SoftBank Results Presentation Deck

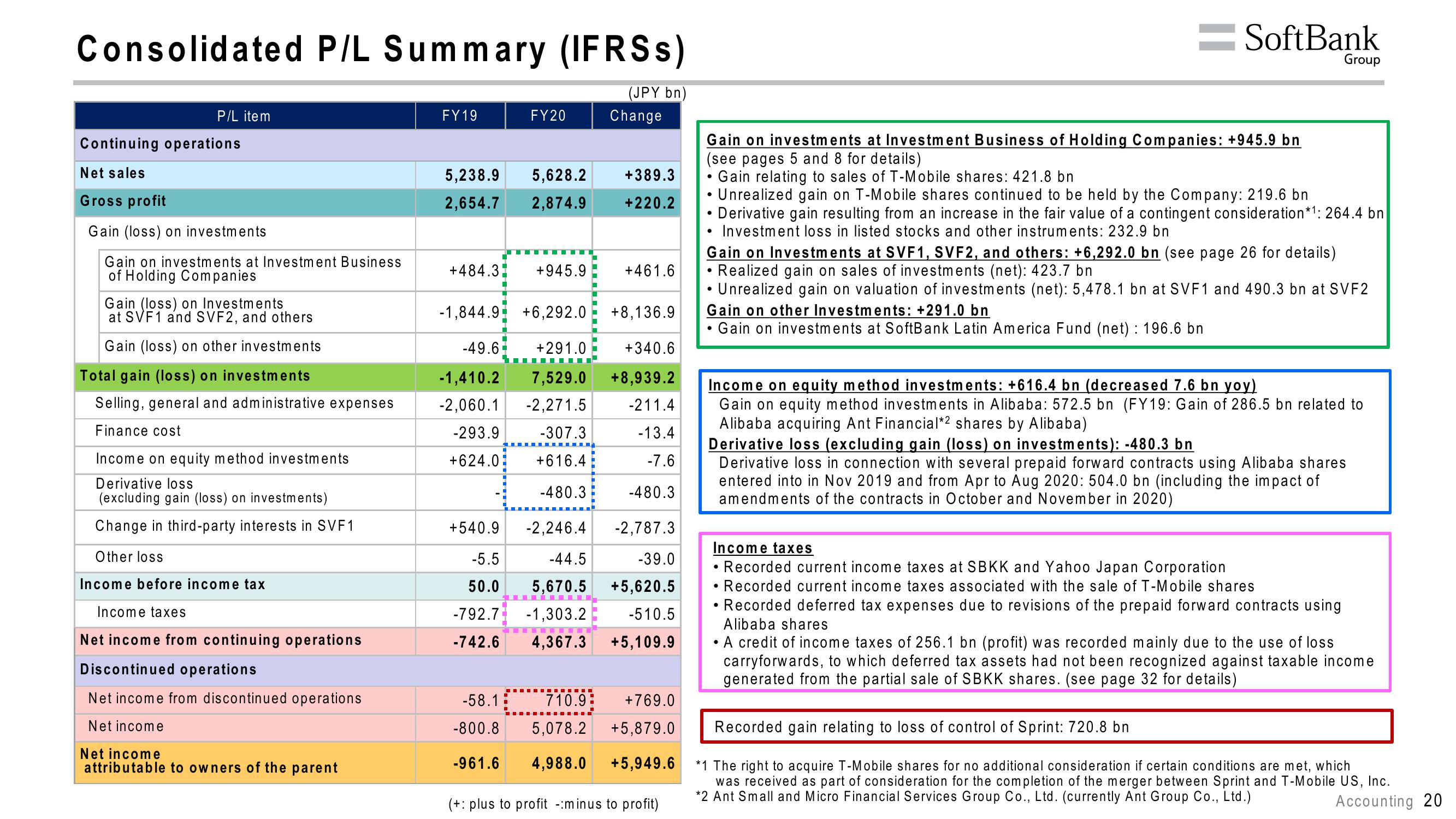

Consolidated P/L Summary (IFRSs)

(JPY bn)

P/L item

Continuing operations

Net sales

Gross profit

Gain (loss) on investments

Gain on investments at Investment Business

of Holding Companies

Gain (loss) on Investments

at SVF1 and SVF2, and others

Gain (loss) on other investments

Total gain (loss) on investments

Selling, general and administrative expenses

Finance cost

Income on equity method investments

Derivative loss

(excluding gain (loss) on investments)

Change in third-party interests in SVF1

Other loss

Income before income tax

Income taxes

Net income from continuing operations

Discontinued operations

Net income from discontinued operations

Net income

Net income

attributable to owners of the parent

FY19

5,238.9

2,654.7

+484.3

+540.9

-5.5

50.0

-792.7

-742.6

FY20

5,628.2

2,874.9

-1,844.9

+6,292.0

-49.6 +291.0

-1,410.2 7,529.0

-2,060.1 -2,271.5

-293.9

-307.3

+624.0

+616.4

-480.3

-961.6

+945.9

Change

+389.3

+220.2

+461.6

+8,136.9

+340.6

+8,939.2

-211.4

-13.4

-7.6

-480.3

-2,787.3

-39.0

-2,246.4

-44.5

5,670.5 +5,620.5

-1,303.2

4,367.3 +5,109.9

-510.5

-58.1 710.9: +769.0

-800.8 5,078.2 +5,879.0

4,988.0 +5,949.6

(+: plus to profit -:minus to profit)

Gain on investments at Investment Business of Holding Companies: +945.9 bn

(see pages 5 and 8 for details)

Gain relating to sales of T-Mobile shares: 421.8 bn

●

·

●

·

SoftBank

Gain on Investments at SVF1, SVF2, and others: +6,292. bn (see page 26 for details)

Realized gain on sales of investments (net): 423.7 bn

• Unrealized gain on valuation of investments (net): 5,478.1 bn at SVF1 and 490.3 bn at SVF2

Gain on other Investments: +291.0 bn

Gain on investments at SoftBank Latin America Fund (net): 196.6 bn

Group

Unrealized gain on T-Mobile shares continued to be held by the Company: 219.6 bn

Derivative gain resulting from an increase in the fair value of a contingent consideration *1: 264.4 bn

Investment loss in listed stocks and other instruments: 232.9 bn

Income on equity method investments: +616.4 bn (decreased 7.6 bn yoy)

Gain on equity method investments in Alibaba: 572.5 bn (FY19: Gain of 286.5 bn related to

Alibaba acquiring Ant Financial*2 shares by Alibaba)

●

Derivative loss (excluding gain (loss) on investments): -480.3 bn

Derivative loss in connection with several prepaid forward contracts using Alibaba shares

entered into in Nov 2019 and from Apr to Aug 2020: 504.0 bn (including the impact of

amendments of the contracts in October and November in 2020)

Income taxes

Recorded current income taxes at SBKK and Yahoo Japan Corporation

Recorded current income taxes associated with the sale of T-Mobile shares

• Recorded deferred tax expenses due to revisions of the prepaid forward contracts using

Alibaba shares

●

A credit of income taxes of 256.1 bn (profit) was recorded mainly due to the use of loss

carryforwards, to which deferred tax assets had not been recognized against taxable income

generated from the partial sale of SBKK shares. (see page 32 for details)

●

Recorded gain relating to loss of control of Sprint: 720.8 bn

*1 The right to acquire T-Mobile shares for no additional consideration if certain conditions are met, which

was received as part of consideration for the completion of the merger between Sprint and T-Mobile US, Inc.

*2 Ant Small and Micro Financial Services Group Co., Ltd. (currently Ant Group Co., Ltd.)

Accounting 20View entire presentation