IGI SPAC Presentation Deck

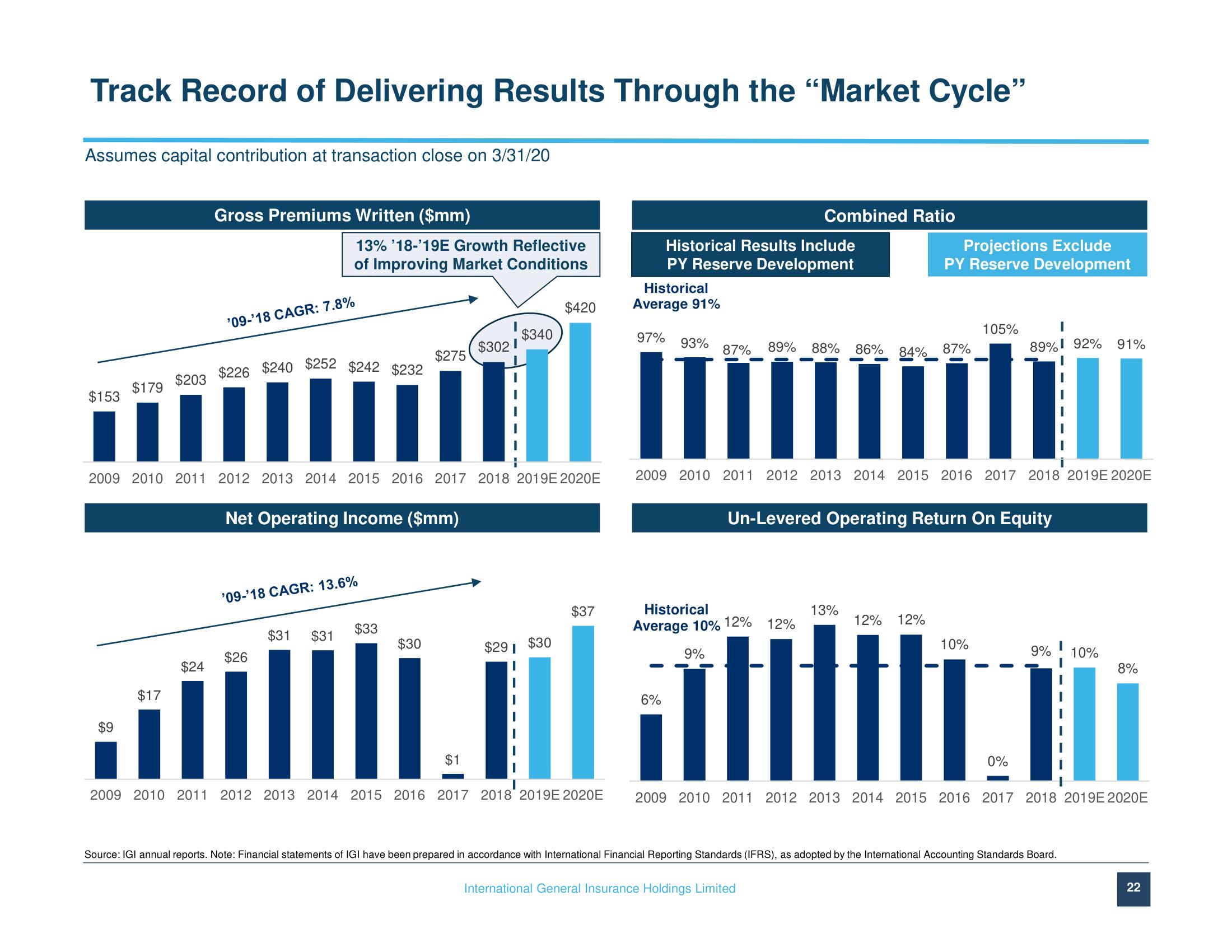

Track Record of Delivering Results Through the "Market Cycle"

Assumes capital contribution at transaction close on 3/31/20

$153

$179

$9

$203

$17

Gross Premiums Written ($mm)

$252 $242 $232

$226 $240

11 III

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019E 2020E

'09-'18 CAGR: 7.8%

$24

13% '18-'19E Growth Reflective

of Improving Market Conditions

Net Operating Income ($mm)

'09-'18 CAGR: 13.6%

$26

$31 $31

$275

$33

$30

$420

$340

il

$302

$1

$291

Historical

Average 91%

97%

Historical Results Include

PY Reserve Development

93%

6%

87% 89% 88%

Combined Ratio

Historical

Average 10% 12%

9%

$37

$30

il

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019E 2020E 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019E 2020E

86%

12%

International General Insurance Holdings Limited

13%

I

89% 92%

mou

84%

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019E 2020E

Projections Exclude

PY Reserve Development

Un-Levered Operating Return On Equity

87%

12% 12%

105%

10%

0%

9%

Source: IGI annual reports. Note: Financial statements of IGI have been prepared in accordance with International Financial Reporting Standards (IFRS), as adopted by the International Accounting Standards Board.

91%

10%

8%

22View entire presentation