AT&T Analyst & Investor Conference

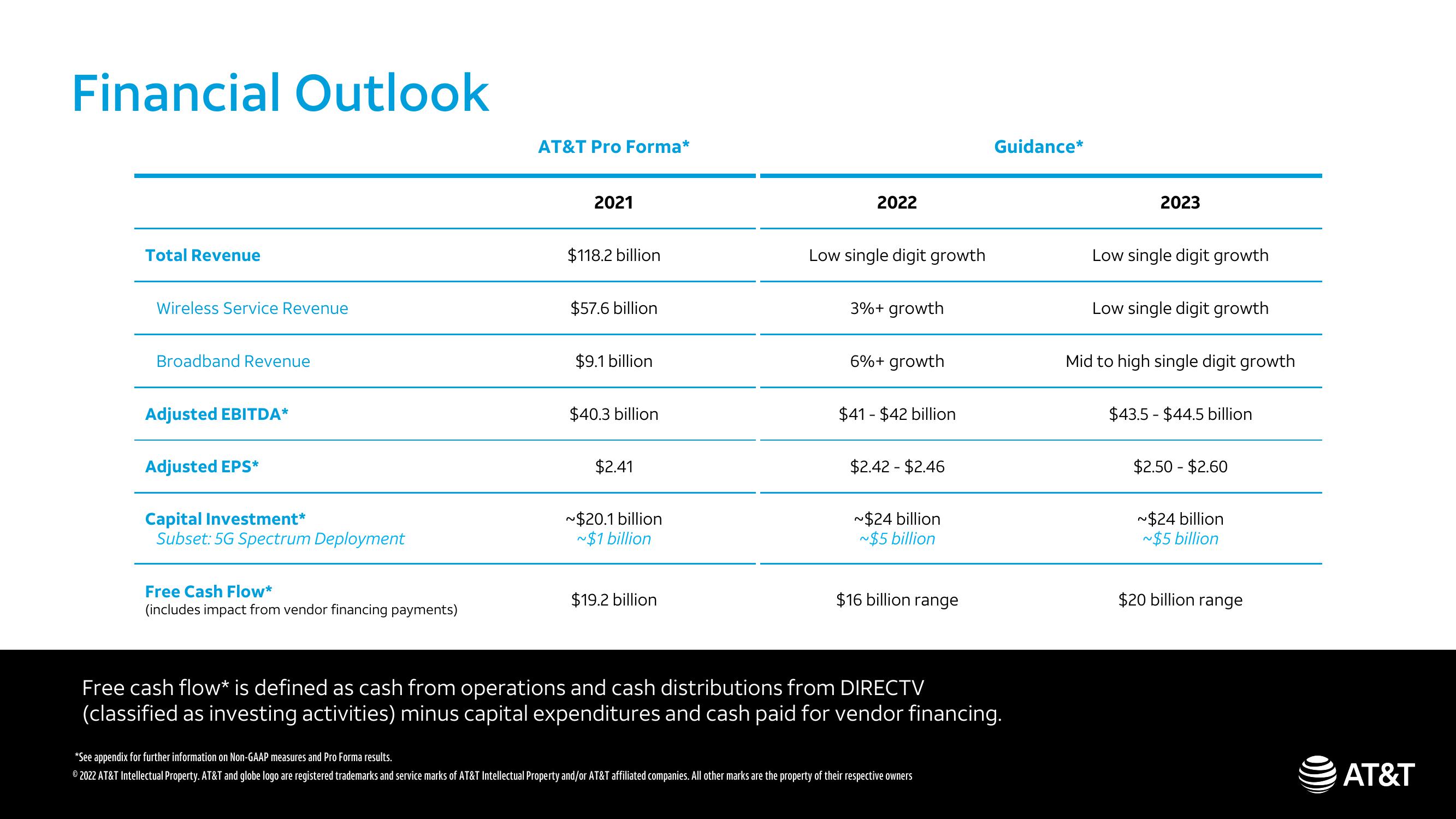

Financial Outlook

AT&T Pro Forma*

2021

2022

Guidance*

2023

Total Revenue

$118.2 billion

Low single digit growth

Low single digit growth

Wireless Service Revenue

$57.6 billion

3%+ growth

Low single digit growth

Broadband Revenue

$9.1 billion

6%+ growth

Mid to high single digit growth

Adjusted EBITDA*

Adjusted EPS*

Capital Investment*

Subset: 5G Spectrum Deployment

$40.3 billion

$41 $42 billion

$2.41

$2.42 - $2.46

~$20.1 billion

~$1 billion

~$24 billion

~$5 billion

$43.5 $44.5 billion

$2.50 - $2.60

~$24 billion

~$5 billion

Free Cash Flow*

$19.2 billion

(includes impact from vendor financing payments)

$16 billion range

Free cash flow* is defined as cash from operations and cash distributions from DIRECTV

(classified as investing activities) minus capital expenditures and cash paid for vendor financing.

*See appendix for further information on Non-GAAP measures and Pro Forma results.

© 2022 AT&T Intellectual Property. AT&T and globe logo are registered trademarks and service marks of AT&T Intellectual Property and/or AT&T affiliated companies. All other marks are the property of their respective owners

$20 billion range

AT&TView entire presentation