Deutsche Bank Fixed Income Presentation Deck

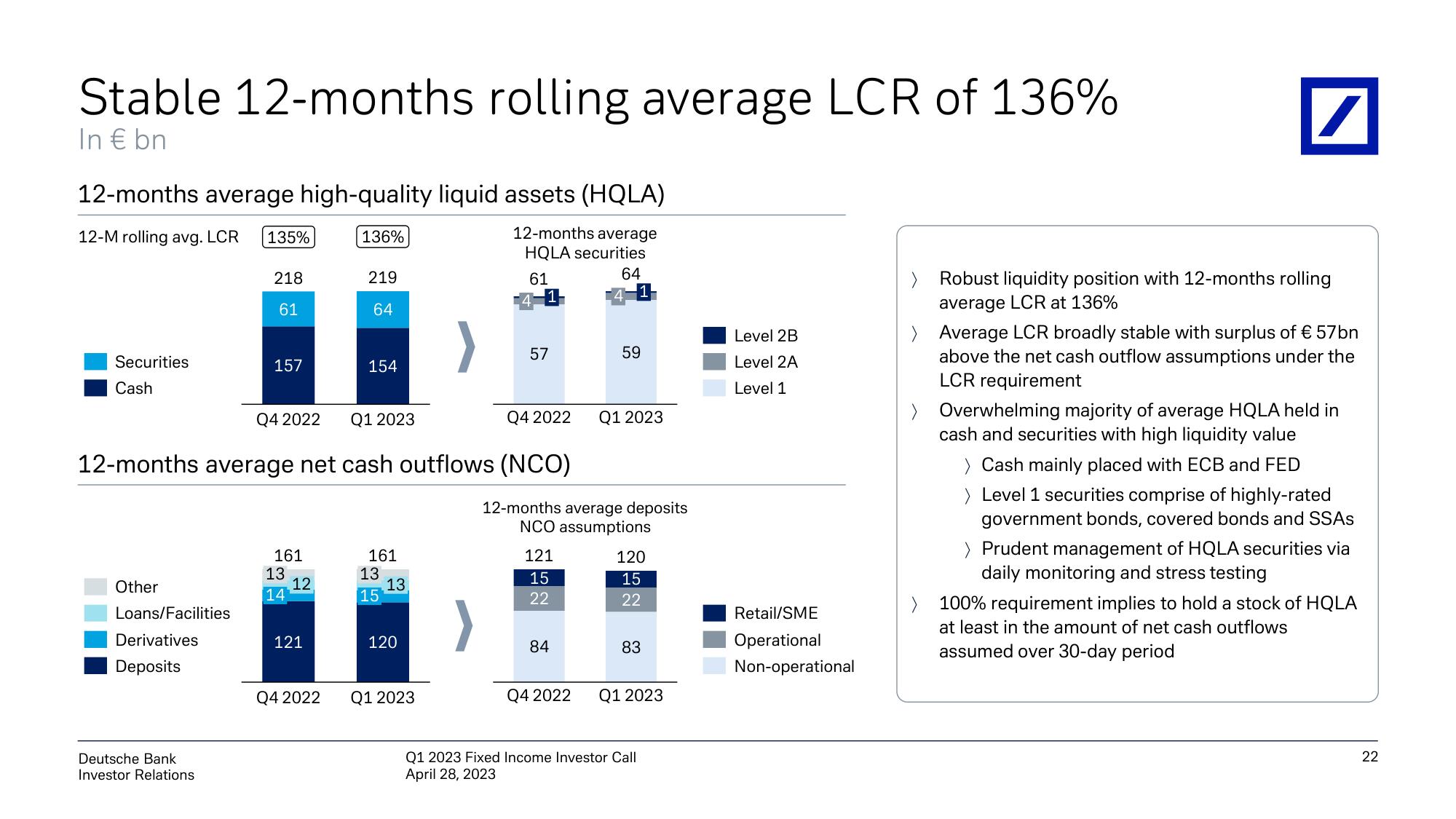

Stable 12-months rolling average LCR of 136%

In € bn

12-months average high-quality liquid assets (HQLA)

12-months average

12-M rolling avg. LCR

HQLA securities

64

61

Securities

Cash

Other

Loans/Facilities

Derivatives

Deposits

135%

Deutsche Bank

Investor Relations

218

61

157

161

Q4 2022 Q1 2023

12-months average net cash outflows (NCO)

13

14

12

121

136%

Q4 2022

219

64

154

161

13

15

13

120

57

Q1 2023

Q4 2022

121

15

22

59

12-months average deposits

NCO assumptions

84

Q1 2023

120

15

22

83

Q4 2022 Q1 2023

Q1 2023 Fixed Income Investor Call

April 28, 2023

Level 2B

Level 2A

Level 1

Retail/SME

Operational

Non-operational

/

Robust liquidity position with 12-months rolling

average LCR at 136%

> Average LCR broadly stable with surplus of € 57bn

above the net cash outflow assumptions under the

LCR requirement

> Overwhelming majority of average HQLA held in

cash and securities with high liquidity value

> Cash mainly placed with ECB and FED

> Level 1 securities comprise of highly-rated

government bonds, covered bonds and SSAs

> Prudent management of HQLA securities via

daily monitoring and stress testing

> 100% requirement implies to hold a stock of HQLA

at least in the amount of net cash outflows

assumed over 30-day period

22View entire presentation