Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

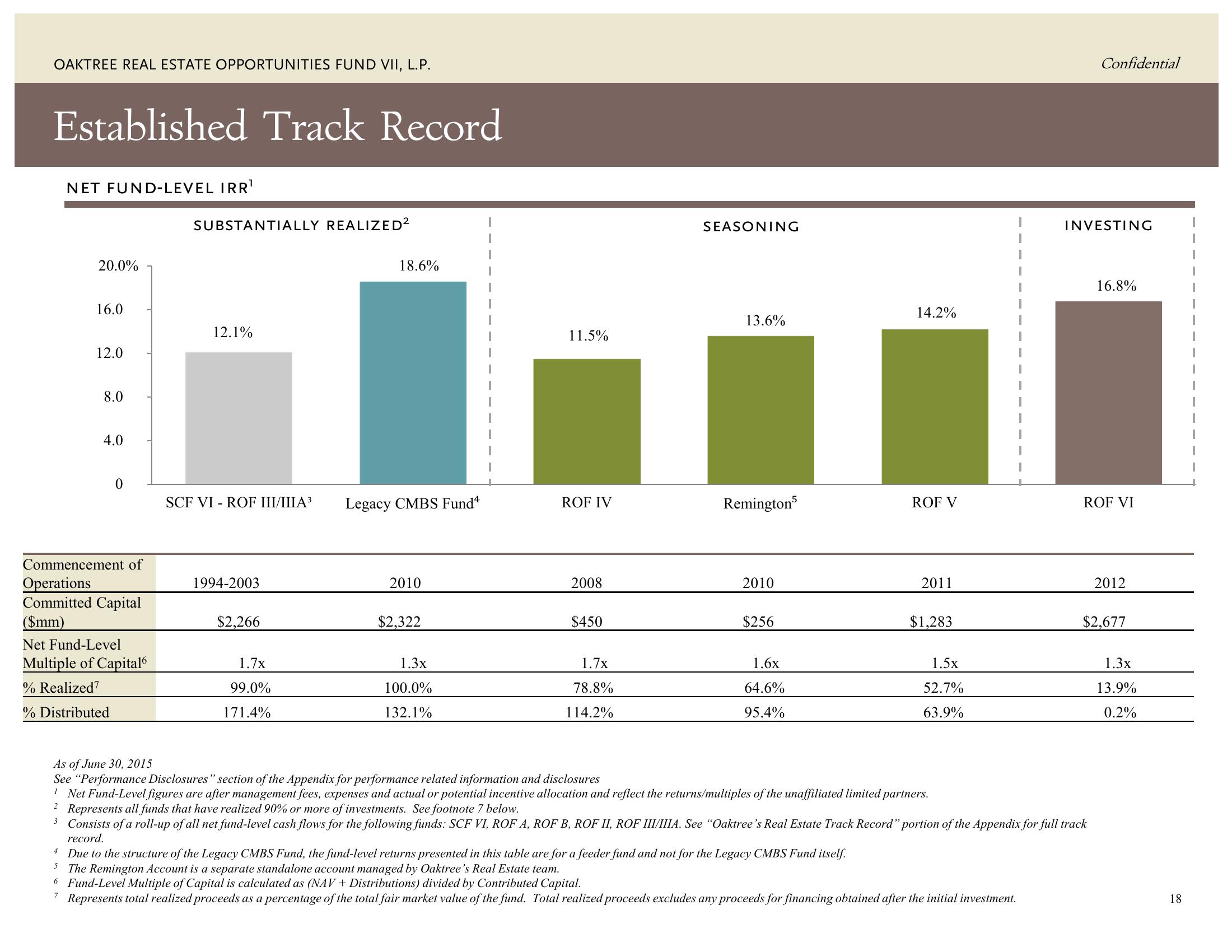

Established Track Record

NET FUND-LEVEL IRR¹

20.0%

16.0

12.0

8.0

4.0

0

Commencement of

Operations

Committed Capital

($mm)

Net Fund-Level

Multiple of Capital

% Realized7

% Distributed

SUBSTANTIALLY REALIZED²

12.1%

SCF VIROF III/IIIA³

1994-2003

$2,266

1.7x

99.0%

171.4%

18.6%

Legacy CMBS Fundª

2010

$2,322

1.3x

100.0%

132.1%

I

11.5%

ROF IV

2008

$450

1.7x

78.8%

114.2%

SEASONING

13.6%

Remington5

2010

$256

1.6x

64.6%

95.4%

14.2%

ROF V

2011

$1,283

1.5x

52.7%

63.9%

As of June 30, 2015

See "Performance Disclosures" section of the Appendix for performance related information and disclosures

1 Net Fund-Level figures are after management fees, expenses and actual or potential incentive allocation and reflect the returns/multiples of the unaffiliated limited partners.

2 Represents all funds that have realized 90% or more of investments. See footnote 7 below.

I

4 Due to the structure of the Legacy CMBS Fund, the fund-level returns presented in this table are for a feeder fund and not for the Legacy CMBS Fund itself.

5 The Remington Account is a separate standalone account managed by Oaktree's Real Estate team.

6 Fund-Level Multiple of Capital is calculated as (NAV+ Distributions) divided by Contributed Capital.

7

Represents total realized proceeds as a percentage of the total fair market value of the fund. Total realized proceeds excludes any proceeds for financing obtained after the initial investment.

Confidential

INVESTING

3 Consists of a roll-up of all net fund-level cash flows for the following funds: SCF VI, ROF A, ROF B, ROF II, ROF III/IIIA. See "Oaktree's Real Estate Track Record" portion of the Appendix for full track

record.

16.8%

ROF VI

2012

$2,677

1.3x

13.9%

0.2%

18View entire presentation