Aeva Investor Presentation Deck

Transaction Overview

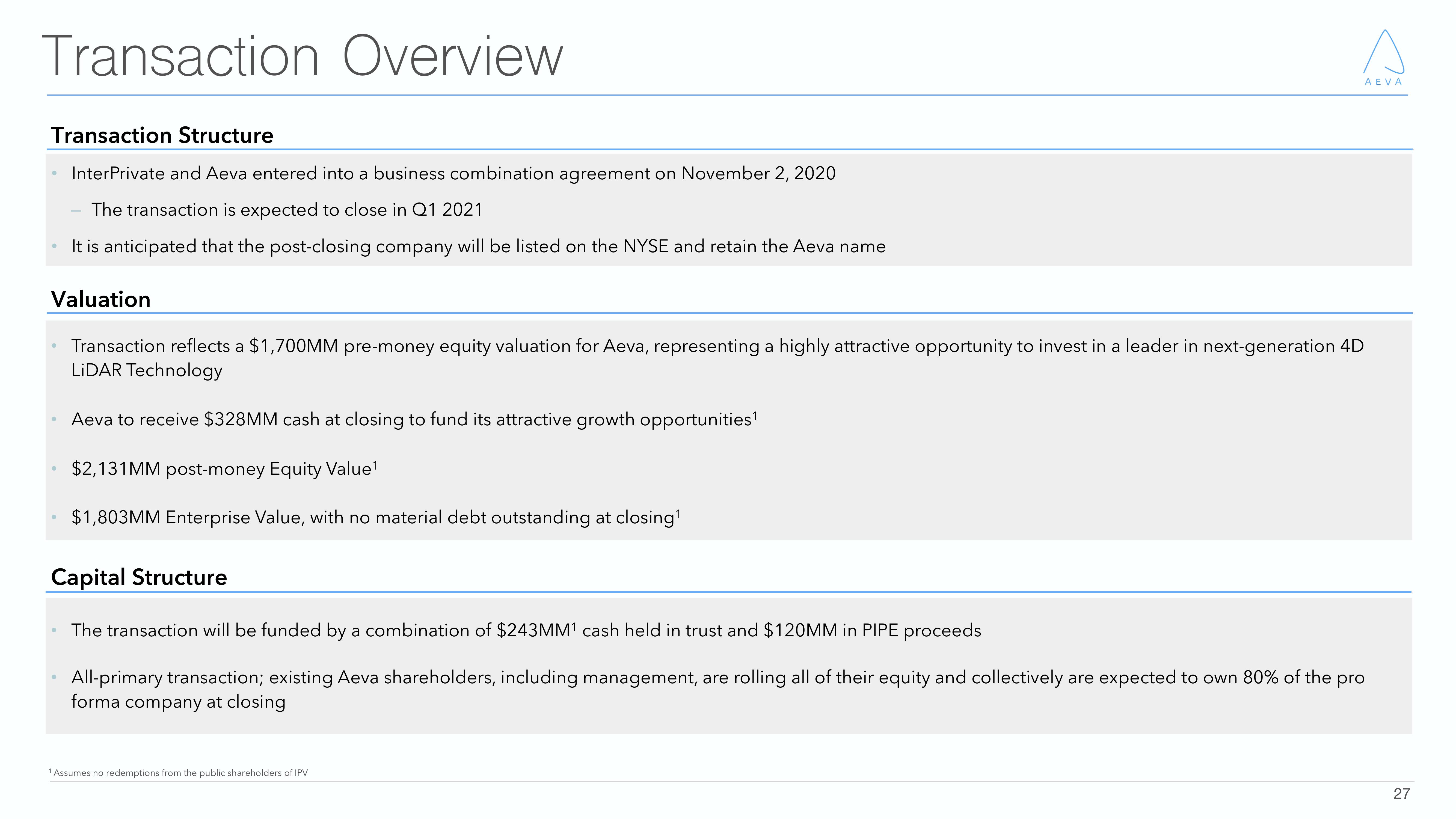

Transaction Structure

InterPrivate and Aeva entered into a business combination agreement on November 2, 2020

The transaction is expected to close in Q1 2021

It is anticipated that the post-closing company will be listed on the NYSE and retain the Aeva name

Valuation

Transaction reflects a $1,700MM pre-money equity valuation for Aeva, representing a highly attractive opportunity to invest in a leader in next-generation 4D

LiDAR Technology

Aeva to receive $328MM cash at closing to fund its attractive growth opportunities¹

$2,131MM post-money Equity Value¹

$1,803MM Enterprise Value, with no material debt outstanding at closing¹

AEVA

Capital Structure

The transaction will be funded by a combination of $243MM¹ cash held in trust and $120MM in PIPE proceeds

All-primary transaction; existing Aeva shareholders, including management, are rolling all of their equity and collectively are expected to own 80% of the pro

forma company at closing

¹Assumes no redemptions from the public shareholders of IPV

27View entire presentation