KKR Real Estate Finance Trust Results Presentation Deck

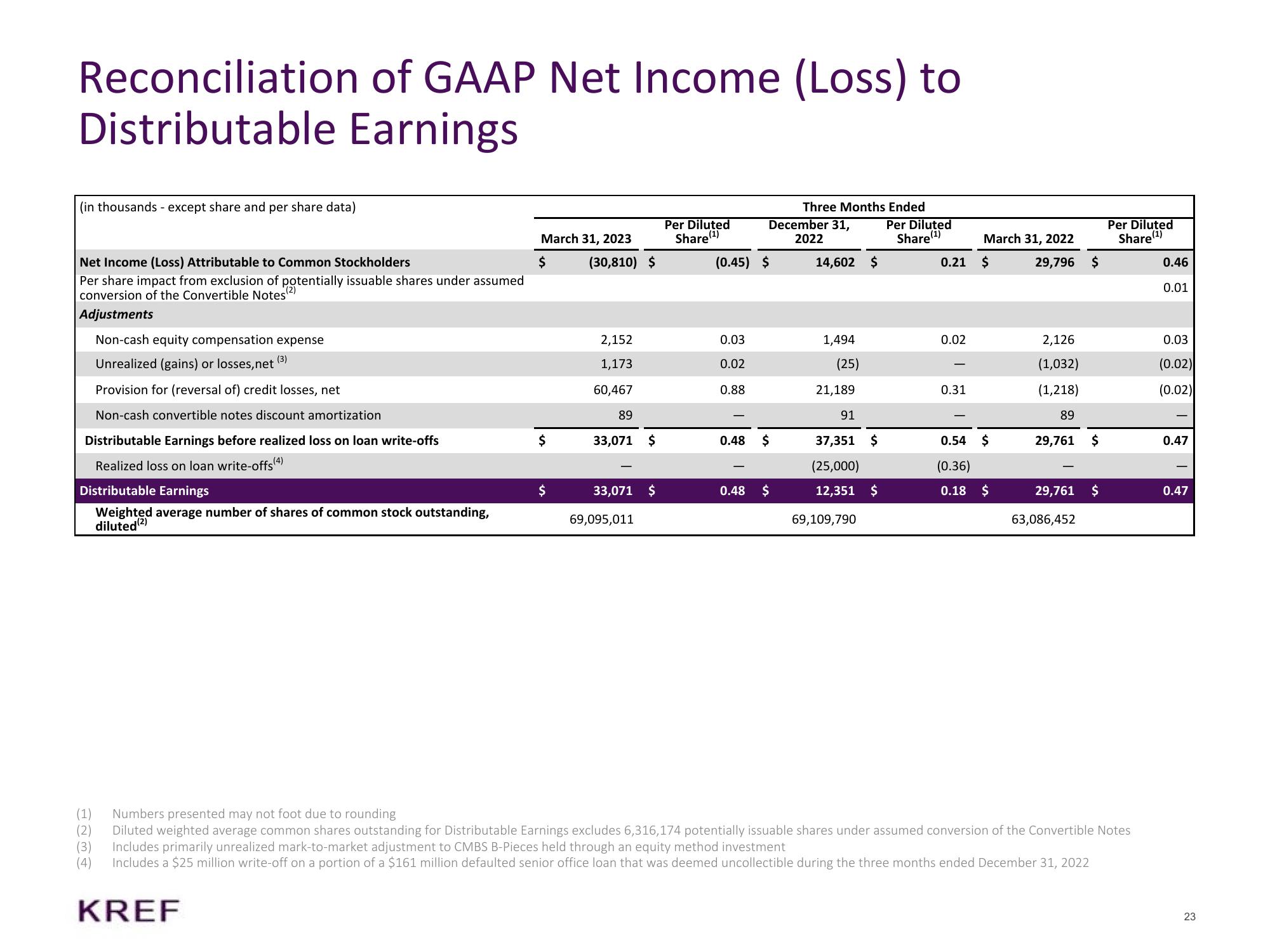

Reconciliation of GAAP Net Income (Loss) to

Distributable Earnings

(in thousands - except share and per share data)

Net Income (Loss) Attributable to Common Stockholders

Per share impact from exclusion of potentially issuable shares under assumed

conversion of the Convertible Notes (²)

Adjustments

Non-cash equity compensation expense

Unrealized (gains) or losses, net

(3)

Provision for (reversal of) credit losses, net

Non-cash convertible notes discount amortization

Distributable Earnings before realized loss on loan write-offs

Realized loss on loan write-offs(4)

Distributable Earnings

Weighted average number of shares of common stock outstanding,

diluted (2)

(1)

(3)

(4)

March 31, 2023

$

KREF

$

$

(30,810) $

2,152

1,173

60,467

89

33,071 $

33,071 $

69,095,011

Per Diluted

Share (¹)

(0.45) $

0.03

0.02

0.88

December 31,

2022

0.48 $

Three Months Ended

Per Diluted

Share (¹)

0.48 $

14,602 $

1,494

(25)

21,189

91

37,351 $

(25,000)

12,351 $

69,109,790

0.21 $

0.02

March 31, 2022

0.31

0.54

(0.36)

0.18 $

$

29,796 $

2,126

(1,032)

(1,218)

89

29,761 $

29,761 $

63,086,452

Per Diluted

Share (¹)

Numbers presented may not foot due to rounding

Diluted weighted average common shares outstanding for Distributable Earnings excludes 6,316,174 potentially issuable shares under assumed conversion of the Convertible Notes

Includes primarily unrealized mark-to-market adjustment to CMBS B-Pieces held through an equity method investment

Includes a $25 million write-off on a portion of a $161 million defaulted senior office loan that was deemed uncollectible during the three months ended December 31, 2022

0.46

0.01

0.03

(0.02)

(0.02)

0.47

0.47

23View entire presentation