IGI SPAC Presentation Deck

Conservative Specialty-Class Individual Risk Underwriter

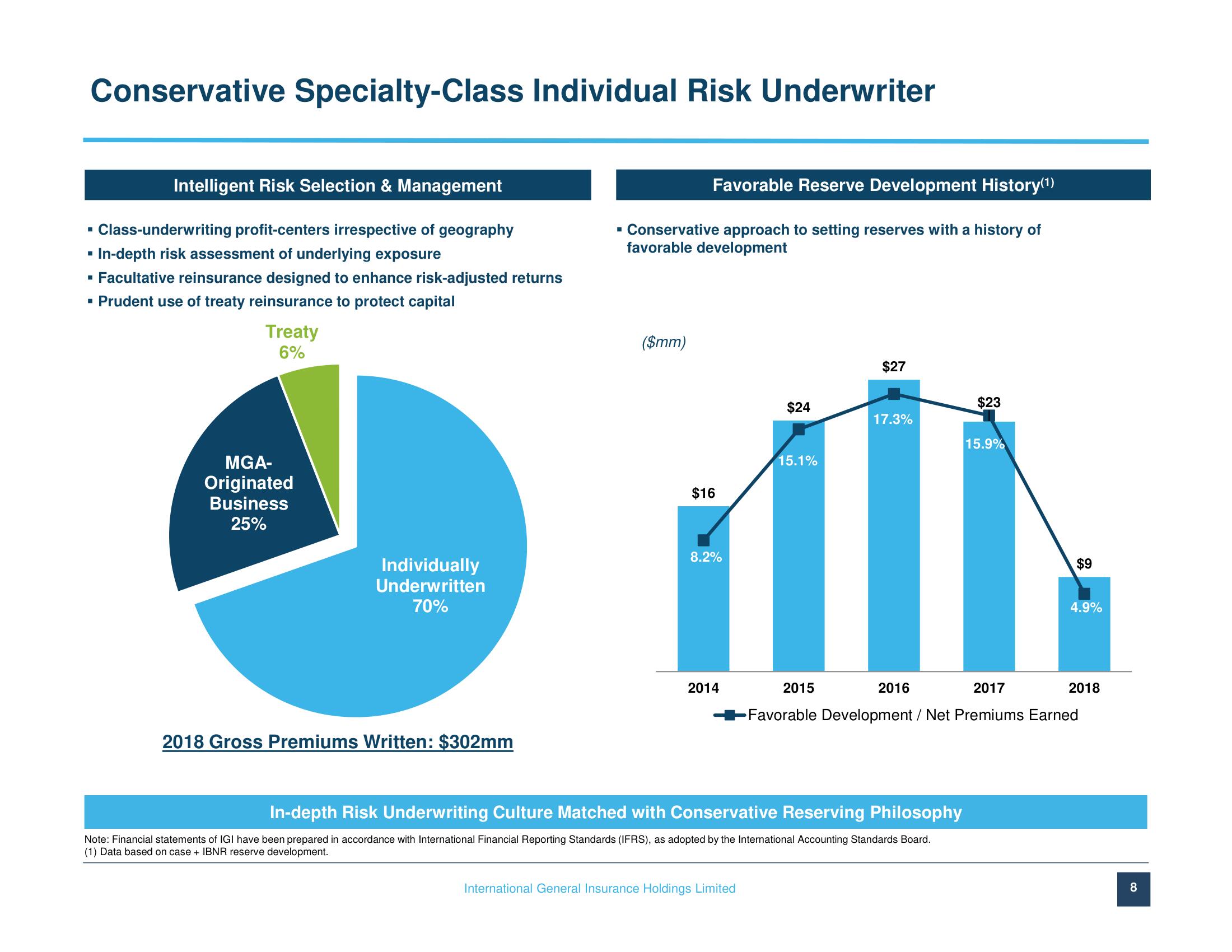

Intelligent Risk Selection & Management

■

Class-underwriting profit-centers irrespective of geography

▪ In-depth risk assessment of underlying exposure

▪ Facultative reinsurance designed to enhance risk-adjusted returns

▪ Prudent use of treaty reinsurance to protect capital

Treaty

6%

MGA-

Originated

Business

25%

Individually

Underwritten

70%

2018 Gross Premiums Written: $302mm

Favorable Reserve Development History(¹)

▪ Conservative approach to setting reserves with a history of

favorable development

($mm)

$16

8.2%

2014

$24

International General Insurance Holdings Limited

15.1%

2015

$27

17.3%

2016

In-depth Risk Underwriting Culture Matched with Conservative Reserving Philosophy

Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board.

(1) Data based on case + IBNR reserve development.

$23

15.9%

$9

4.9%

2017

Favorable Development / Net Premiums Earned

2018

8View entire presentation