Credit Suisse Investment Banking Pitch Book

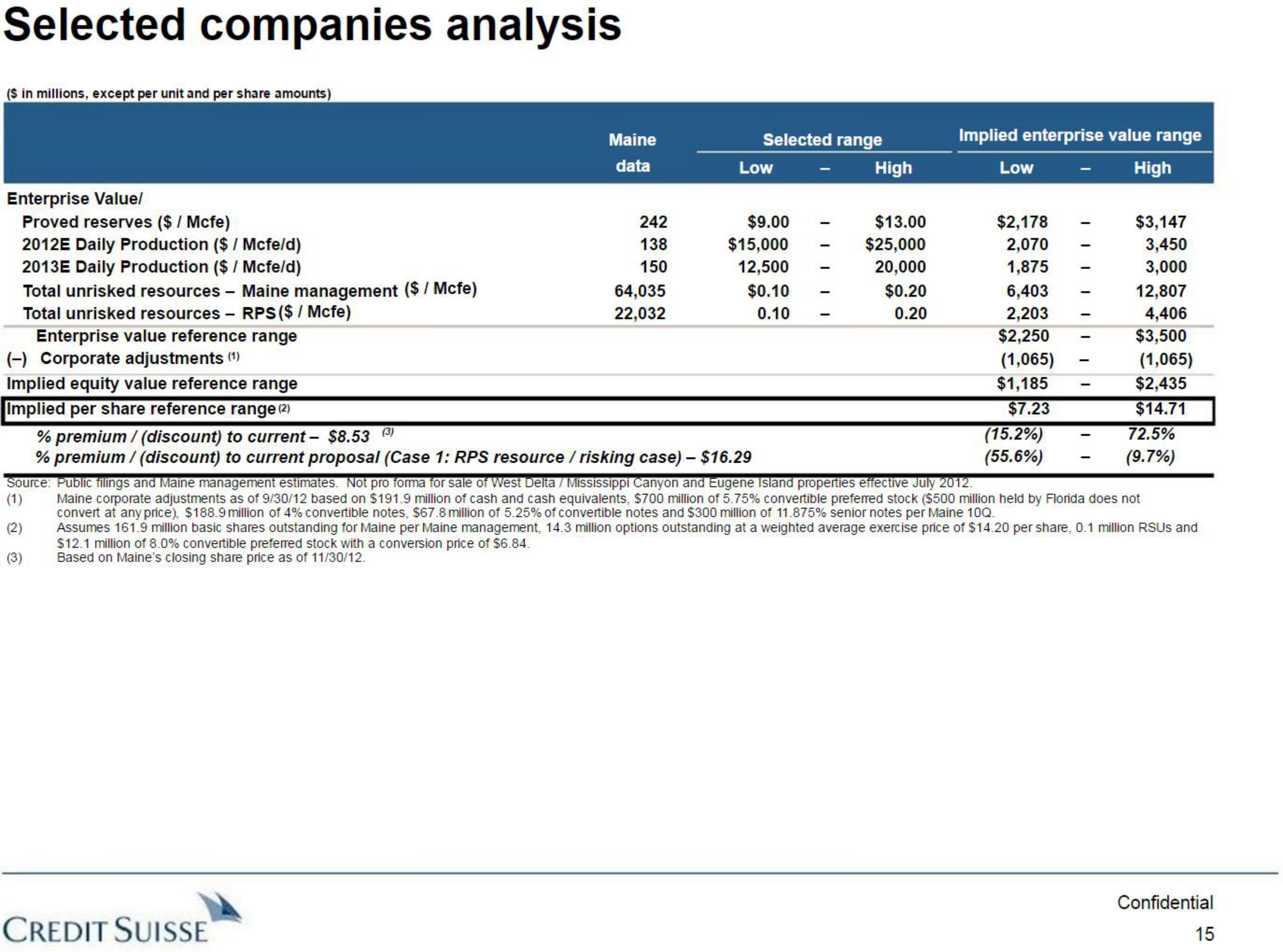

Selected companies analysis

($ in millions, except per unit and per share amounts)

Enterprise Value/

Proved reserves ($ / Mcfe)

2012E Daily Production ($/ Mcfe/d)

2013E Daily Production ($ / Mcfe/d)

Total unrisked resources - Maine management ($ / Mcfe)

Total unrisked resources RPS ($ / Mcfe)

-

Enterprise value reference range

(-) Corporate adjustments (¹1)

Implied equity value reference range

Implied per share reference range (2)

Maine

data

CREDIT SUISSE

242

138

150

64,035

22,032

Selected range

Low

% premium/(discount) to current - $8.53 (3)

% premium / (discount) to current proposal (Case 1: RPS resource / risking case) - $16.29

$9.00

$15,000

12,500

$0.10

0.10

High

$13.00

$25,000

20,000

$0.20

0.20

Implied enterprise value range

High

Low

$2,178

2,070

1,875

6,403

2,203

$2,250

(1,065)

$1,185

$7.23

(15.2%)

(55.6%)

-

$3,147

3,450

3,000

12,807

4,406

$3,500

(1,065)

$2,435

$14.71

72.5%

(9.7%)

Source: Public filings and Maine management estimates. Not pro forma for sale of West Delta / Mississippi Canyon and Eugene Island properties effective July 2012.

(1) Maine corporate adjustments as of 9/30/12 based on $191.9 million of cash and cash equivalents, $700 million of 5.75% convertible preferred stock ($500 million held by Florida does not

convert at any price), $188.9 million of 4% convertible notes, $67.8 million of 5.25% of convertible notes and $300 million of 11.875% senior notes per Maine 10Q.

(2)

Assumes 161.9 million basic shares outstanding for Maine per Maine management, 14.3 million options outstanding at a weighted average exercise price of $14.20 per share, 0.1 million RSUS and

$12.1 million of 8.0% convertible preferred stock with a conversion price of $6.84.

Based on Maine's closing share price as of 11/30/12.

(3)

Confidential

15View entire presentation