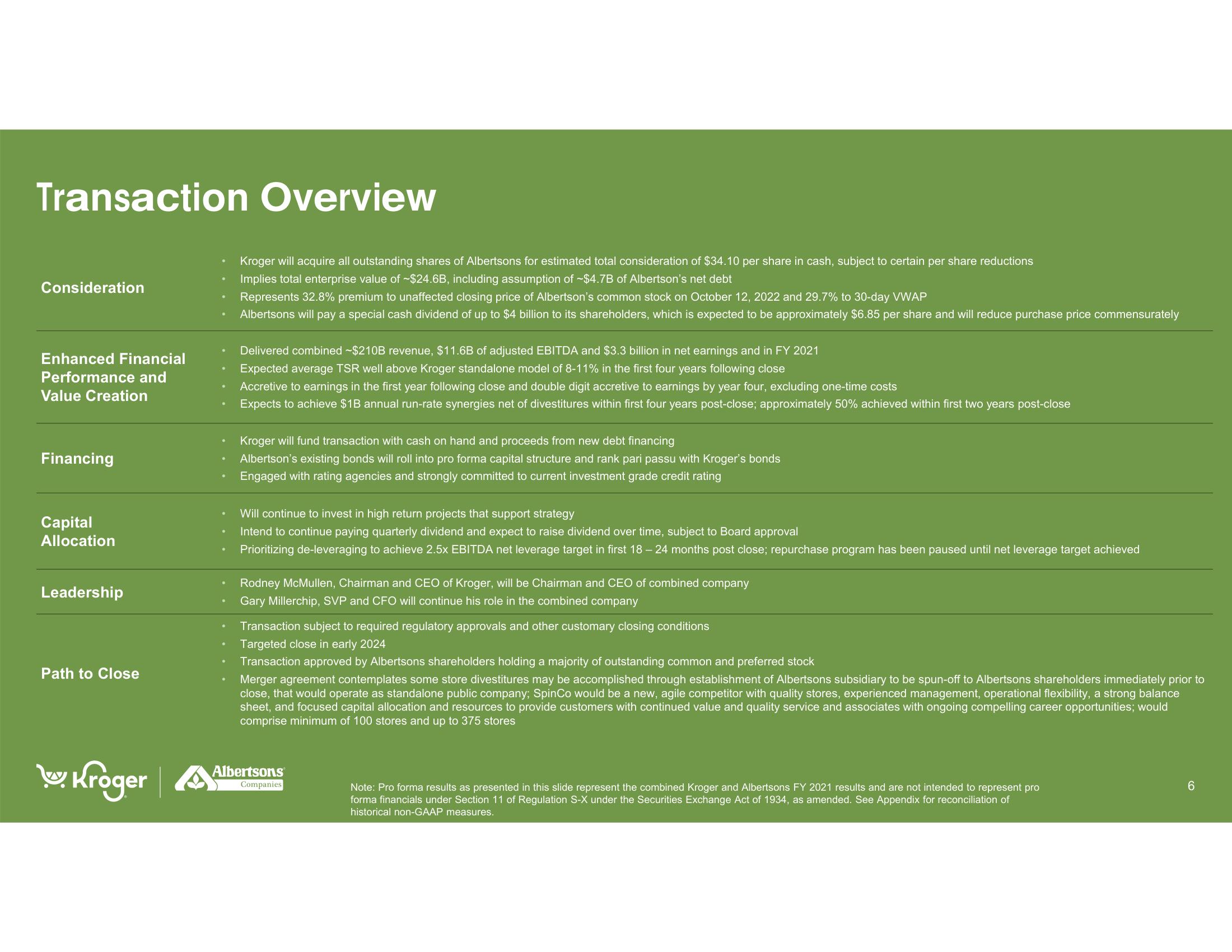

Transaction Overview

Consideration

Enhanced Financial

Performance and

Value Creation

Financing

Capital

Allocation

Leadership

Path to Close

Kroger

.

Kroger will acquire all outstanding shares of Albertsons for estimated total consideration of $34.10 per share in cash, subject to certain per share reductions

Implies total enterprise value of ~$24.6B, including assumption of ~$4.7B of Albertson's net debt

Represents 32.8% premium to unaffected closing price of Albertson's common stock on October 12, 2022 and 29.7% to 30-day VWAP

Albertsons will pay a special cash dividend of up to $4 billion to its shareholders, which is expected to be approximately $6.85 per share and will reduce purchase price commensurately

Delivered combined -$210B revenue, $11.6B of adjusted EBITDA and $3.3 billion in net earnings and in FY 2021

Expected average TSR well above Kroger standalone model of 8-11% in the first four years following close

Accretive to earnings in the first year following close and double digit accretive to earnings by year four, excluding one-time costs

Expects to achieve $1B annual run-rate synergies net of divestitures within first four years post-close; approximately 50% achieved within first two years post-close

Kroger will fund transaction with cash on hand and proceeds from new debt financing

Albertson's existing bonds will roll into pro forma capital structure and rank pari passu with Kroger's bonds

Engaged with rating agencies and strongly committed to current investment grade credit rating

Will continue to invest in high return projects that support strategy

Intend to continue paying quarterly dividend and expect to raise dividend over time, subject to Board approval

Prioritizing de-leveraging to achieve 2.5x EBITDA net leverage target in first 18 - 24 months post close; repurchase program has been paused until net leverage target achieved

Rodney McMullen, Chairman and CEO of Kroger, will be Chairman and CEO of combined company

Gary Millerchip, SVP and CFO will continue his role in the combined company

Transaction subject to required regulatory approvals and other customary closing conditions

Targeted close in early 2024

Transaction approved by Albertsons shareholders holding a majority of outstanding common and preferred stock

Merger agreement contemplates some store divestitures may be accomplished through establishment of Albertsons subsidiary to be spun-off to Albertsons shareholders immediately prior to

close, that would operate as standalone public company; SpinCo would be a new, agile competitor with quality stores, experienced management, operational flexibility, a strong balance

sheet, and focused capital allocation and resources to provide customers with continued value and quality service and associates with ongoing compelling career opportunities; would

comprise minimum of 100 stores and up to 375 stores

Albertsons

Companies

Note: Pro forma results as presented in this slide represent the combined Kroger and Albertsons FY 2021 results and are not intended to represent pro

forma financials under Section 11 of Regulation S-X under the Securities Exchange Act of 1934, as amended. See Appendix for reconciliation of

historical non-GAAP measures.

6View entire presentation