Bed Bath & Beyond Results Presentation Deck

FINANCIAL OUTLOOK

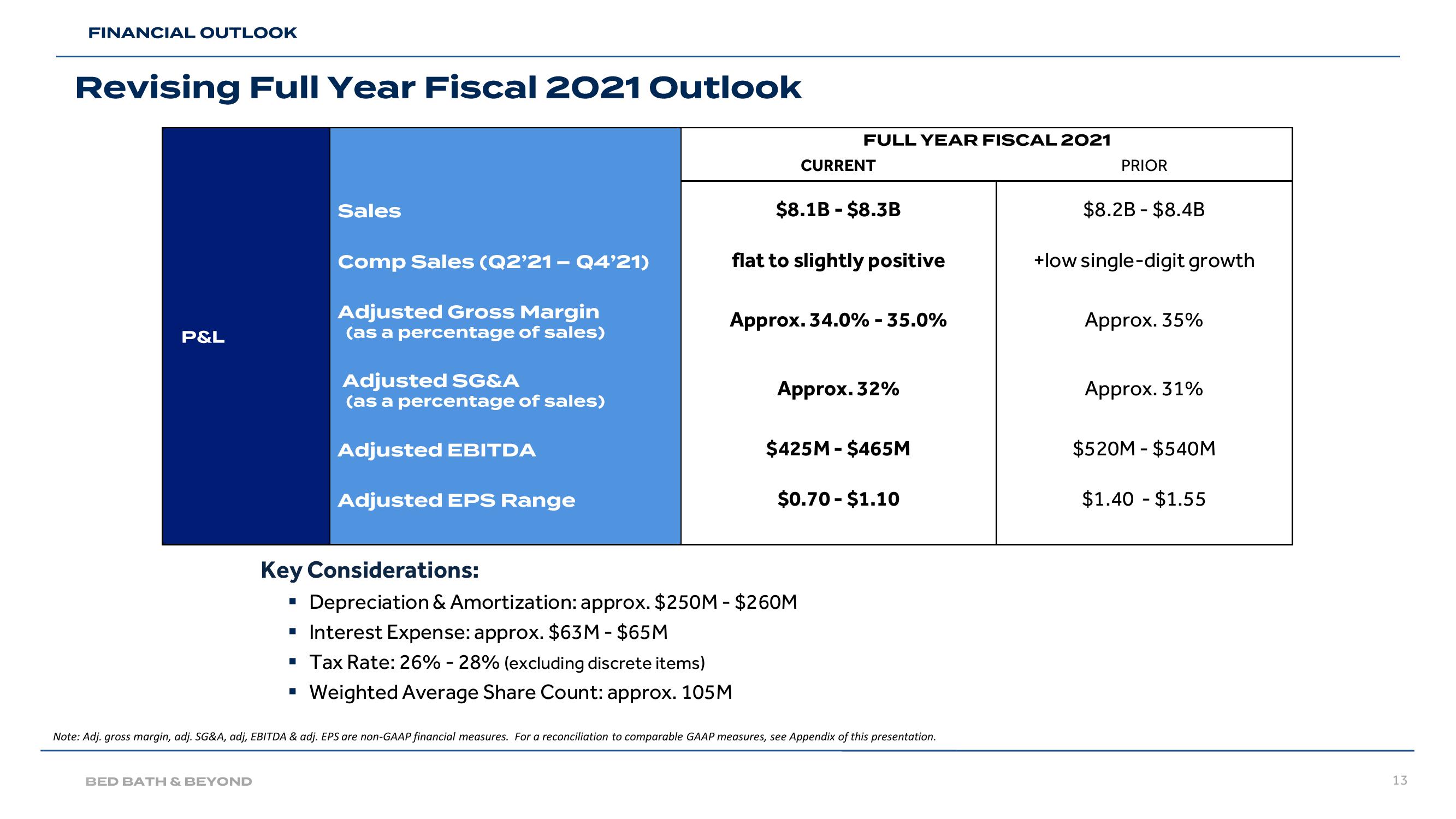

Revising Full Year Fiscal 2021 Outlook

P&L

BED BATH & BEYOND

Sales

Comp Sales (Q2'21 – Q4'21)

Adjusted Gross Margin

(as a percentage of sales)

■

Adjusted SG&A

(as a percentage of sales)

Adjusted EBITDA

Adjusted EPS Range

Key Considerations:

FULL YEAR FISCAL 2021

CURRENT

$8.1B - $8.3B

flat to slightly positive

Approx. 34.0% - 35.0%

Approx. 32%

Depreciation & Amortization: approx. $250M - $260M

▪ Interest Expense: approx. $63M - $65M

▪ Tax Rate: 26% -28% (excluding discrete items)

Weighted Average Share Count: approx. 105M

$425M-$465M

$0.70-$1.10

Note: Adj. gross margin, adj. SG&A, adj, EBITDA & adj. EPS are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

PRIOR

$8.2B - $8.4B

+low single-digit growth

Approx. 35%

Approx. 31%

$520M - $540M

$1.40 - $1.55

13View entire presentation