Baird Investment Banking Pitch Book

REVIEW OF KEY FOCUS AREAS & OBJECTIVES

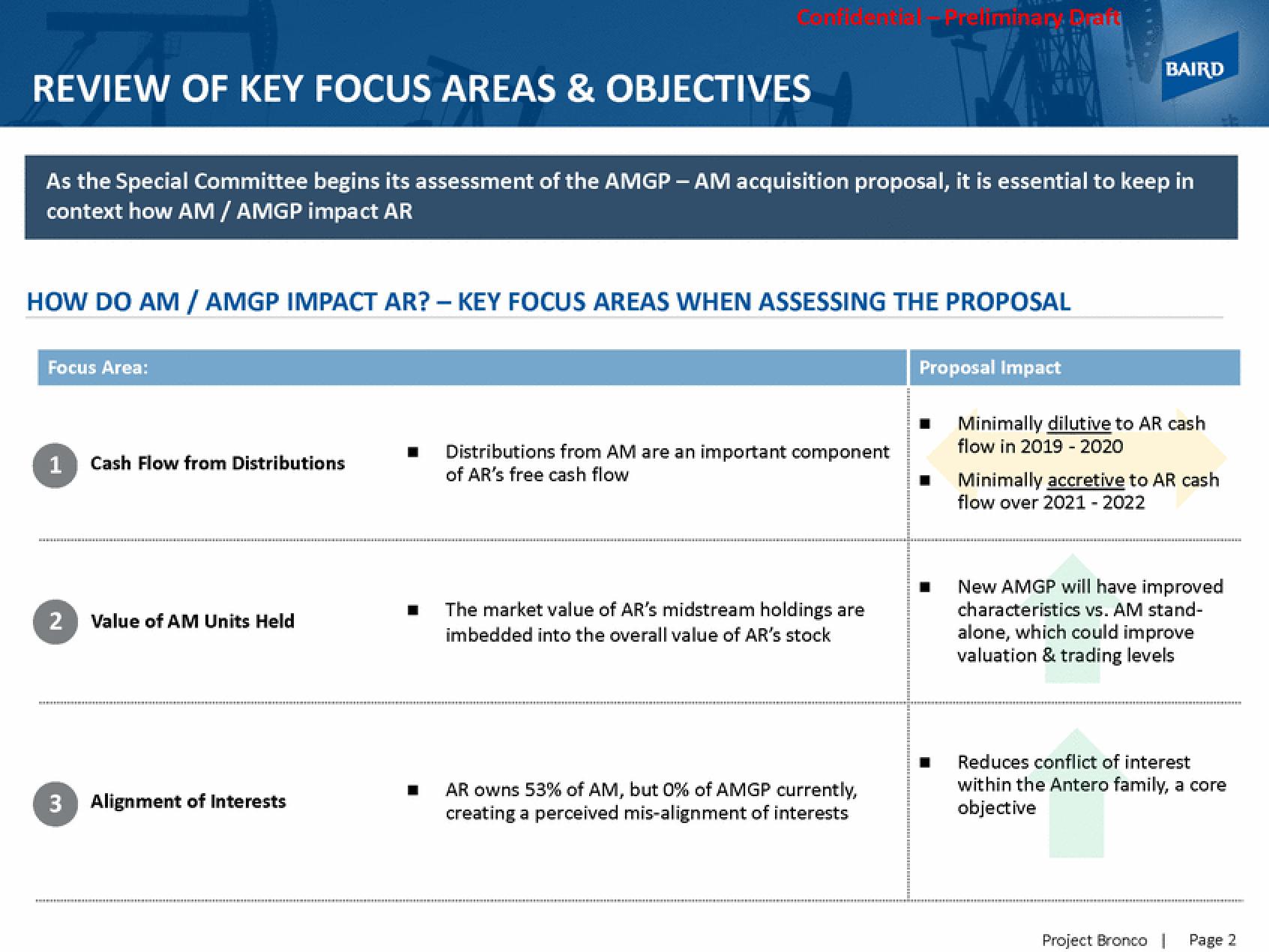

As the Special Committee begins its assessment of the AMGP-AM acquisition proposal, it is essential to keep in

context how AM / AMGP impact AR

HOW DO AM / AMGP IMPACT AR? - KEY FOCUS AREAS WHEN ASSESSING THE PROPOSAL

Focus Area:

1 Cash Flow from Distributions

conftantin Freliminar Draft

2 Value of AM Units Held

3

Alignment of Interests

Distributions from AM are an important component

of AR's free cash flow

The market value of AR's midstream holdings are

imbedded into the overall value of AR's stock

■ AR owns 53% of AM, but 0% of AMGP currently,

creating a perceived mis-alignment of interests

Proposal Impact

BAIRD

Minimally dilutive to AR cash

flow in 2019 - 2020

Minimally accretive to AR cash

flow over 2021 - 2022

New AMGP will have improved

characteristics vs. AM stand-

alone, which could improve

valuation & trading levels

Reduces conflict of interest

within the Antero family, a core

objective

Project Bronco

Page 2View entire presentation