Better SPAC Presentation Deck

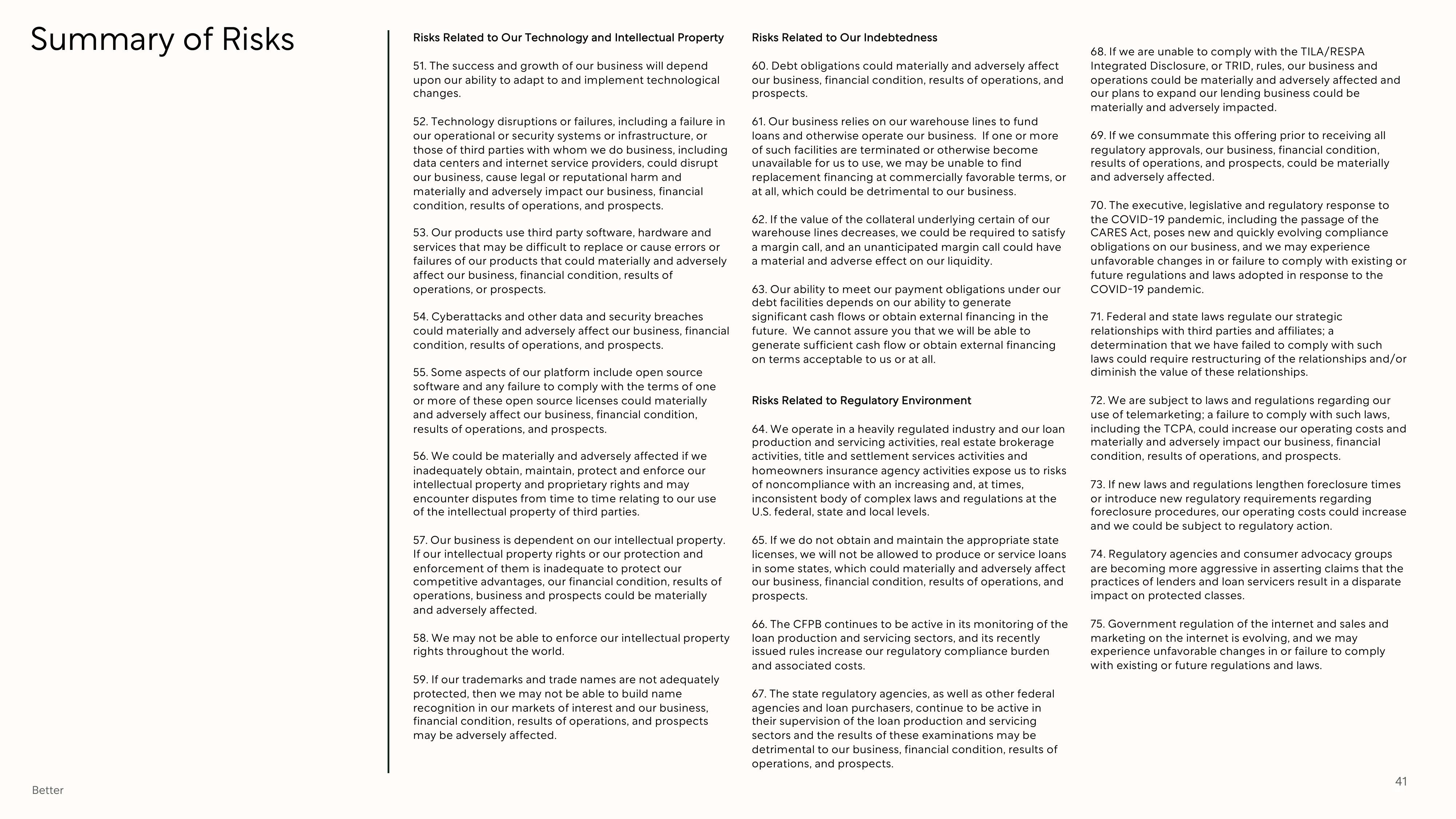

Summary of Risks

Better

Risks Related to Our Technology and Intellectual Property

51. The success and growth of our business will depend

upon our ability to adapt to and implement technological

changes.

52. Technology disruptions or failures, including a failure in

our operational or security systems or infrastructure, or

those of third parties with whom we do business, including

data centers and internet service providers, could disrupt

our business, cause legal or reputational harm and

materially and adversely impact our business, financial

condition, results of operations, and prospects.

53. Our products use third party software, hardware and

services that may be difficult to replace or cause errors or

failures of our products that could materially and adversely

affect our business, financial condition, results of

operations, or prospects.

54. Cyberattacks and other data and security breaches

could materially and adversely affect our business, financial

condition, results of operations, and prospects.

55. Some aspects of our platform include open source

software and any failure to comply with the terms of one

or more of these open source licenses could materially

and adversely affect our business, financial condition,

results of operations, and prospects.

56. We could be materially and adversely affected if we

inadequately obtain, maintain, protect and enforce our

intellectual property and proprietary rights and may

encounter disputes from time to time relating to our use

of the intellectual property of third parties.

57. Our business is dependent on our intellectual property.

If our intellectual property rights or our protection and

enforcement of them is inadequate to protect our

competitive advantages, our financial condition, results of

operations, business and prospects could be materially

and adversely affected.

58. We may not be able to enforce our intellectual property

rights throughout the world.

59. If our trademarks and trade names are not adequately

protected, then we may not be able to build name

recognition in our markets of interest and our business,

financial condition, results of operations, and prospects

may be adversely affected.

Risks Related to Our Indebtedness

60. Debt obligations could materially and adversely affect

our business, financial condition, results of operations, and

prospects.

61. Our business relies on our warehouse lines to fund

loans and otherwise operate our business. If one or more

of such facilities are terminated or otherwise become

unavailable for us to use, we may be unable to find

replacement financing at commercially favorable terms, or

at all, which could be detrimental to our business.

62. If the value of the collateral underlying certain of our

warehouse lines decreases, we could be required to satisfy

a margin call, and an unanticipated margin call could have

a material and adverse effect on our liquidity.

63. Our ability to meet our payment obligations under our

debt facilities depends on our ability to generate

significant cash flows or obtain external financing in the

future. We cannot assure you that we will be able to

generate sufficient cash flow or obtain external financing

on terms acceptable to us or at all.

Risks Related to Regulatory Environment

64. We operate in a heavily regulated industry and our loan

production and servicing activities, real estate brokerage

activities, title and settlement services activities and

homeowners insurance agency activities expose us to risks

of noncompliance with an increasing and, at times,

inconsistent body of complex laws and regulations at the

U.S. federal, state and local levels.

65. If we do not obtain and maintain the appropriate state

licenses, we will not be allowed to produce or service loans

in some states, which could materially and adversely affect

our business, financial condition, results of operations, and

prospects.

66. The CFPB continues to be active in its monitoring of the

loan production and servicing sectors, and its recently

issued rules increase our regulatory compliance burden

and associated costs.

67. The state regulatory agencies, as well as other federal

agencies and loan purchasers, continue to be active in

their supervision of the loan production and servicing

sectors and the results of these examinations may be

detrimental to our business, financial condition, results of

operations, and prospects.

68. If we are unable to comply with the TILA/RESPA

Integrated Disclosure, or TRID, rules, our business and

operations could be materially and adversely affected and

our plans to expand our lending business could be

materially and adversely impacted.

69. If we consummate this offering prior to receiving all

regulatory approvals, our business, financial condition,

results of operations, and prospects, could be materially

and adversely affected.

70. The executive, legislative and regulatory response to

the COVID-19 pandemic, including the passage of the

CARES Act, poses new and quickly evolving compliance

obligations on our business, and we may experience

unfavorable changes in or failure to comply with existing or

future regulations and laws adopted in response to the

COVID-19 pandemic.

71. Federal and state laws regulate our strategic

relationships with third parties and affiliates; a

determination that we have failed to comply with such

laws could require restructuring of the relationships and/or

diminish the value of these relationships.

72. We are subject to laws and regulations regarding our

use of telemarketing; a failure to comply with such laws,

including the TCPA, could increase our operating costs and

materially and adversely impact our business, financial

condition, results of operations, and prospects.

73. If new laws and regulations lengthen foreclosure times

or introduce new regulatory requirements regarding

foreclosure procedures, our operating costs could increase

and we could be subject to regulatory action.

74. Regulatory agencies and consumer advocacy groups

are becoming more aggressive in asserting claims that the

practices of lenders and loan servicers result in a disparate

impact on protected classes.

75. Government regulation of the internet and sales and

marketing on the internet is evolving, and we may

experience unfavorable changes in or failure to comply

with existing or future regulations and laws.

41View entire presentation