J.P.Morgan Results Presentation Deck

JPMORGAN CHASE & CO.

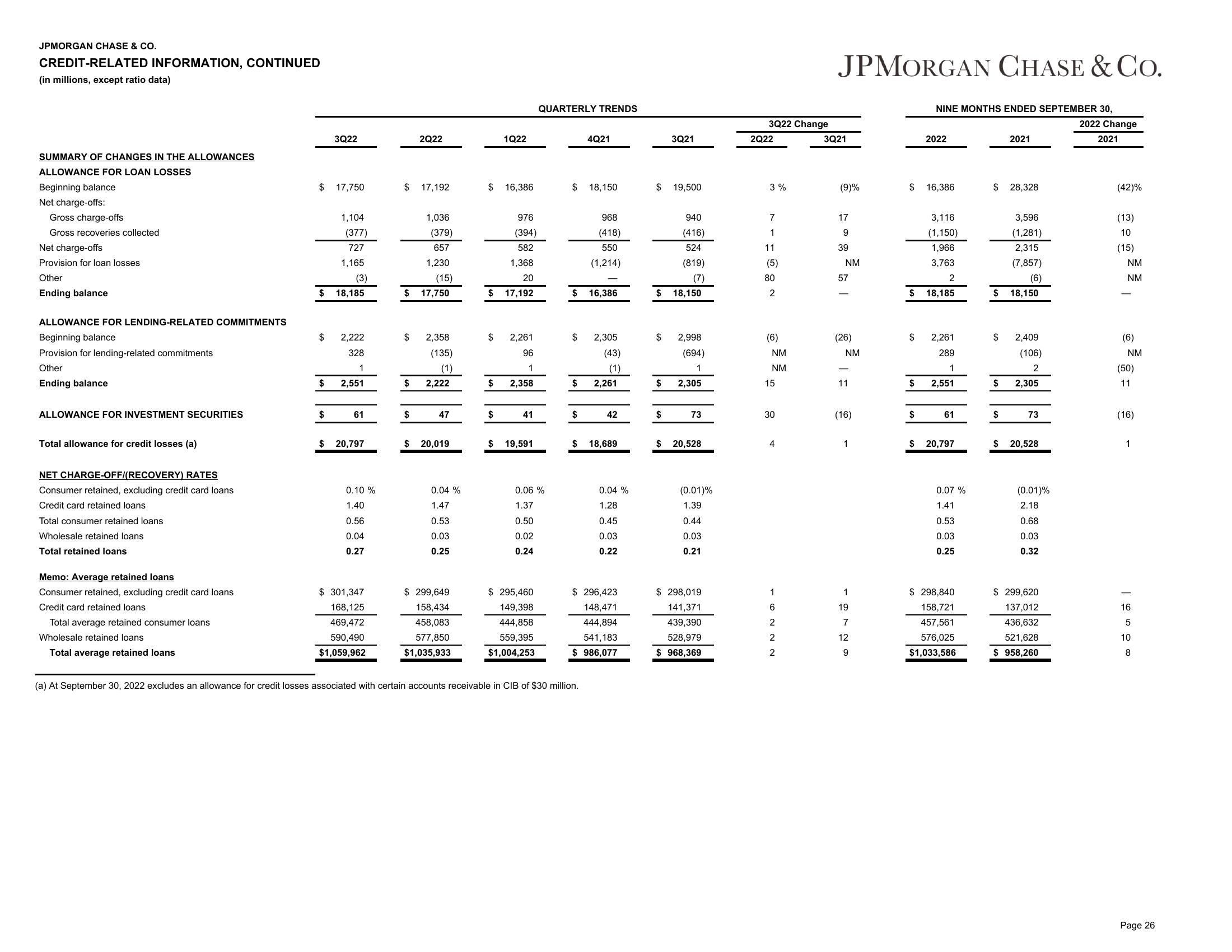

CREDIT-RELATED INFORMATION, CONTINUED

(in millions, except ratio data)

SUMMARY OF CHANGES IN THE ALLOWANCES

ALLOWANCE FOR LOAN LOSSES

Beginning balance

Net charge-offs:

Gross charge-offs

Gross recoveries collected

Net charge-offs

Provision for loan losses

Other

Ending balance

ALLOWANCE FOR LENDING-RELATED COMMITMENTS

Beginning balance

Provision for lending-related commitments

Other

Ending balance

ALLOWANCE FOR INVESTMENT SECURITIES

Total allowance for credit losses (a)

NET CHARGE-OFF/(RECOVERY) RATES

Consumer retained, excluding credit card loans

Credit card retained loans

Total consumer retained loans

Wholesale retained loans

Total retained loans

Memo: Average retained loans

Consumer retained, excluding credit card loans

Credit card retained loans

Total average retained consumer loans

Wholesale retained loans

Total average retained loans

$ 17,750

$

3Q22

(3)

$ 18,185

$

$

1,104

(377)

727

1,165

2,222

328

1

2,551

61

$ 20,797

0.10 %

1.40

0.56

0.04

0.27

$ 301,347

168,125

469,472

590,490

$1,059,962

$ 17,192

2Q22

$

1,036

(15)

$ 17,750

$

(379)

657

1,230

2,358

(135)

(1)

$ 2,222

47

$ 20,019

0.04%

1.47

0.53

0.03

0.25

$ 299,649

158,434

458,083

577,850

$1,035,933

$

1Q22

976

(394)

582

1,368

20

$ 17,192

$

16,386

$ 2,261

96

1

2,358

$

41

$ 19,591

QUARTERLY TRENDS

0.06 %

1.37

0.50

0.02

0.24

$ 295,460

149,398

444,858

559,395

$1,004,253

$ 18,150

$

$ 16,386

4Q21

$

2,305

(43)

(1)

$ 2,261

$

968

(418)

550

(1,214)

(a) At September 30, 2022 excludes an allowance for credit losses associated with certain accounts receivable in CIB of $30 million.

42

18,689

0.04%

1.28

0.45

0.03

0.22

$ 296,423

148,471

444,894

541,183

$ 986,077

$ 19,500

$

$

3Q21

$

940

(416)

524

(819)

(7)

18,150

2,998

(694)

1

$ 2,305

73

$20,528

(0.01)%

1.39

0.44

0.03

0.21

$ 298,019

141,371

439,390

528,979

$968,369

3Q22 Change

2Q22

3%

7

1

11

(5)

80

2

(6)

NM

NM

15

30

4

-6N N N

1

2

2

2

JPMORGAN CHASE & Co.

3Q21

(9)%

17

9

39

NM

57

(26)

NM

11

(16)

1

1

19

7

12

9

$

$

$

$

NINE MONTHS ENDED SEPTEMBER 30,

2022

16,386

3,116

(1,150)

1,966

3,763

2

18,185

2,261

289

1

2,551

61

$ 20,797

0.07%

1.41

0.53

0.03

0.25

$ 298,840

158,721

457,561

576,025

$1,033,586

$ 28,328

$

$

$

2021

$

3,596

(1,281)

2,315

(7,857)

(6)

18,150

2,409

(106)

2

2,305

73

$ 20,528

(0.01)%

2.18

0.68

0.03

0.32

$299,620

137,012

436,632

521,628

$958,260

2022 Change

2021

(42)%

(13)

10

(15)

NM

NM

(6)

NM

(50)

11

(16)

1

16

5

10

8

Page 26View entire presentation