Syniverse SPAC Presentation Deck

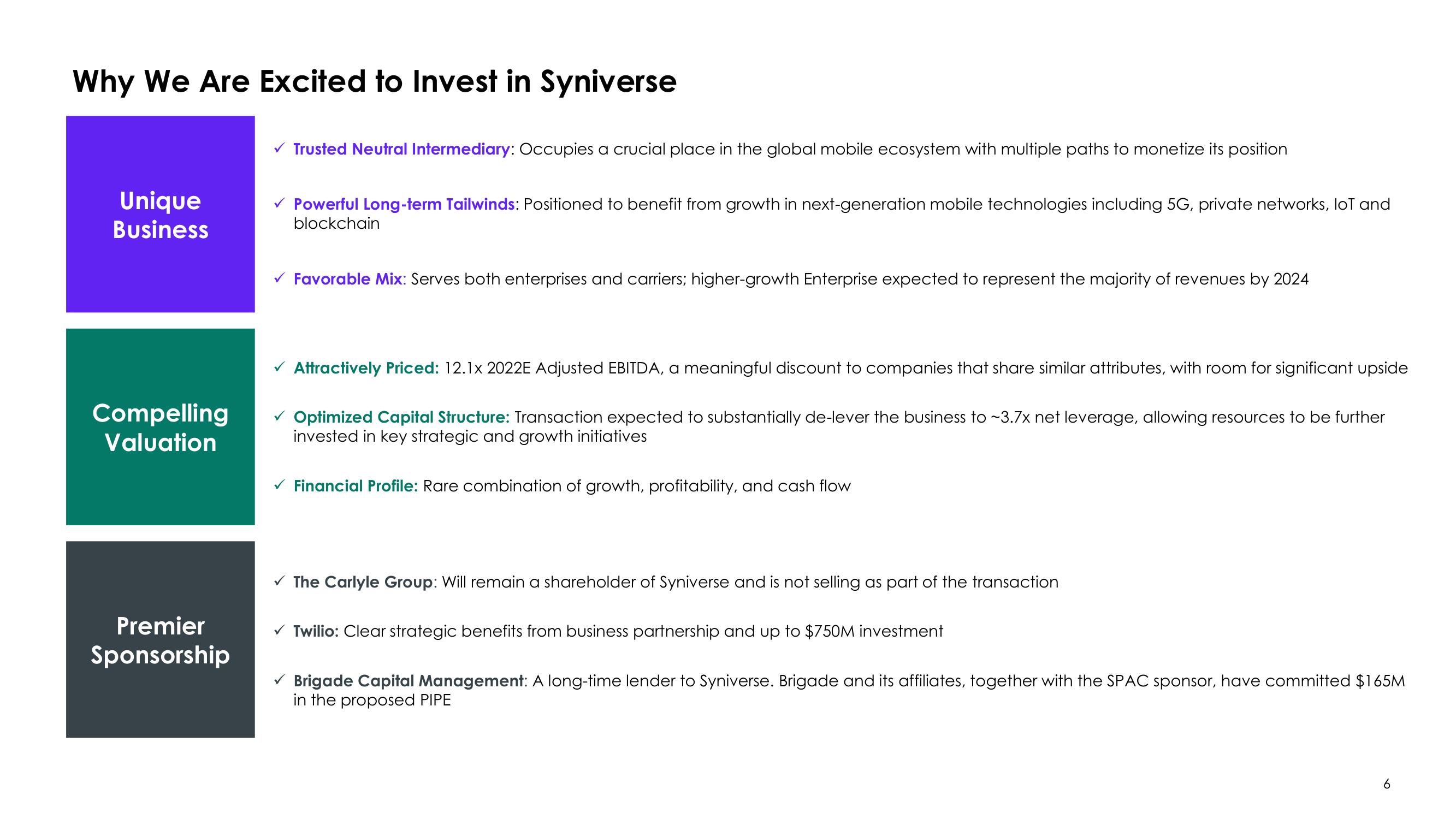

Why We Are Excited to Invest in Syniverse

Unique

Business

Compelling

Valuation

Premier

Sponsorship

✓ Trusted Neutral Intermediary: Occupies a crucial place in the global mobile ecosystem with multiple paths to monetize its position

✓ Powerful Long-term Tailwinds: Positioned to benefit from growth in next-generation mobile technologies including 5G, private networks, loT and

blockchain

✓ Favorable Mix: Serves both enterprises and carriers; higher-growth Enterprise expected to represent the majority of revenues by 2024

✓ Attractively Priced: 12.1x 2022E Adjusted EBITDA, a meaningful discount to companies that share similar attributes, with room for significant upside

✓ Optimized Capital Structure: Transaction expected to substantially de-lever the business to ~3.7x net leverage, allowing resources to be further

invested in key strategic and growth initiatives

✓ Financial Profile: Rare combination of growth, profitability, and cash flow

✓ The Carlyle Group: Will remain a shareholder of Syniverse and is not selling as part of the transaction

✓ Twilio: Clear strategic benefits from business partnership and up to $750M investment

Brigade Capital Management: A long-time lender to Syniverse. Brigade and its affiliates, together with the SPAC sponsor, have committed $165M

in the proposed PIPE

6View entire presentation