WeWork Restructuring Presentation Deck

Transaction Term Sheet (Cont'd)

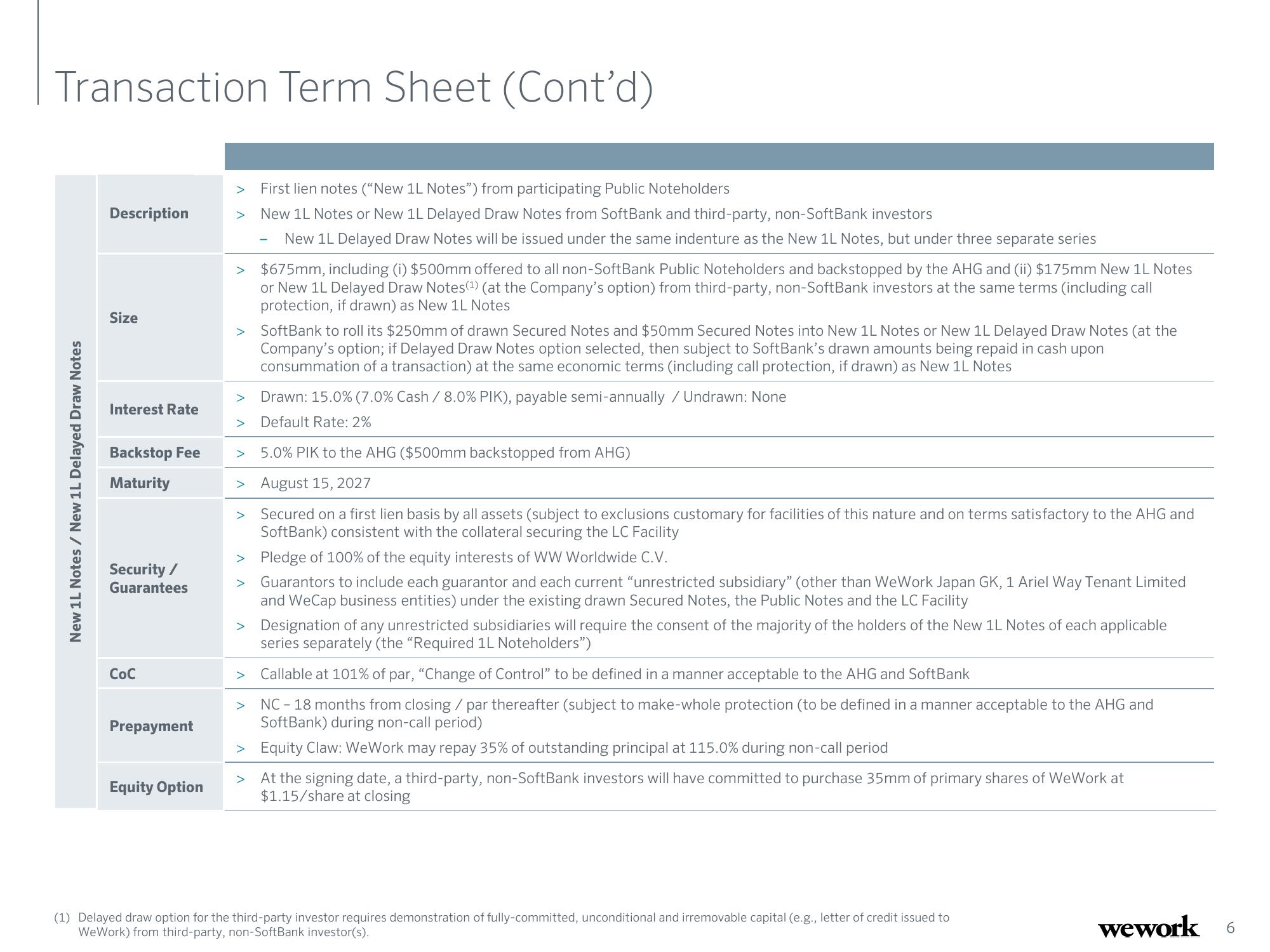

New 1L Notes / New 1L Delayed Draw Notes

Description

Size

Interest Rate

Backstop Fee

Maturity

Security /

Guarantees

CoC

Prepayment

Equity Option

>

First lien notes ("New 1L Notes") from participating Public Noteholders

New 1L Notes or New 1L Delayed Draw Notes from SoftBank and third-party, non-SoftBank investors

New 1L Delayed Draw Notes will be issued under the same indenture as the New 1L Notes, but under three separate series

> $675mm, including (i) $500mm offered to all non-SoftBank Public Noteholders and backstopped by the AHG and (ii) $175mm New 1L Notes

or New 1L Delayed Draw Notes (¹) (at the Company's option) from third-party, non-SoftBank investors at the same terms (including call

protection, if drawn) as New 1L Notes

>

SoftBank to roll its $250mm of drawn Secured Notes and $50mm Secured Notes into New 1L Notes or New 1L Delayed Draw Notes (at the

Company's option; if Delayed Draw Notes option selected, then subject to SoftBank's drawn amounts being repaid in cash upon

consummation of a transaction) at the same economic terms (including call protection, if drawn) as New 1L Notes

Drawn: 15.0% (7.0% Cash / 8.0% PIK), payable semi-annually / Undrawn: None

Default Rate: 2%

5.0% PIK to the AHG ($500mm backstopped from AHG)

> August 15, 2027

Secured on a first lien basis by all assets (subject to exclusions customary for facilities of this nature and on terms satisfactory to the AHG and

SoftBank) consistent with the collateral securing the LC Facility

> Pledge of 100% of the equity interests of WW Worldwide C.V.

Guarantors to include each guarantor and each current "unrestricted subsidiary" (other than WeWork Japan GK, 1 Ariel Way Tenant Limited

and WeCap business entities) under the existing drawn Secured Notes, the Public Notes and the LC Facility

> Designation of any unrestricted subsidiaries will require the consent of the majority of the holders of the New 1L Notes of each applicable

series separately (the "Required 1L Noteholders")

> Callable at 101% of par, "Change of Control" to be defined in a manner acceptable to the AHG and SoftBank

NC - 18 months from closing / par thereafter (subject to make-whole protection (to be defined in a manner acceptable to the AHG and

SoftBank) during non-call period)

> Equity Claw: WeWork may repay 35% of outstanding principal at 115.0% during non-call period

At the signing date, a third-party, non-SoftBank investors will have committed to purchase 35mm of primary shares of WeWork at

$1.15/share at closing

(1) Delayed draw option for the third-party investor requires demonstration of fully-committed, unconditional and irremovable capital (e.g., letter of credit issued to

WeWork) from third-party, non-SoftBank investor(s).

wework 6View entire presentation