Commercial Metals Company Results Presentation Deck

Q3 Europe

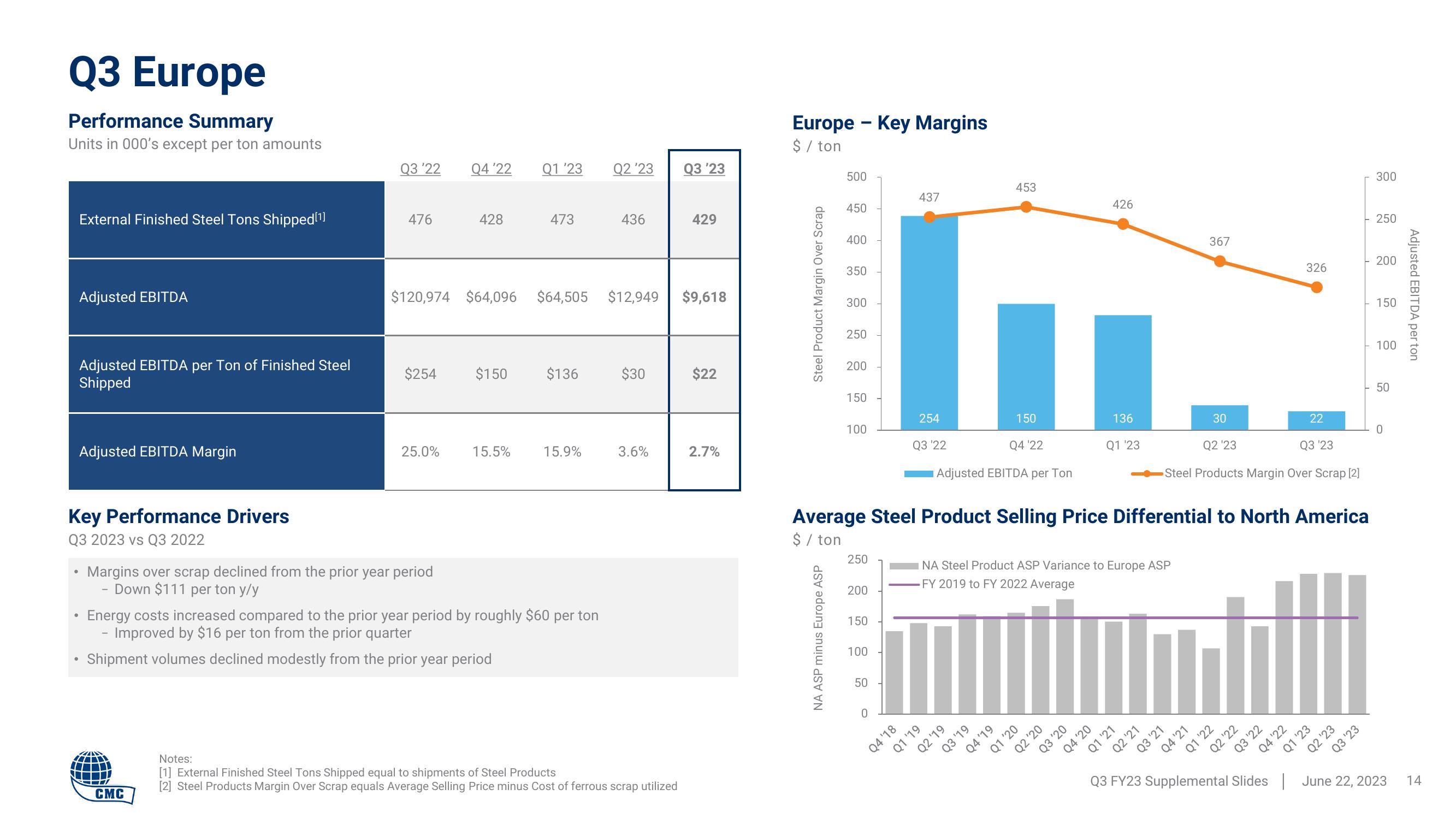

Performance Summary

Units in 000's except per ton amounts

Adjusted EBITDA

Adjusted EBITDA per Ton of Finished Steel

Shipped

External Finished Steel Tons Shipped [¹]

Adjusted EBITDA Margin

Key Performance Drivers

Q3 2023 vs Q3 2022

●

●

●

Q3 '22

476

CMC

Q4 '22

25.0%

Margins over scrap declined from the prior year period

Down $111 per ton y/y

428

Q1 '23

$254 $150 $136

473

15.5%

$120,974 $64,096 $64,505 $12,949 $9,618

15.9%

Energy costs increased compared to the prior year period by roughly $60 per ton

Improved by $16 per ton from the prior quarter

Shipment volumes declined modestly from the prior year period

Q2 '23

436

$30

3.6%

Q3 '23

Notes:

[1] External Finished Steel Tons Shipped equal to shipments of Steel Products

[2] Steel Products Margin Over Scrap equals Average Selling Price minus Cost of ferrous scrap utilized

429

$22

2.7%

Europe - Key Margins

$ / ton

Steel Product Margin Over Scrap

500

NA ASP minus Europe ASP

450

400

350

300

250

200

150

100

250

200

150

100

50

437

0

254

Q3 '22

Q4 '18

Q1 '19

Q4 '22

Adjusted EBITDA per Ton

453

Average Steel Product Selling Price Differential to North America

$ / ton

Q2 '19

150

Q3 '19

Q4'19

NA Steel Product ASP Variance to Europe ASP

FY 2019 to FY 2022

Average

Q1 '20

Q2 '20

426

Q3 '20

136

Q4 '20

Q1 '23

Q1 '21

Q2 '21

367

Q3 '21

30

Q2 '23

Q3 '23

Steel Products Margin Over Scrap [2]

Q4 '21

Q1 '22

Q2 '22

326

Q3 '22

22

Q4 '22

Q1 '23

Q2 '23

Q3 '23

300

250

200

150

100

50

0

Q3 FY23 Supplemental Slides June 22, 2023

Adjusted EBITDA per ton

14View entire presentation