AMC Other Presentation Deck

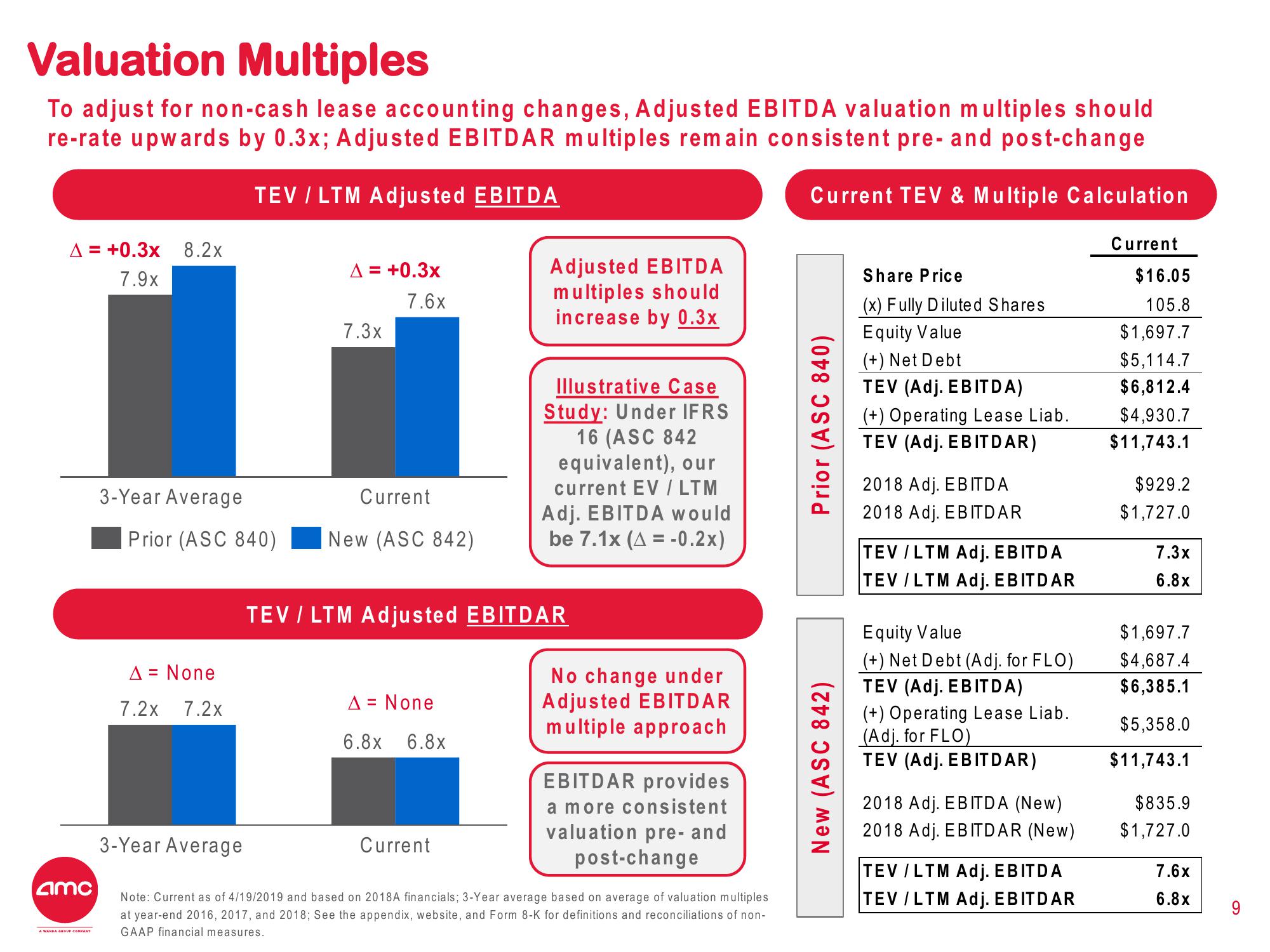

Valuation Multiples

To adjust for non-cash lease accounting changes, Adjusted EBITDA valuation multiples should

re-rate upwards by 0.3x; Adjusted EBITDAR multiples remain consistent pre- and post-change

TEV / LTM Adjusted EBITDA

Current TEV & Multiple Calculation

A = +0.3x 8.2x

7.9x

amc

A WANDA GROUP COMPANY

3-Year Average

Prior (ASC 840)

A = None

7.2x 7.2x

3-Year Average

A = +0.3x

7.6x

7.3x

Current

New (ASC 842)

A = None

6.8x 6.8x

Adjusted EBITDA

multiples should

increase by 0.3x

TEV / LTM Adjusted EBITDAR

Current

Illustrative Case

Study: Under IFRS

16 (ASC 842

equivalent), our

current EV / LTM

Adj. EBITDA would

be 7.1x (A = -0.2x)

No change under

Adjusted EBITDAR

multiple approach

EBITDAR provides

a more consistent

valuation pre- and

post-change

Note: Current as of 4/19/2019 and based on 2018A financials; 3-Year average based on average of valuation multiples

at year-end 2016, 2017, and 2018; See the appendix, website, and Form 8-K for definitions and reconciliations of non-

GAAP financial measures.

Prior (ASC 840)

New (ASC 842)

Share Price

(x) Fully Diluted Shares

Equity Value

(+) Net Debt

TEV (Adj. EBITDA)

(+) Operating Lease Liab.

TEV (Adj. EBITDAR)

2018 Adj. EBITDA

2018 Adj. EBITDAR

TEV / LTM Adj. EBITDA

TEV / LTM Adj. EBITDAR

Equity Value

(+) Net Debt (Adj. for FLO)

TEV (Adj. EBITDA)

(+) Operating Lease Liab.

(Adj. for FLO)

TEV (Adj. EBITDAR)

2018 Adj. EBITDA (New)

2018 Adj. EBITDAR (New)

TEV / LTM Adj. EBITDA

TEV / LTM Adj. EBITDAR

Current

$16.05

105.8

$1,697.7

$5,114.7

$6,812.4

$4,930.7

$11,743.1

$929.2

$1,727.0

7.3x

6.8x

$1,697.7

$4,687.4

$6,385.1

$5,358.0

$11,743.1

$835.9

$1,727.0

7.6x

6.8xView entire presentation